Accounting for the liquidation of a partnership

Learning Objective 6

2. Loss on Disposal $55,000

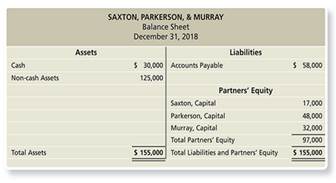

The partnership of Saxton, Parkerson, & Murray has experienced operating losses for three consecutive years. The partners—who have shared profits and losses in the ratio of Saxton, 10%; Parkerson, 65%; and Murray, 25%—are liquidating the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership balance sheet at December 31, 2018:

Requirements

1. Assume the non-cash assets are sold for $170,000. Journalize the liquidation transactions.

2. Assume the non-cash assets are sold for $70,000. Journalize the liquidation transactions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Horngren's Accounting, The Financial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (12th Edition)

- Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $20,500. February 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. August 19 Purchased Kodak bonds for $15,300. December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black & Decker bonds for $50,400. August 3 Sold all of the Sara…arrow_forwardWhat is the ending inventory?arrow_forwardMaple industries uses the straight line method solution general accounting questionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning