Horngren's Financial & Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780133866292

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 13.36AP

Identifying sources of equity, stock issuance, and dividends

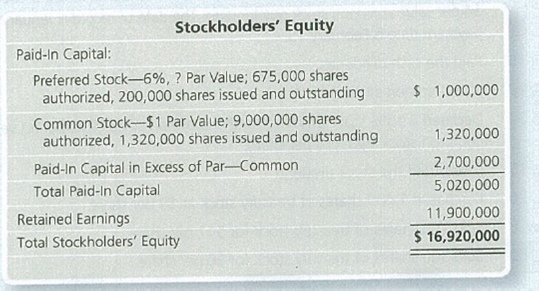

Travel Comfort Specialists, Inc. reported the following

Requirements

- 1. Identify the different classes of stock that Travel has outstanding.

- 2. What is the par value per share of Travel's

preferred stock ? - 3. Make two summary

journal entries to record issuance of all the Travel stock for cash. Explanations are not required. - 4. No preferred dividends are in arrears. Journalize the declaration of a $900,000 dividend at June 30, 2016, and the payment of the dividend on July 20, 201 6. Use separate Dividends Payable accounts for preferred and common stock. An explanation is not required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Write down as many descriptions describing rock and roll that you can.

From these descriptions can you come up with s denition of rock and roll?

What performers do you recognize?

What performers don’t you recognize?

What can you say about musical inuence on these current rock musicians?

Try to break these inuences into genres and relate them to the rock musicians. What does

Mick Jagger say about country artists?

What does pioneering mean?

What kind of ensembles w

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Chapter 13 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

Ch. 13 - Prob. 1QCCh. 13 - Prob. 2QCCh. 13 - Suppose Value Home and Garden Imports issued...Ch. 13 - Prob. 4QCCh. 13 - Prob. 5QCCh. 13 - Assume that a company paid 6 per share to purchase...Ch. 13 - Prob. 7QCCh. 13 - A small stock dividend a. decreases common stock....Ch. 13 - Jackson Health Foods has 8,000 shares of 2 par...Ch. 13 - Prob. 10QC

Ch. 13 - Prob. 1RQCh. 13 - Prob. 2RQCh. 13 - How does authorized stock differ from outstanding...Ch. 13 - What are the four basic rights of stockholders?Ch. 13 - How does preferred stock differ from common stock?Ch. 13 - Prob. 6RQCh. 13 - What are the two basic sources of stockholders'...Ch. 13 - Prob. 8RQCh. 13 - If stock is issued for assets other than cash,...Ch. 13 - Prob. 10RQCh. 13 - Where and how is treasury stock reported on the...Ch. 13 - What is the effect on the accounting equation when...Ch. 13 - What are the three relevant dates involving cash...Ch. 13 - How does cumulative preferred stock differ from...Ch. 13 - What is a stock dividend?Ch. 13 - Prob. 16RQCh. 13 - What are some reasons corporations issue stock...Ch. 13 - Prob. 18RQCh. 13 - What does the statement of retained earnings...Ch. 13 - What is a prior-period adjustment?Ch. 13 - Prob. 21RQCh. 13 - What does earnings per share report, and how is it...Ch. 13 - What is the price/earnings ratio, and how is it...Ch. 13 - What does the rate of return on common stock show,...Ch. 13 - Prob. 13.1SECh. 13 - Journalizing issuance of stock- at par and at a...Ch. 13 - Journalizing issuance of stock-no-par Ashford...Ch. 13 - Journalizing issuance of stock- stated value...Ch. 13 - Journalizing issuance o f stock for assets other...Ch. 13 - Prob. 13.6SECh. 13 - Accounting for cash dividends Frenchroast Company...Ch. 13 - Dividing cash dividends between preferred and...Ch. 13 - Prob. 13.9SECh. 13 - Prob. 13.10SECh. 13 - Prob. 13.11SECh. 13 - Preparing a statement of retained earnings Tinder,...Ch. 13 - Analyzing the effect of prior-period adjustments...Ch. 13 - Prob. 13.14SECh. 13 - Prob. 13.15SECh. 13 - Prob. 13.16SECh. 13 - Prob. 13.17ECh. 13 - Prob. 13.18ECh. 13 - Journaling issuance of stock Skylar Systems...Ch. 13 - Prob. 13.20ECh. 13 - Prob. 13.21ECh. 13 - Prob. 13.22ECh. 13 - Journalizing treasury stock transactions and...Ch. 13 - Journalizing issuance of s tock and treasury stock...Ch. 13 - Computing dividends on preferred and common stock...Ch. 13 - Computing dividends on preferred and common stock...Ch. 13 - Journalizing a stock dividend and reporting...Ch. 13 - Prob. 13.28ECh. 13 - Reporting stockholders' equity after a stock split...Ch. 13 - Determining the effects of cash dividends, stock...Ch. 13 - Prob. 13.31ECh. 13 - Prob. 13.32ECh. 13 - Computing earnings per share and price/earnings...Ch. 13 - Computing rate of return on common stockholders'...Ch. 13 - Organizing a corporation and issuing stock John...Ch. 13 - Identifying sources of equity, stock issuance, and...Ch. 13 - Prob. 13.37APCh. 13 - Journalizing dividends and treasury stock...Ch. 13 - Journalizing dividend and treasury stock...Ch. 13 - Prob. 13.40APCh. 13 - Prob. 13.41BPCh. 13 - Prob. 13.42BPCh. 13 - Prob. 13.43BPCh. 13 - Journalizing dividends and treasury stock...Ch. 13 - Journalizing dividend and treasury stock...Ch. 13 - Prob. 13.46BPCh. 13 - Sources of equity and journalizing stock issuance...Ch. 13 - Prob. 13.1CTFSCCh. 13 - Prob. 13.1CTCA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

9 Different Types of Stocks | Investing For Beginners; Author: Kiana Danial - Invest Diva;https://www.youtube.com/watch?v=CdJYcjZfCH0;License: Standard Youtube License