a)

Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

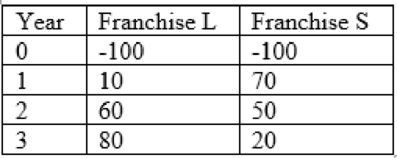

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

Here are the net cash flows (in thousand $)

To determine: The definition of

b)

To determine: The relationship between IRR and YTM and IRR if equal

c)

To determine: The logic behind the IRR method and the franchises must be accepted if they are independent and equally exclusive.

d)

To determine: Whether IRR changes with respect to change in cost of capital.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning