1.

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances.

1.

Explanation of Solution

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

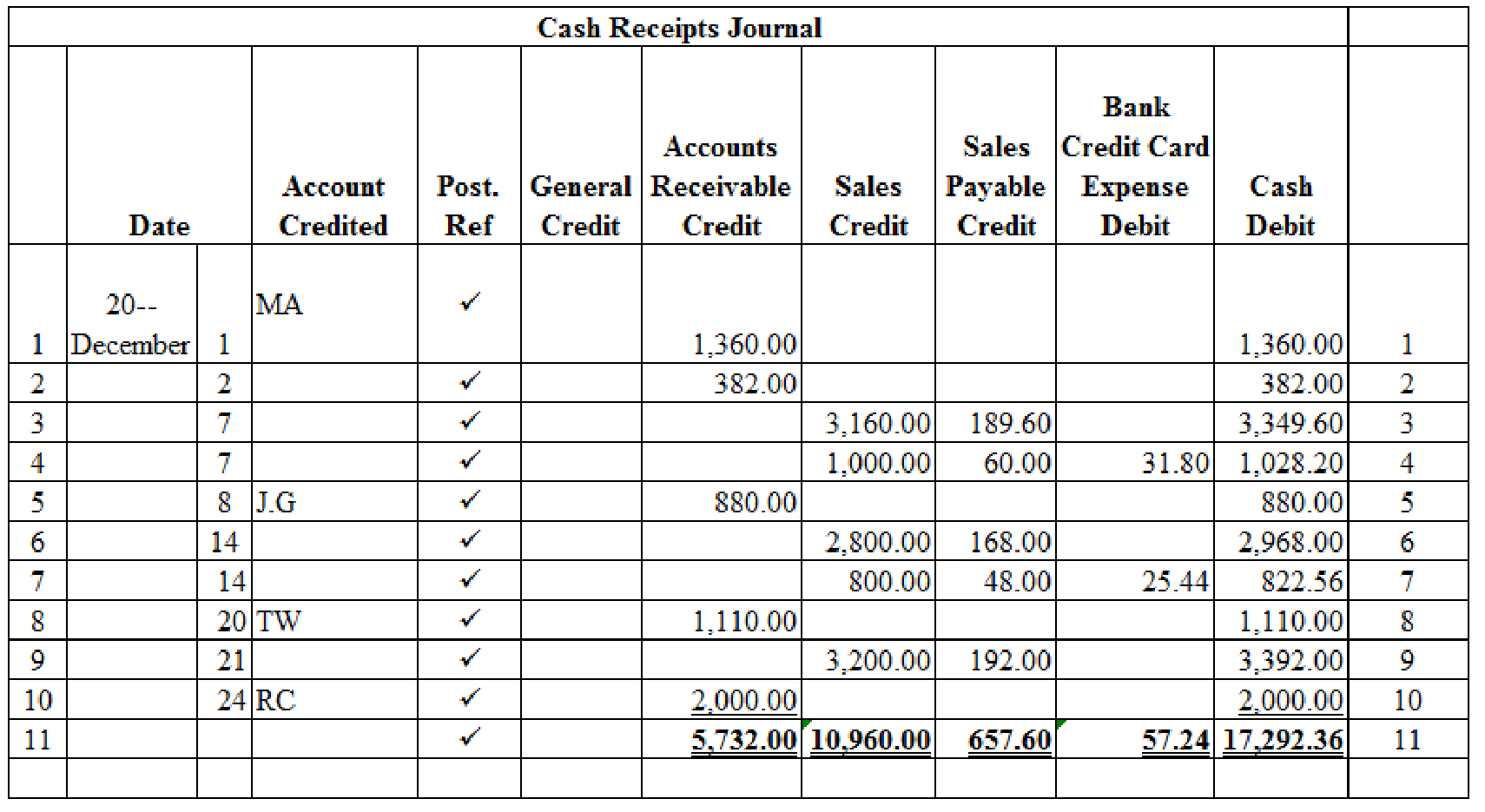

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances:

Table (1)

Verification of total debit and credit column:

Working note 1:

Calculate the amount of cash on dated 7th December:

Working note 2:

Calculate the amount of bank credit card expense on dated 7th December:

Working note 3:

Calculate the amount of cash on dated 7th December:

Working note 4:

Calculate the amount of cash on dated 14th December:

Working note 5:

Calculate the amount of bank credit card expense on dated 14th December:

Working note 6:

Calculate the amount of cash on dated 14th December:

Working note 7:

Calculate the amount of cash on dated 21st December:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on December 11:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 11 | Sales Returns and Allowances | 401.1 | 60.00 | ||

| Sales Tax Payable | 231 | 3.60 | ||||

| Accounts Receivable, MA | 122/✓ | 63.60 | ||||

| (To record the merchandise returned) | ||||||

Table (2)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, MA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount.

Transaction on December 21:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 21 | Sales Returns and Allowances | 401.1 | 22.00 | ||

| Sales Tax Payable | 231 | 1.32 | ||||

| Accounts Receivable, A Manufacturing | 122/✓ | 23.32 | ||||

| (To record the merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, A Manufacturing is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount;

2.

Post the prepared journal to the general ledger, and to the accounts receivable ledger.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,862.00 | |||

| 31 | CR10 | 17,292.36 | 27,154.36 | ||||

Table (4)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,352.00 | |||

| 11 | J8 | 63.60 | 9,288.40 | ||||

| 21 | J8 | 23.32 | 9,265.08 | ||||

| 31 | CR10 | 5,732.00 | 3,533.08 | ||||

Table (5)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 3.60 | 3.60 | |||

| 21 | J8 | 1.32 | 4.92 | ||||

| 31 | CR10 | 657.60 | 652.68 | ||||

Table (6)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 10,960.00 | 10,960.00 | |||

Table (7)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 60.00 | 60.00 | |||

| 21 | J8 | 22.00 | 82.00 | ||||

Table (8)

| ACCOUNT Bank Credit Card Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 57.24 | 57.24 | |||

Table (9)

Post the journals to the accounts receivable ledger.

| NAME MA | ||||||

| ADDRESS 233 W 11th Avenue, D, Mi 59500-1154 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 2,480.00 | ||

| 1 | CR10 | 1,360.00 | 1,120.00 | |||

| 11 | J8 | 63.60 | 1,056.40 | |||

Table (10)

| NAME A Manufacturing | ||||||

| ADDRESS 284 W 88 Street, D, Mi 59522-1168 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 982.00 | ||

| 2 | CR10 | 382.00 | 600.00 | |||

| 21 | J8 | 23.32 | 576.68 | |||

Table (11)

| NAME JG | ||||||

| ADDRESS P.O. Box 864, D, Mi 59552-0864 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 880.00 | ||

| 8 | CR10 | 880.00 | 0 | |||

Table (12)

| NAME TW | ||||||

| ADDRESS 100 N w S Street., D, Mi 59210-1337 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 1,810.00 | ||

| 20 | CR10 | 1,110.00 | 700.00 | |||

Table (13)

| NAME RC | ||||||

| ADDRESS 11312 Fourteenth Avenue South, D, Mi 59221-1142 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 3,200.00 | ||

| 24 | CR10 | 2,000.00 | 1,200.00 | |||

Table (14)

Want to see more full solutions like this?

Chapter 12 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardI need help solving this accounting question with the proper methodology.arrow_forwardA company manufactures custom lighting fixtures and uses a process costing system. During the month of November, the company started production on 720 units and completed 580 units. The remaining 140 units were65% complete in terms of materials and 35% complete in terms of labor and overhead. The total cost incurred during the month for materials was $46,400,and the cost for labor and overhead was $38,700. Using the weighted-average method, what is the equivalent unit cost for materials and conversion costs(labor and overhead)? Provide right answerarrow_forward

- Quaker Industries has a cost of goods manufactured of $550,000, beginning finished goods inventory of $150,000, and ending finished goods inventory of $200,000. The cost of goods sold is: A. $400,000 B. $500,000 C. $550,000 D. $600,000arrow_forwardWhat is the ending inventory under variable costing?arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- Cleopatra Manufacturing, which uses the high-low method of estimating costs, reported total costs of $28 per unit when production was at its lowest level, at 15,000 units. When production increased to its highest level, 27,000units, the total cost per unit dropped to $20. What would Crestview estimate as the variable cost per unit? Answerarrow_forwardA constructive obligation differs from a legal obligation because it _? (a) Is created by law (b) Only applies to government entities (c) Has no financial impact (d) Is created by valid expectations from past practice solve this Accounting MCQarrow_forwardCleopatra Manufacturing, which uses the high-low method of estimating costs, reported total costs of $28 per unit when production was at its lowest level, at 15,000 units. When production increased to its highest level, 27,000units, the total cost per unit dropped to $20. What would Crestview estimate as the variable cost per unit?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning