Concept explainers

21ST CENTURY EDUCATION PRODUCTS

OTHER TOPICS IN CAPITAL BUDGETING 21st Century Educational Products (21st Century) is a rap idly growing software company, and consistent with its growth, it has a relatively large capital budget Although most of the company’s projects are fairly easy to evaluate, a handful of projects involve more complex evaluations.

John Keller, a senior member of the company’s finance staff, coordinates the evaluation of these more complex projects. His group brings their recommendations directly to the company’s CFO and CEO, Kristin Riley and Bob Stevens, respectively.

- a. In recent months, Keller’s group has focused on real option analysis.

- 1. What is real option analysis?

- 2. What are some examples of projects with real options?

- b. Considering real options, one of Keller’s colleagues, Barbara Hudson, has suggested that instead of investing in Project X today, it might make sense to wait 1 year because 21st Century would learn more about market conditions and would improve its

forecast of the project's cash flows. Right now 21st Century forecasts that Project X will generate expected cash flows of $33,500 for 4 years. However, if the company waits 1 year, it will learn more about market conditions. There is a 50% chance that the market will be strong and a 50% chance that it will be weak. If the market is strong, the annual cash flows will be $43,500. If tire market is weak, the annual cash flows will be only $23,500. If 21st Century chooses to wait 1 year, the initial investment will remain $100,000, and cash flows will continue for 4 years after the initial investment is made. Assume that all cash flows are discounted at 10%. Should 21st Century invest in Project X today, or should it wait a year before deciding whether to invest in the project? - c. Now assume that there is more uncertainty about the future cash flows. More specifically, assume that the annual cash flows are $53,500 if the market is strong and $13,500 if the market is weak. Assume that the upfront cost is still $100,000 and that the WACC is still 10%. Will this increased uncertainty' make the firm more or less willing to invest in the project today? Explain.

- d. 21st Century is considering another project, Project Y. Project Y has an up-front cost of $200,000 and an economic life of 3 years. If the company develops the project, its after-tax operating costs will be $100,000 a year, however, the project is expected to produce after-tax

cash inflows of $180,000 a year. Thus, the project’s estimated cash flows are as follows:

|

|

|

|

| 0 | ($200,000) | $0 | ($200,000) |

| 1 | (100,000) | 180,000 | 80,000 |

| 2 | (100,000) | 180,000 | 80,000 |

| 3 | (100,000) | 180,000 | 80,000 |

- 1. The project has an estimated WACC of 10%. What is the project's expected NPV?

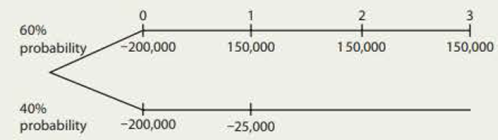

- 2. Although the project’s operating costs are fairly certain at 5100,000 per year, the estimated cash inflows depend critically on whether 21st Century’s largest customer uses the product. Keller estimates that there is a 60% chance that the customer will use the product, in which case the project will produce after-tax cash inflows of $250,000. Thus, its estimated project cash flows will be $150,000 per year However, there is a 40% chance that the customer will not use the product, in which case the project will produce after-tax cash inflows of only $75,000. Thus, its estimated project cash flows will be -$25,000. Write out the estimated cash flows, and calculate the project’s expected NPV under each of the two scenarios.

- 3. Although 21** Century does not have the option to delay the project, it will know 1 year from now whether the key customer has selected the product. If the customer chooses not to adopt the product, 21** Century has the option to abandon the project. If 21- Century abandons the project, it will not receive any cash flows after Year 1, and it will not incur any' operating costs after Year 1. Thus, if the company chooses to abandon the project, its estimated cash flow's will be as follows:

Again, assuming a WACC of 10%, what is the project’s expected NPV if it abandons the project? Should 21st Century invest in Project Y today, realizing it has the option to abandon the project at t = 1?

- 4. Up until now, we have assumed that the abandonment option has not affected tile project’s WACC. Is this assumption reasonable? How might the abandonment option affect the WACC?

- e. Finally, 21st Century is also considering Project Z. Project Z has an up-front cost of $500,000, and it is expected to produce cash flows of $100,000 at the end of each of the next 5 years (t = 1, 2, 3, 4, and 5). Because Project Z has a WACC of 12%, it clearly has a negative NPV. However, Keller and his group recognize that if 21st Century goes ahead with Project Z today, there is a 10% chance that this will lead to subsequent opportunities that have an expected

net present value at t = 5 equal to $3,000,000. At the same time, there is a 90% chance that the subsequent opportunities will have an expected negative net present value (-$1,000,000) at t = 5. On the basis of their knowledge of real options, Keller and his group understand that the company will choose to develop these subsequent opportunities only if they appear to be profitable at t = 5. Given this information, should 21st Century invest in Project Z today? Explain your answer.

a)

To discuss: The meaning of real option analysis.

1.

A contract to purchase a financial asset from one party and sell it to another party on an agreed price for a future date is termed as Option.

Explanation of Solution

The meaning of real option analysis is as follows:

A real option takes place when the company’s mangers can influence on the riskiness and size of the cash flows of the project by way of undertaking various actions at the end of the project’s life. This real option analysis include a benefit analysis on the Net present value (NPV) capital budgeting. It is done with a study of opportunities resulting from the manager’s responses to change outcomes of the project.

2.

To discuss: The example of projects with real options.

Explanation of Solution

The examples of projects with real options are as follows:

- Abandonment option is a type of real options. It is an option to end a particular project when the project’s operating cash flows are lower as compared to the expected cash flows.

- Growth option is also a type of real options. It exists when the investment creates an opportunity to make profitable investments.

- Flexibility options are also a type of real options. This option allows a company to change its operations based on the changes of current conditions during the life of the project. As a result, inputs, outputs, or both can be altered easily according to the present market demands.

b.

To discuss: Whether the C Company has to invest in Project X at present or wait for one-year before deciding to invest in the project.

Explanation of Solution

Given information:

C Company has decided to invest in Project X. The expected cash flows from the project at present are $33,500 for 4-years period. This project indicates that there is a 50% chance that the market will be strong and there is even 50% chance that the market condition will be weaker. The annual cash flows are $43,500 when the market condition is strong and $23,500 when the market is weak. The initial investment is $100,000 and discounted rate is 10 percent.

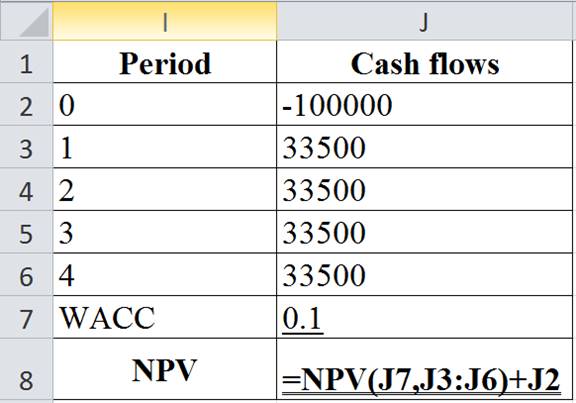

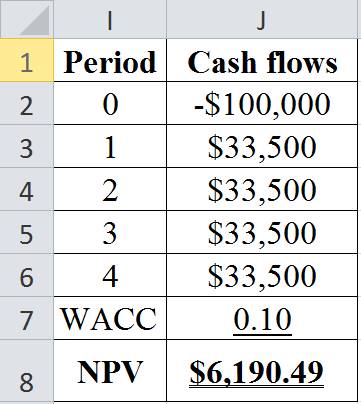

Compute the NPV for doing the project at present:

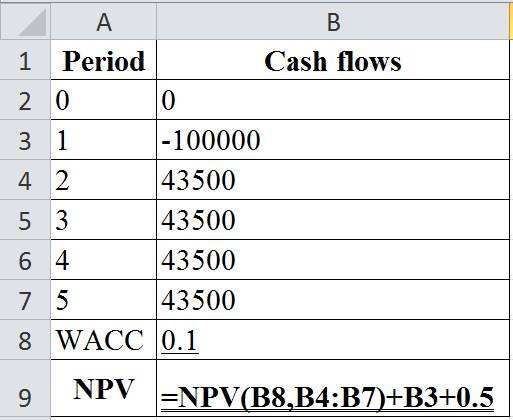

The table below shows the Excel formula to calculate the NPV for doing the project at present:

The table below shows the calculated values of NPV for doing the project at present:

Hence, the NPV for doing the project at present is $6,190.49.

Compute the NPV of waiting to do project:

Note: At the time when the project has 50 percent chance of good conditions.

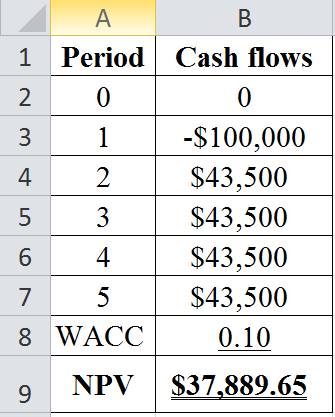

The table below shows the Excel formula to calculate the NPV of waiting to do project:

The table below shows the calculated values of NPV of waiting to do project:

Hence, the NPV when the project is in good condition is $37,889.65.

Compute the NPV:

Note: At the time when the project has 50 percent chance of weaker market.

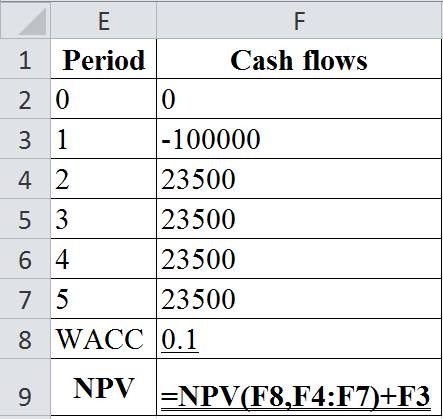

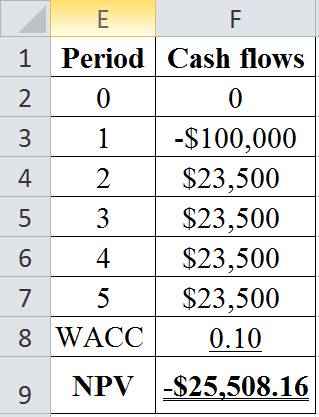

The table below shows the Excel formula to calculate the NPV of waiting to do project:

The table below shows the calculated values of NPV of waiting to do project:

Hence, the NPV when the project is in bad condition is −$25,508.16. Therefore, the company cannot undertake the project in the weaker market because its NPV is less than zero.

Compute the expected NPV of waiting one-year:

Hence, the expected NPV of waiting one-year is $18,944.825. This is the present value for one-year, so it has to be discounted back to determine the current value for waiting to undertake the Project X. As a result, the present value of waiting is $17,222.57

c.

To discuss: Whether the increased uncertainty makes the company more or less willing to invest in the project at present.

Explanation of Solution

Given information:

The C Company’s project has more uncertainty regarding the future cash flows. The annual cash flows are $53,500 when the market is strong and $13,500 when the market is weak. The initial cost is $100,000 and the WACC is 10 percent.

Compute the NPV for strong market condition case:

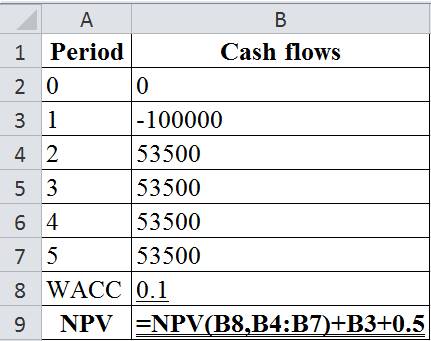

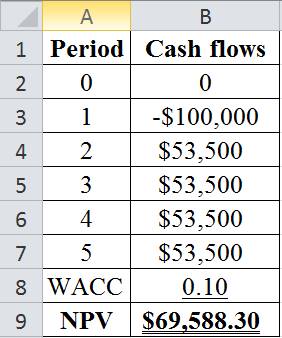

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV:

Hence, the NPV when the project is in strong market condition is $69,588.30.

Compute the NPV for weaker market condition case:

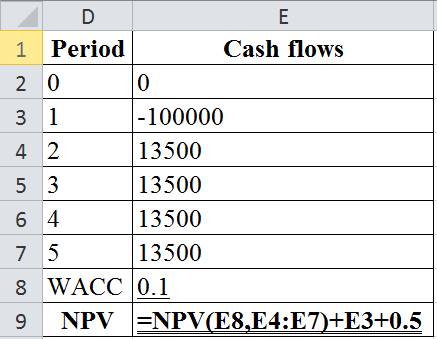

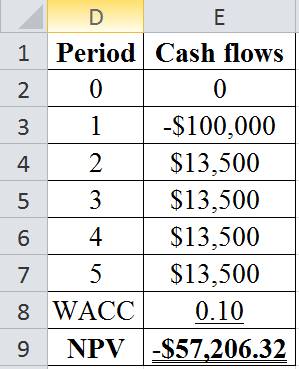

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV:

Hence, the NPV when the project is in bad condition is −$57,206.32. Therefore, the company cannot undertake the project in the weaker market because its NPV is less than zero.

Compute the expected NPV of waiting one-year:

Hence, the expected NPV of waiting one-year is $34,794.15. This is the present value for one-year, so it has to be discounted back to determine the current value for waiting to undertake the Project X. As a result, the present value of waiting is $31,631.05

d.

To discuss: The expected NPV of the project.

1.

NPV is the variation between the present value of the cash outflows and the present value of the cash inflows. In capital budgeting, the NPV is utilized to analyze the profitability of a project or investment.

Explanation of Solution

Given information:

C Company is considering another project that is Project Y. The initial cost of this project is $200,000 and the economic life of the project is 3-years. The after-tax operating cost is $100,000 per year, WACC is 10 percent, and expected after-tax cash inflows are $180,000 a year. The project’s estimated cash flows are as follows:

| Year |

Cash outflows |

Cash inflows |

Estimated project cash flows |

| 0 | -$200,000 | $0 | -$200,000 |

| 1 | -$100,000 | $180,000 | $80,000 |

| 2 | -$100,000 | $180,000 | $80,000 |

| 3 | -$100,000 | $180,000 | $80,000 |

Compute the NPV:

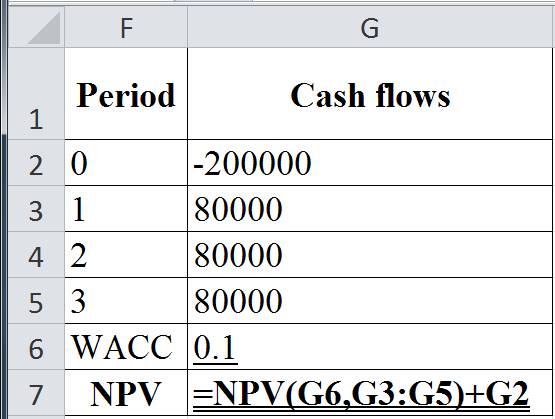

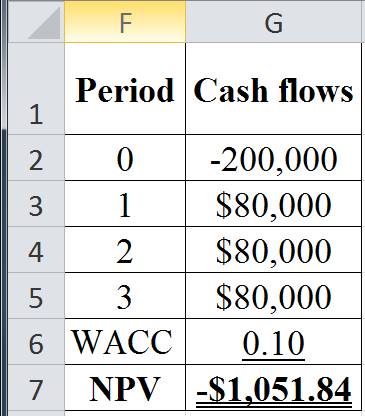

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV:

Hence, the expected NPV is −$1,051.84.

2.

To find: The expected NPV of the project in each scenario.

Explanation of Solution

Given information:

The operating cost of the project is $100,000 per year. This project indicates that there is a 60% probability that the customers will use the product and produce after-tax cash inflows of $250,000. The estimated cash flows of the project will be $150,000 per year. Even there is 40% chance that the customer will not use the product and produce after-tax cash inflows of $75,000. In this case, the estimated project’s cash flows is −$25,000.

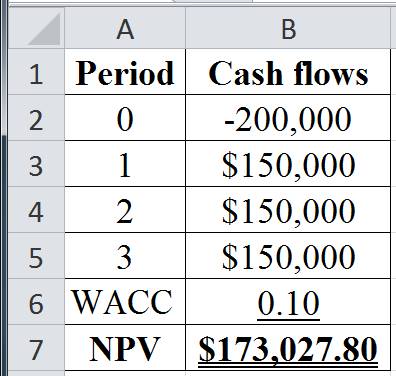

Compute the NPV when customer uses the product:

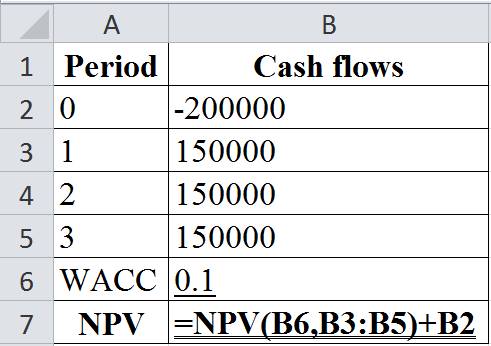

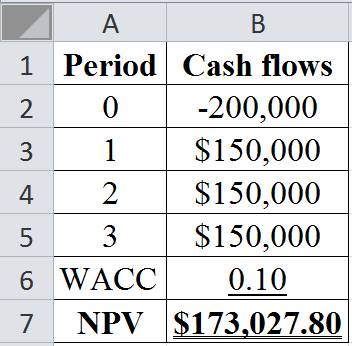

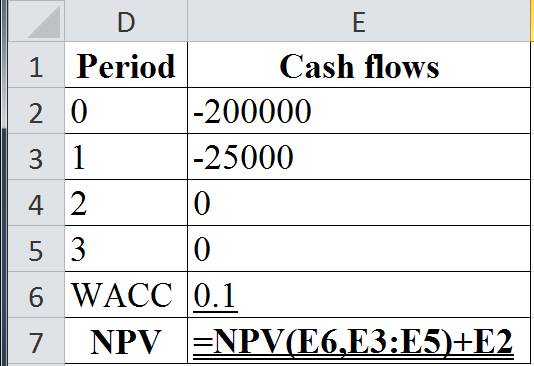

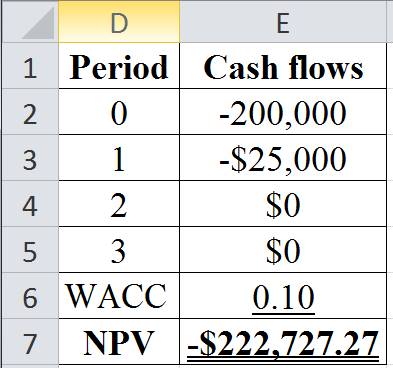

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV when customer uses the product:

Hence, the NPV when customer uses the product is $173,027.80.

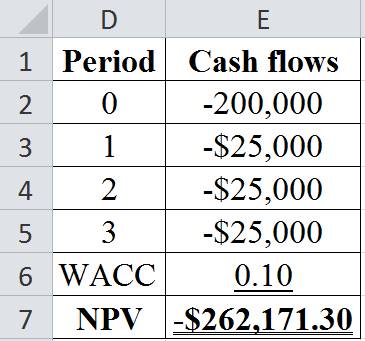

Compute the NPV when customer does not use the product:

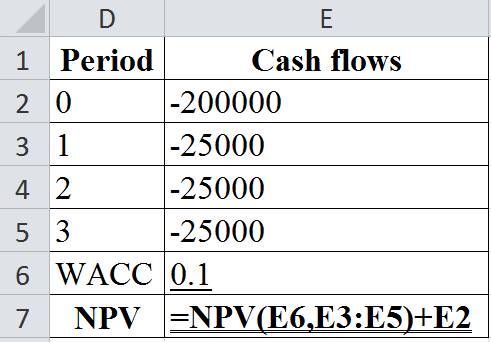

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV when customer does not use the product:

Hence, the NPV when customer does not use the product is −$262,171.30.

Compute the expected NPV:

Hence, the expected NPV is −$1,051.84.

3.

To find: The expected NPV of the project.

Explanation of Solution

Given information:

The operating cost of the project is $100,000 per year. This project indicates that there is a 60% probability that the customers will use the product and produce after-tax cash inflows of $250,000. The estimated cash flows of the project will be $150,000 per year. Even there is 40% chance that the customer will not use the product and produce after-tax cash inflows of $75,000. In this case, the estimated project’s cash flows is −$25,000.

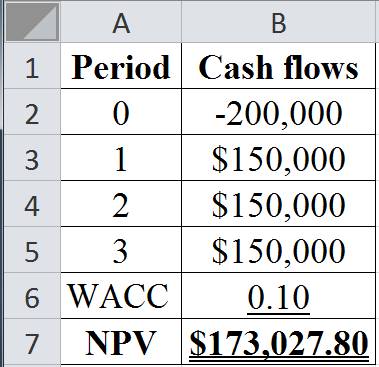

Compute the NPV when there is 60% chance:

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV when there is 60% chance:

Hence, the NPV when there is 60% chance is $173,027.80.

Compute the NPV when there is 40% chance:

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV when there is 40% chance:

Hence, the NPV when there is 40% chance is −$222,727.27.

Compute the expected NPV:

Hence, the expected NPV is $14,725.772. Therefore, the C Company can execute the project currently.

4.

To discuss: Whether the assumption is reasonable and ways in which the abandonment option affect the WACC.

Explanation of Solution

Determine whether the assumption is reasonable and ways in which the abandonment option affect the WACC:

The assumption is not reasonable to assume that the abandonment option has not effected on the WACC of the project. The abandonment option has the ability to reduce risk and it even reduces the WACC of the project.

e.

To find: Whether the C Company has to invest in Project Z at present.

Explanation of Solution

C Company has decided to invest in Project Z. The initial cost of this project is $500,000 and the expected cash flows produced is $100,000 at the end of next 5-years. The WACC is 12 percent and there is 10 percent chance that the expected NPV of the project will be $3,000,000. Even there is 90 percent chance that the expected NPV will be −$1,000,000.

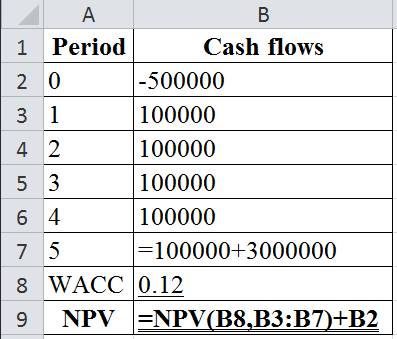

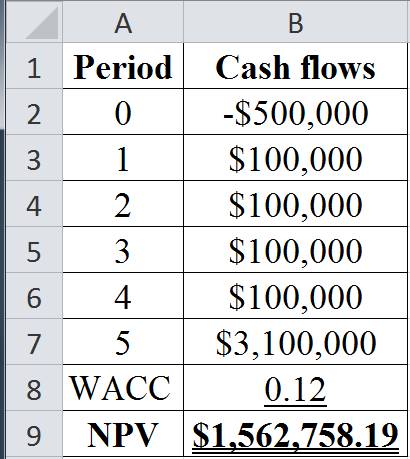

Compute the NPV when there is 10% chance:

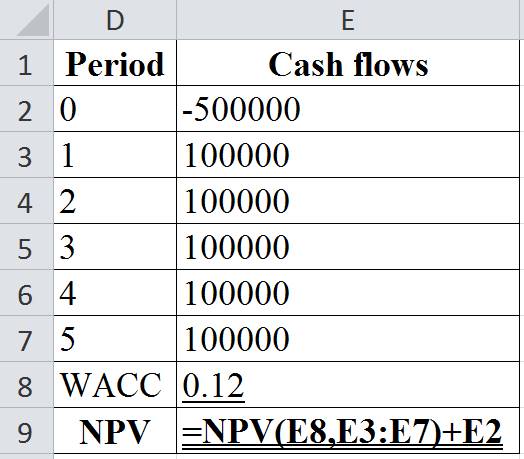

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV when there is 10% chance:

Hence, the NPV when there is 10% chance is $1,562,758.19.

Compute the NPV when there is 90% chance:

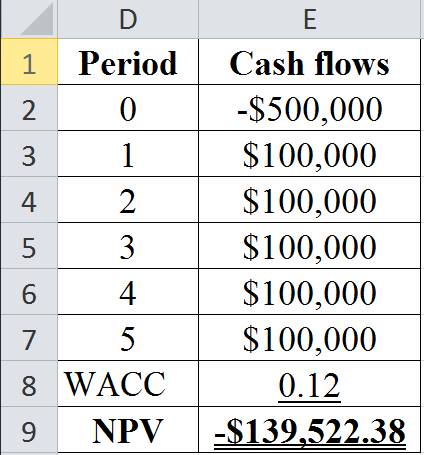

The table below shows the Excel formula to calculate the NPV:

The table below shows the calculated values of NPV when there is 90% chance:

Hence, the NPV when there is 90% chance is −$139,522.38. The C Company will not undertake the project that has a negative NPV of future opportunities. Therefore, the cash flows include only $500,000 and $100,000 inflows.

Compute the expected NPV:

Hence, the expected NPV is $30,705.68. Therefore, the Project Z has a positive NPV so the C Company can invest in the project at present.

Want to see more full solutions like this?

Chapter 13 Solutions

Bundle: Fundamentals Of Financial Management, 15th + Mindtap Finance, 2 Terms (12 Months) Printed Access Card

- What are AIrbnb's Legal Foundations? What are Airbnb's Business Ethics? What are Airbnb's Corporate Social Responsibility?arrow_forwardDiscuss in detail the differences between the Primary Markets versus the Secondary Markets, The Money Market versus the Capital Market AND the Spot Market versus the Futures Market. Additionally, discuss the various Interest Rate Determinants listed in your textbook (such as default-risk premium.....).arrow_forwardHow can the book value still serve as a useful metric for investors despite the dominance of market value?arrow_forward

- How do you think companies can practically ensure that stakeholder interests are genuinely considered, while still prioritizing the financial goal of maximizing shareholder equity? Do you think there’s a way to measure and track this balance effectively?arrow_forward$5,000 received each year for five years on the first day of each year if your investments pay 6 percent compounded annually. $5,000 received each quarter for five years on the first day of each quarter if your investments pay 6 percent compounded quarterly. Can you show me either by hand or using a financial calculator please.arrow_forwardCan you solve these questions on a financial calculator: $5,000 received each year for five years on the last day of each year if your investments pay 6 percent compounded annually. $5,000 received each quarter for five years on the last day of each quarter if your investments pay 6 percent compounded quarterly.arrow_forward

- Now suppose Elijah offers a discount on subsequent rooms for each house, such that he charges $40 for his frist room, $35 for his second, and $25 for each room thereafter. Assume 30% of his clients have only one room cleaned, 25% have two rooms cleaned, 30% have three rooms cleaned, and the remaining 15% have four rooms cleaned. How many houses will he have to clean before breaking even? If taxes are 25% of profits, how many rooms will he have to clean before making $15,000 profit? Answer the question by making a CVP worksheet similar to the depreciation sheets. Make sure it works well, uses cell references and functions/formulas when appropriate, and looks nice.arrow_forward1. Answer the following and cite references. • what is the whole overview of Green Markets (Regional or Sectoral Stock Markets)? • what is the green energy equities, green bonds, and green financing and how is this related in Green Markets (Regional or Sectoral Stock Markets)? Give a detailed explanation of each of them.arrow_forwardCould you help explain “How an exploratory case study could be goodness of work that is pleasing to the Lord?”arrow_forward

- What are the case study types and could you help explain and make an applicable example.What are the 4 primary case study designs/structures (formats)?arrow_forwardThe Fortune Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 24 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Year 0 Year 1 Year 2 Year 3 Year 4 Investment $ 28,000 Sales revenue $ 14,500 $ 15,000 $ 15,500 $ 12,500 Operating costs 3,100 3,200 3,300 2,500 Depreciation 7,000 7,000 7,000 7,000 Net working capital spending 340 390 440 340 ?arrow_forwardWhat are the six types of alternative case study compositional structures (formats)used for research purposes, such as: 1. Linear-Analytical, 2. Comparative, 3. Chronological, 4. Theory Building, 5. Suspense and 6. Unsequenced. Please explainarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education