Accounting for the liquidation of a

Learning Objective 6

2. Loss on Disposal $55,000

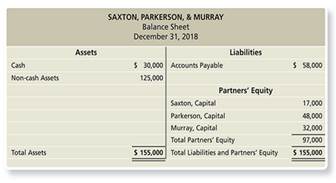

The partnership of Saxton, Parkerson, & Murray has experienced operating losses for three consecutive years. The partners—who have shared profits and losses in the ratio of Saxton, 10%; Parkerson, 65%; and Murray, 25%—are liquidating the business. They ask you to analyze the effects of liquidation. They present the following condensed partnership

Requirements

1. Assume the non-cash assets are sold for $170,000. Journalize the liquidation transactions.

2. Assume the non-cash assets are sold for $70,000. Journalize the liquidation transactions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Horngren's Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (12th Edition)

- Problem Solving : a. Gulane, Tormis and Sailadin decided to Liquidate their partnership in June 30, 2018. The partners shared profits and losses in the ratio 2:2:1 respectively. The firms post closing trial balance follows: Gulane, Tormis and Sailadin Post Closing Trial Balance June 30, 2018 Account Name Debit Credit P 419,170 Cash Merchandise Inventory Other Assets Accounts Payable Gulane Capital Tormis Capital Sailadin, Capital 612,300 472,680 P 131,350 561,600 436.800 374,400 1.504,150 1.504.150 The merchandise inventory and the other assets were sold for P 582,800 and P 550,900 respectively. Required : Prepare the Liquidation journal entries.arrow_forwardWhat is the correct ansarrow_forwardProvide solutionarrow_forward

- Homework Activity 1 A, B and C are in Partnership sharing profits and losses in the ratio of 2:1:1. During the year ending 31st Dec 2019, the business made a profit of RO 64,000 before providing Interest on capital : A 2,000, B 1500, C 1000 Interest on drawings: A 200, B 150, C 100 Salary to Partners A 500 B 700 C 600 Commission to Partners A 200 B 300 C 400 Prepare a profit and loss appropriation account to show the distribution of profit among the partners.arrow_forwardHelping tags: Accounting . . . . WILL SURELY UPVOTE, just pls help me answer all the parts pls. Thank you!arrow_forwardMake-up assignment Partnership Dissolution Instruction: Prepare the answers and solutions in written form using a clean paper (e.g. Yellow pad, bond paper, notebook etc.) and submit a snapshot in CANVAS. Problem 1. A and B are partners in an electrical repair business. Their respective capital balances are P90,000 and P50,000, and they share profits or losses equally. Because the partners are confronted with personal financial problems, they decided to admit a new partner to the partnership. After an extensive interviewing process, they elect to admit C into the partnership. Required: Prepare the journal entry to record the admission of C into the partnership and determine capital balances of A, B and C under each of the following condition: 1. Cacquires one-fourth interest of A's capital interest by paying 30,000 directly to him. 2. Cacquires one-fifth interest of each A and B capital interest. A receives P25,000 and B receives P15,000 directly from C. 3. Cacquires a one-fifth…arrow_forward

- Pls help me solve this onearrow_forwardPlease do not give solution in image format thankuarrow_forwardSECTION: PROFESSOR: Problem #14 Admission by Investment of Assets On Jan. 31, 2019, Partners Abad, Ramos and Cammayo had the following loan and capital account balances (after closing entries for Jan.): Loan receivable from Abad P 20,000 dr 60,000 cr Abad payable to Cammayo Abad, Capital Ramos, Capital Cammayo, Capital 30,000 dr 120,000 cr 70,000 cr The partnership's income-sharing ratio was Abad, 50%; Ramos, 20%; and Cammayo, 30%. On Jan. 31, 2019, Gonzales was admitted to the partnership for a 20% interest in total capital of the partnership in exchange for an investment of P40,000 cash. Prior to Gonzales's admission, the existing partners agreed to increase the carrying amount of the partnership's inventories to current fair value, a P60,000 increase. Required: Prepare the journal entries the increase in inventories and the admission of Gonzales.arrow_forward

- 9) ACCOUNTING PRINCIPLES II coursearrow_forwardInstruction: Prepare the answers in written form using a clean paper (e.g. Yellow pad, bond paper, notebook etc.) and submit a snapshot in CANVAS. Assume A, B, C and D are partners sharing profits 40%, 20%, 20%, 20%, respectively. On January 1, 2020, they agree to liquidate. A balance sheet prepared on this date is shown as follows: Assets Liabilities and Capital Non- Cash assets P 181,800 Liabilities P 84,000 A, Loan 6,000 D, Loan 3,000 A, Capital 26,400 В, Сapital C, Capital D, Capital 25,800 20,400 16,200 Total P 181,800 P 181,800 Results of liquidation are summarized below: Month Proceeds Book Value Liquidation exp. Cash withheld January P72,000 P90,000 P1,200 P4,800 February 21,600 30,000 1,320 1,800 March 19,200 24,000 1,440 1,200 April 6,000 19,800 4,800 600 May 2,400 18,000 960 Required: Prepare the statement of liquidation and related schedule of safe payment for the month of January to May 2020 and determine payment to partners for every month.arrow_forwardPlease solve this problem completelyarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning