Interim Income Statement

Chris Inc. has accumulated the following information for its second−quarter income statement for20X2:

Additional In formation

1. First-quarter income before taxes was $100,000, and the estimated effective annual tax rate was 40 percent. At the end of the second quarter, expected annual income is $600,000, and a dividend exclusion of $30,000 and a business tax credit of $15,000 are anticipated. The combined state and federal tax rate is 50 percent.

2. The $420,000 cost of goods sold is determined by using the LIFO method and includes 7,500 units from the base layer at a cost of $12 per unit. However, you have determined that theseunits are expected to be replaced at a cost of $26 per unit.

3. The operating expenses of $230,000 include a $60,000 factory rearrangement cost incurred inApril. You have determined that the second quarter will receive about 25 percent of the benefits from this project with the remainder benefiting the third and fourth quarters.

Required

- Calculate the effective annual tax rate expected at the end of the second quarter for Chris Inc.

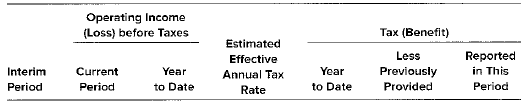

- Prepare the income statement for the second quarter of 20X2. Your solution should include a computation of income tax (or benefit) with the following headings:

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

- Provide Answerarrow_forwardTremont Global, Inc. produces and sells a single product. The product sells for $175.00 per unit, and its variable expense is $52.50 per unit. The company's monthly fixed expense is $245,600. What is the monthly break-even in total dollar sales?arrow_forwardget correct answer account questionsarrow_forward

- Need help with this financial accounting questionarrow_forwardQuestion: MOH cost: A company's manufacturing overhead includes $7.10 per machine hour for variable manufacturing overhead and $207,000 per period for fixed manufacturing overhead. What is the predetermined overhead rate for the denominator level of activity of 4,600 machine hours? Right answerarrow_forwardAccurate Answerarrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning