a.

Prepare the

a.

Explanation of Solution

Stockholders’ equity section: The section of balance sheet which reports the changes in stock, paid-in capital,

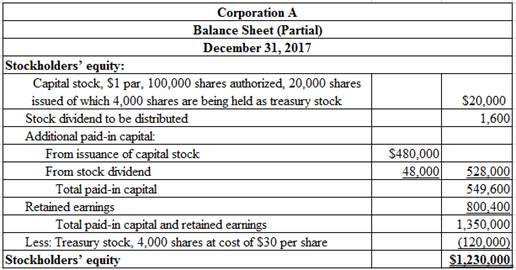

Prepare the stockholders’ equity section of the balance sheet for Corporation A at December 31, 2017.

Table (1)

Working Notes:

Compute the capital stock value.

Compute the amount of stock dividends to be distributed.

Step 1: Compute the number of shares to be distributed as stock dividends.

Step 2: Compute the amount of stock dividends to be distributed (Refer to Equation (1) for stock dividend shares value).

Compute additional paid-in capital from issuance of stock.

Compute additional paid-in capital from stock dividends (Refer to Equation (1) for stock dividend shares).

Compute amount of retained earnings for the year ended December 31, 2017.

Step 1: Compute amount of retained earnings distributable for stock dividends (Refer to Equation (1) for stock dividend shares value).

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2017 | |

| Retained earnings, January 1, 2017 | $0 |

| Add: Net income | 850,000 |

| 850,000 | |

| Less: Stock dividends | (49,600) |

| Retained earnings, December 31, 2017 | $800,400 |

Table (2)

Note: Refer to Equation (2) for value and computation of stock dividends.

Thus, the total stockholders’ equity of Corporation M December 31, 2017 is $1,230,000.

b.

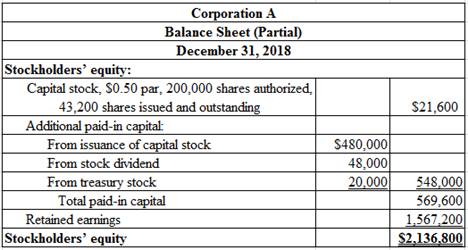

Prepare the stockholders’ equity section of the balance sheet for Corporation A at December 31, 2018.

b.

Explanation of Solution

Prepare the stockholders’ equity section of the balance sheet for Corporation A at December 31, 2018.

Table (3)

Working Notes:

Compute the number of shares issued and outstanding, after the stock dividend and stock split transactions.

Compute the capital stock value (Refer to Equation (3) for value of number of shares issued and outstanding).

Compute additional paid-in capital value from treasury stock.

Compute amount of retained earnings for the year ended December 31, 2018.

Step 1: Compute amount of cash dividends.

Step 2: Compute amount of retained earnings.

| Corporation A | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2018 | |

| Retained earnings, January 1, 2018 | $800,400 |

| Add: Net income | 810,000 |

| 1,610,400 | |

| Less: Cash dividends | (43,200) |

| Retained earnings, December 31, 2018 | $1,567,200 |

Table (4)

Note: Refer to Table (2) for value and computation of opening retained earnings balance, and Equation (4) for value and computation of cash dividends.

Thus, the total stockholders’ equity of Corporation A at December 31, 2018 is $1,567,200.

Want to see more full solutions like this?

Chapter 12 Solutions

Financial Accounting

- A Statement of Financial Position (Balance Sheet) shows liabilities of $125,000 and assets of $240,000. The Income Statement shows income of $80,000 and expenses of $35,000. Equity is: a. $45,000. b. $115,000. c. $160,000. d. $365,000.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardIntrasol Inc. sells a product at $52 per unit. The variable cost per unit is $30, total fixed costs are $28,000, and the company sells 7,200 units. If the tax rate is 30%,what is the net income?arrow_forwardThe liabilities of Underwood Corporation are $93,420. Also, common stock account is $167,500, dividends are $84,300, revenues are $512,680, and expenses are $395,240. What is the amount of Underwood Corporation's total assets?arrow_forward

- The Terra corporation uses the straight-line method to depreciate its machinery. On March 1, 2022, the company purchased some machinery for $360,000. The machinery is estimated to have a useful life of eight years and a salvage value of $40,000. How much depreciation expense should Terra record for the machinery in the adjusting entry on December 31, 2022?arrow_forwardI need help with this problem and accounting questionarrow_forwardStevenson Corporation reported a pretax book income of $500,000 in 2022. Included in the computation were favorable temporary differences of $60,000, unfavorable temporary differences of $25,000, and favorable permanent differences of $50,000. What is the book equivalent of taxable income for Stevenson Corporation? Ansarrow_forward

- The 2014 balance sheet of Sugarpova's Tennis Shop, Inc., showed long- term debt of $6.1 million, and the 2015 balance sheet showed long- term debt of $6.3 million. The 2015 income statement showed an interest expense of $210,000. During 2015, the company had a cash flow to creditors of $10,000 and the cash flow to stockholders for the year was $65,000. Suppose you also know that the firm's net capital spending for 2015 was $1,460,000 and that the firm reduced its net working capital investment by $87,000. What was the firm's 2015 operating cash flow, or OCF?arrow_forwardA company sells goods at a mark-up of 80% on cost. The total sales revenue is $500,000. What is the cost of sales?arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education