Concept explainers

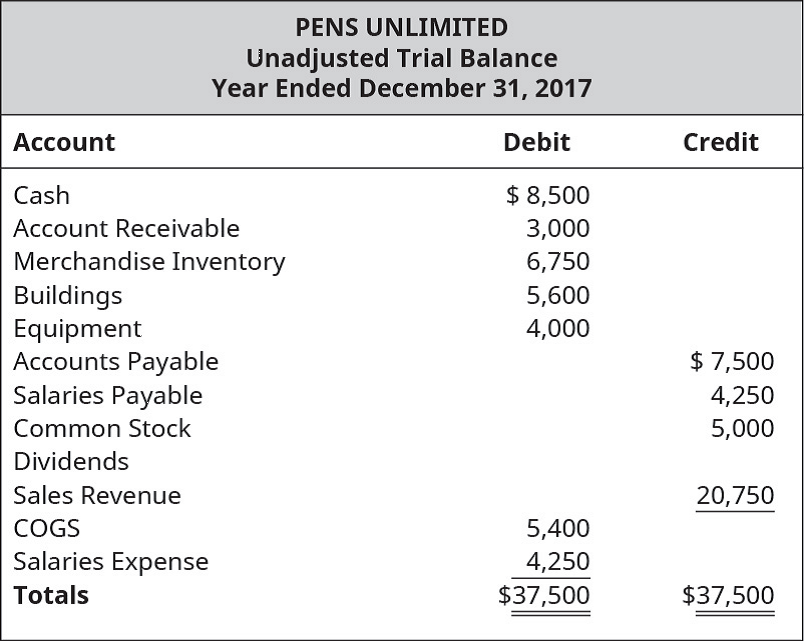

Following is the unadjusted

You are also given the following supplemental information: A pending lawsuit, claiming $4,200 in damages, is considered likely to favor the plaintiff and can be reasonably estimated. Pens Unlimited believes a customer may win a lawsuit for $5,000 in damages, but the outcome is only reasonably possible to occur. Pens Unlimited records warranty estimates on the basis of 2% of annual sales revenue.

A. Using the unadjusted trial balance and supplemental information for Pens Unlimited, construct an income statement for the year ended December 31, 2017. Pay particular attention to expenses resulting from contingencies.

B. Construct a

C. Prepare any necessary

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

MARKETING:REAL PEOPLE,REAL CHOICES

Financial Accounting, Student Value Edition (5th Edition)

Engineering Economy (17th Edition)

Horngren's Accounting (12th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of lending for a longer time period. Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest.Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest. Select the options to display a 120-month installment note with 12% interest. How much of the principal amount is due after the 60th payment?arrow_forward!??arrow_forwardaccounting questionarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College