Principles of Financial Accounting.

24th Edition

ISBN: 9781260158625

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 18E

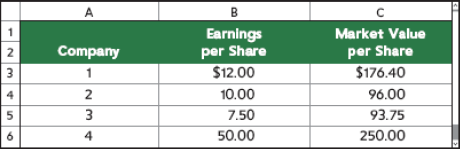

Price-earnings ratio computation and interpretation

Compute the price-earnings ratio for each of these four separate companies. Which stock might an analyst likely investigate as being potentially undervalued by the market? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please answer the financial accounting question

What is the gross margin percentage of this financial accounting question?

Need answer the financial accounting question please solve

Chapter 13 Solutions

Principles of Financial Accounting.

Ch. 13 - A corporation issues 6,000 shares of 5 par value...Ch. 13 - A company reports net income of 75,000. Its...Ch. 13 - A company has 5,000 shares of 100 par preferred...Ch. 13 - A company paid cash dividends of 0.81 per share....Ch. 13 - Prob. 5MCQCh. 13 - What are organization expenses? Provide examples.Ch. 13 - How are organization expenses reported?Ch. 13 - Prob. 3DQCh. 13 - What is the difference between authorized shares...Ch. 13 - Prob. 5DQ

Ch. 13 - List the general rights of common stockholders.Ch. 13 - What is the difference between the market value...Ch. 13 - Identify and explain the importance of the three...Ch. 13 - Prob. 9DQCh. 13 - How does declaring a stock dividend affect the...Ch. 13 - What is the difference between a stock dividend...Ch. 13 - Prob. 12DQCh. 13 - Prob. 13DQCh. 13 - How is book value per share computed for a...Ch. 13 - Prob. 15DQCh. 13 - Prob. 16DQCh. 13 - Prob. 17DQCh. 13 - Prob. 1QSCh. 13 - Issuance of common stock Prepare the journal entry...Ch. 13 - Issuance of par and stated value common stock...Ch. 13 - Issuance of no-par common stock Prepare the...Ch. 13 - Prob. 5QSCh. 13 - Accounting for cash dividends Prepare journal...Ch. 13 - Prob. 7QSCh. 13 - Accounting for small stock dividend The...Ch. 13 - Prob. 9QSCh. 13 - Accounting for dividends For each of the following...Ch. 13 - Preferred stock issuance and dividends 1. Prepare...Ch. 13 - Dividend allocation between classes of...Ch. 13 - Prob. 13QSCh. 13 - Prob. 14QSCh. 13 - Purchase and sale of treasury stock On May 3,...Ch. 13 - Prob. 16QSCh. 13 - Prob. 17QSCh. 13 - For each situation, identify whether it is treated...Ch. 13 - Prob. 19QSCh. 13 - Basic earnings per share Murray Company reports...Ch. 13 - Epic Company earned net income of 900,000 this...Ch. 13 - Price-earnings ratio Compute Topp Companys...Ch. 13 - Prob. 23QSCh. 13 - Book value per common share The stockholders...Ch. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - Accounting for par, stated, and no-par stock...Ch. 13 - Recording stock issuances Prepare journal entries...Ch. 13 - Stock issuance for noncash assets Sudoku Company...Ch. 13 - On June 30, Sharper Corporations stockholders...Ch. 13 - Prob. 7ECh. 13 - The stockholders equity section of TVX Company on...Ch. 13 - Prob. 9ECh. 13 - Yorks outstanding stock consists of 80,000 shares...Ch. 13 - Prob. 11ECh. 13 - Prob. 12ECh. 13 - In Draco Corporations first year of business, the...Ch. 13 - Prob. 14ECh. 13 - Prob. 15ECh. 13 - Prob. 16ECh. 13 - Prob. 17ECh. 13 - Price-earnings ratio computation and...Ch. 13 - Prob. 19ECh. 13 - The equity section of Cyril Corporations balance...Ch. 13 - Prob. 21ECh. 13 - Stockholders equity transactions and analysis...Ch. 13 - Prob. 2APCh. 13 - Prob. 3APCh. 13 - The equity sections for Atticus Group at the...Ch. 13 - Prob. 5APCh. 13 - Stockholders equity transactions and analysis...Ch. 13 - Balthus Corp. reports the following components of...Ch. 13 - Prob. 3BPCh. 13 - Prob. 4BPCh. 13 - Prob. 5BPCh. 13 - Santana Rey created Business Solutions on October...Ch. 13 - Prob. 1AACh. 13 - Use the following comparative figures for Apple...Ch. 13 - Prob. 3AACh. 13 - Prob. 1BTNCh. 13 - Access the March 1, 2017, fi ling of the 2016...Ch. 13 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The underapplication of overhead will result in Group of answer choices understatement of net income. overstatement of cost of goods sold. understatement of cost of goods sold. overvalued finished goods inventory.arrow_forwardchoose best answer financial accountingarrow_forwardWhat is the couple marriage penalty or benefit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License