Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 1P

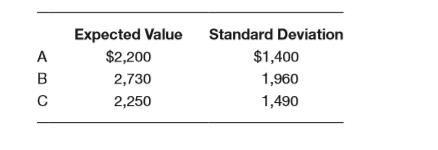

Assume you are risk-averse and have the following three choices. Which project will you select? Compute the coefficient of variation for each.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

3. A bond's yield to maturity (YTM) is:A. The coupon rateB. The rate of return required by investorsC. The market price of the bondD. The par value of the bond

Need help

The time value of money concept suggests:A. A dollar today is worth less than a dollar tomorrowB. Money loses value over time due to inflationC. A dollar today is worth more than a dollar in the futureD. Interest has no effect on present value

The time value of money concept suggests:A. A dollar today is worth less than a dollar tomorrowB. Money loses value over time due to inflationC. A dollar today is worth more than a dollar in the futureD. Interest has no effect on present value

Chapter 13 Solutions

Foundations of Financial Management

Ch. 13 - Prob. 1DQCh. 13 - Discuss the concept of risk and how it might be...Ch. 13 - When is the coefficient of variation a better...Ch. 13 - Explain how the concept of risk can be...Ch. 13 - If risk is to be analyzed in a qualitative way,...Ch. 13 - Assume a company, correlated with the economy, is...Ch. 13 - Assume a firm has several hundred possible...Ch. 13 - Explain the effect of the risk-return trade-off on...Ch. 13 - What is the purpose of using simulation analysis?...Ch. 13 - Assume you are risk-averse and have the following...

Ch. 13 - Myers Business Systems is evaluating the...Ch. 13 - Prob. 3PCh. 13 - Prob. 4PCh. 13 - Prob. 5PCh. 13 - Possible outcomes for three investment...Ch. 13 - Prob. 7PCh. 13 - Prob. 8PCh. 13 - Prob. 9PCh. 13 - Prob. 10PCh. 13 - Prob. 12PCh. 13 - Waste Industries is evaluating a 70,000 project...Ch. 13 - Prob. 14PCh. 13 - Debby’s Dance Studios is considering the...Ch. 13 - Prob. 17PCh. 13 - Prob. 18PCh. 13 - Allison’s Dresswear Manufacturers is preparing a...Ch. 13 - Prob. 20PCh. 13 - Prob. 21PCh. 13 - Prob. 22PCh. 13 - Ms. Sharp is looking at a number of different...Ch. 13 - Prob. 25P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Related to Checkpoint 17.1) (Forecasting discretionary financing needs) Huang Electronics, Inc., operates a chain of electrical lighting and fixture distribution centers throughout northern Arizona. The firm is anticipating expansion of its sales in the coming year as a result of recent population growth trends. The firm's financial analyst has prepared pro forma balance sheets that reflect three different rates of growth in firm sales for the coming year and the corresponding non-discretionary sources of financing the firm expects to have available, as follows: a. What are the firm's discretionary financing needs under each of the three growth scenarios? b. What potential sources of financing are there for Huang Electronics to fulfill its needs for discretionary financing? a. The discretionary financing needs for a 10% growth scenario are $ (Round to the nearest dollar.)arrow_forward(Related to Checkpoint 17.1) (Forecasting discretionary financing needs) In the spring of 2023, the Caswell Publishing Company established a custom publishing business for its business clients. These clients consisted principally of small- to medium-size companies in Round Rock, Texas. However, the company's plans were disrupted when it landed a large printing contract which it expects will run for several years. Specifically, the new contract will increase firm revenues by 100 percent. Consequently, Caswell's managers know they will need to make some significant changes in firm capacity, and quickly. The following balance sheet for 2023 and pro forma balance sheet for 2024 reflect the firm's estimates of the financial impact of the 100 percent revenue growth: a. How much new discretionary financing will Caswell require based on the above estimates? b. Given the nature of the new contract and the specific needs for financing that the firm expects, what recommendations might you offer…arrow_forward(Related to Checkpoint 17.1) (Forecasting discretionary financing needs) Bates Fabricators, Inc. estimates that it invests 25 cents in assets for each dollar of new sales. However, 4 cents in profits are produced by each dollar of additional sales, of which 1 cent(s) can be reinvested in the firm. If sales rise by $773,000 next year from their current level of $5.36 million, and the ratio of spontaneous liabilities to sales is 0.17, what will be the firm's need for discretionary financing? (Hint: In this situation, you do not know what the firm's existing level of assets is, nor do you know how those assets have been financed. Thus, you must estimate the change in financing needs and match this change with the expected changes in spontaneous liabilities, retained earnings, and other sources of discretionary financing.) The discretionary financing needs will be $ (Round to the nearest dollar.)arrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.need helparrow_forwardHello expert see carefully I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful. helloarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful. hiarrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardNeed help with appropriate method please I will unhelpful if you use wrong values .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY