Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

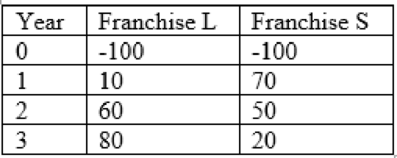

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

Here are the net cash flows (in thousand $)

To determine: The profitability index (PI) of each franchises and the definition of PI.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

- I need help! A company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forwardNeed help!! What does the term "liquidity" refer to in finance? A) The ability to convert assets into cash quickly without significant loss of value B) The ability to increase company profits C) The level of debt in the company D) The diversity of the investment portfolioarrow_forwardI need answer step by step. A company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forward

- Don't use ai A company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forwardA company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forwardI need help! Which of the following best defines "diversification" in investment? A) Investing in a single type of asset for high returns B) Spreading investments across different assets to reduce risk C) Putting all funds into low-risk bonds D) Focusing on high-risk, high-return investmentsarrow_forward

- Which of the following best defines "diversification" in investment? A) Investing in a single type of asset for high returns B) Spreading investments across different assets to reduce risk C) Putting all funds into low-risk bonds D) Focusing on high-risk, high-return investmentsarrow_forwardWhich of the following best describes the "efficient market hypothesis"? A) Stocks are always priced higher than their actual value. B) It is impossible to outperform the market consistently due to all information being already reflected in stock prices. C) Only insider information can help outperform the market. D) The market reacts slowly to new information.arrow_forwardThe "time value of money" concept states that: A) Money today is worth more than the same amount in the future B) Money tomorrow is worth more than today’s money C) Money and time have no relation in financial decisions D) Time has no impact on financial investmentsarrow_forward

- I need help. If net income is $25,000 and total equity is $125,000, what is the return on equity (ROE)?A. 10%B. 15%C. 20%D. 25%arrow_forwardI need help!!Which of the following is NOT a type of financial market? A) Capital Market B) Money Market C) Labor Market D) Commodity Marketarrow_forwardWhich of the following is NOT a type of financial market? A) Capital Market B) Money Market C) Labor Market D) Commodity Marketarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College