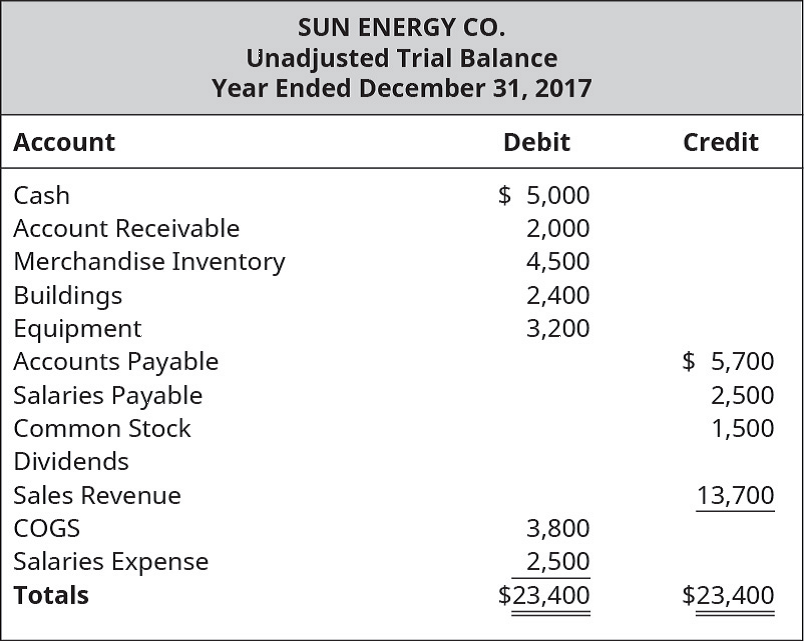

Following is the unadjusted

You are also given the following supplemental information: A pending lawsuit, claiming $2,700 in damages, is considered likely to favor the plaintiff and can be reasonably estimated. Sun Energy Co. believes a customer may win a lawsuit for $3,500 in damages, but the outcome is only reasonably possible to occur. Sun Energy calculated warranty expense estimates of $210.

A. Using the unadjusted trial balance and supplemental information for Sun Energy Co., construct an income statement for the year ended December 31, 2017. Pay particular attention to expenses resulting from contingencies.

B. Construct a

C. Prepare any necessary

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

MARKETING:REAL PEOPLE,REAL CHOICES

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Engineering Economy (17th Edition)

- Hayden Systems has projected revenues of $8.5 billion, a gross profit margin of 55%, and projected SG&A expenses of $1.7 billion. What is the company's operating (EBIT) margin?arrow_forwardWhat is the book equivalent of taxable income ?arrow_forwardWhat amount of joint cost should be allocated to product beta?arrow_forward

- Deterimine the pension asset/liability at December 31,2023.arrow_forwardAt the beginning of the year, Downtown Athletic had an inventory of $200,000. During the year, the company purchased goods costing $800,000. If Downtown Athletic reported ending inventory of$300,000 and sales of $1,050,000, their cost of goods sold and gross profit rate must be ..........................................arrow_forwardGeneral Accountingarrow_forward

- Please provide the answer to this general accounting question using the right approach.arrow_forwardCardinals Company disposed of an asset at the end of the seventh year of its estimated life for $19,500 cash. The asset's life was originally estimated to be 12 years. The original cost was $96,000 with an estimated residual value of $12,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forward

- Compute the cash received from the sale of the equipmentarrow_forwardOvid Holdings acquired Twilight Enterprises on January 1, 2019 for $8,200,000, and recorded goodwill of $1,500,000 as a result of that purchase. At December 31, 2019, the Twilight Enterprises Division had a fair value of $7,300,000. The net identifiable assets of the Division (excluding goodwill) had a fair value of $6,400,000 at that time. What amount of loss on impairment of goodwill should Ovid Holdings record in 2019? a) $0 b) $600,000 c) $900,000 d) $1,500,000arrow_forwardThe company'sarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College