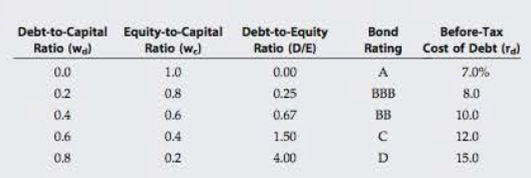

WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm does not currently use

Elliott uses the

- a. What is the firm's optimal capital structure, and what would be its WACC at the optimal capital structure?

- b. If Elliott's managers anticipate that the company's business risk will increase in the future, what effect would this likely have on the firm's target capital structure?

- c. If Congress were to dramatically increase the corporate tax rate, what effect would this likely have on Elliott's target capital structure?

- d. Plot a graph of the after-tax cost of debt, the

cost of equity , and the WACC versus (1) the debt/capital ratio and (2) the debt/equity ratio.

Trending nowThis is a popular solution!

Chapter 13 Solutions

Bundle: Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card), 8th + Aplia Printed Access Card

- Suppose three countries’ per capita Gross Domestic Products (GDPs) are £1000, £2000, and £3000. What is the average of each pair of countries’ GDPs per capita? (b) What is the difference between each of the individual observations and the overall average? What is the sum of these differences? (c) Suppose instead of three countries, we had a sample of 100 countries with the same sample average GDP per capita as the overall average for the three observations above, with the standard deviation of these 100 observations being £1000. Form the 95% confidence interval for the population mean. (d) What might explain differences in GDP across countries? Consider the following regression equation, where Earnings is measured in £/hour, and Experience is measured in years in a particular job, with standard errors in parentheses: Earnings \ = −0.25 (−0.5) + 0.2 (0.1) Experience, One of these numbers has been reported incorrectly - it shouldn’t be negative. Which one and why? (b)…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Research would let you make quarterly payments of $9,130 for 3 years at an interest rate of 3.27 percent per quarter. Your first payment to Silver Research would be today. Island Research would let you make monthly payments of $3,068 for 3 years at an interest rate of X percent per month. Your first payment to Island Research would be in 1 month. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- Make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardYou plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardPlease make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning