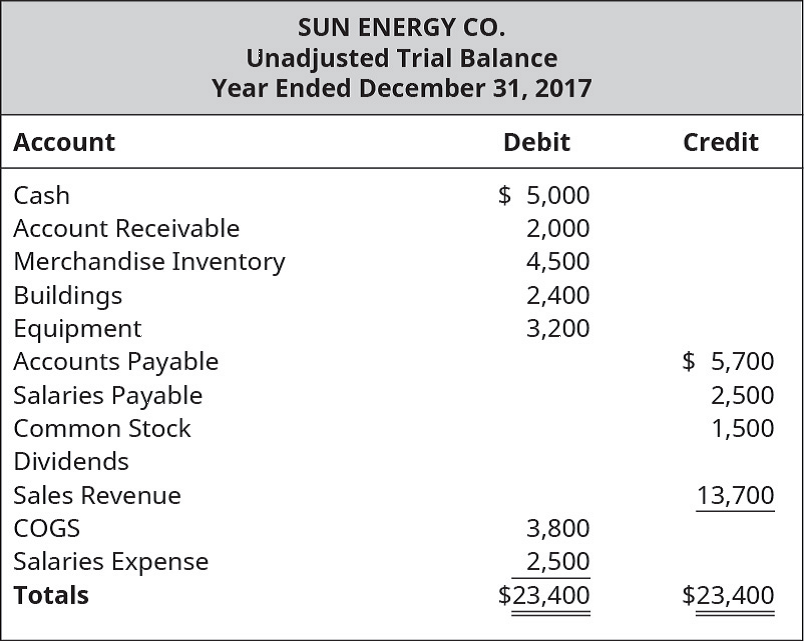

Following is the unadjusted

You are also given the following supplemental information: A pending lawsuit, claiming $2,700 in damages, is considered likely to favor the plaintiff and can be reasonably estimated. Sun Energy Co. believes a customer may win a lawsuit for $3,500 in damages, but the outcome is only reasonably possible to occur. Sun Energy calculated warranty expense estimates of $210.

A. Using the unadjusted trial balance and supplemental information for Sun Energy Co., construct an income statement for the year ended December 31, 2017. Pay particular attention to expenses resulting from contingencies.

B. Construct a

C. Prepare any necessary

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

MARKETING:REAL PEOPLE,REAL CHOICES

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Engineering Economy (17th Edition)

- E-trax, Inc. has provided the following financial information for the year: Finished Goods Inventory: Units produced Beginning balance, in units 640 2,800 2,900 540 Units sold Ending balance, in units Production costs: Variable manufacturing costs per unit $65 Total fixed manufacturing costs $56,000 What is the unit product cost for the year using absorption costing?arrow_forwardWhat is the amount of allocated manufacturing overhead cost for August? Accountingarrow_forwardNonearrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College