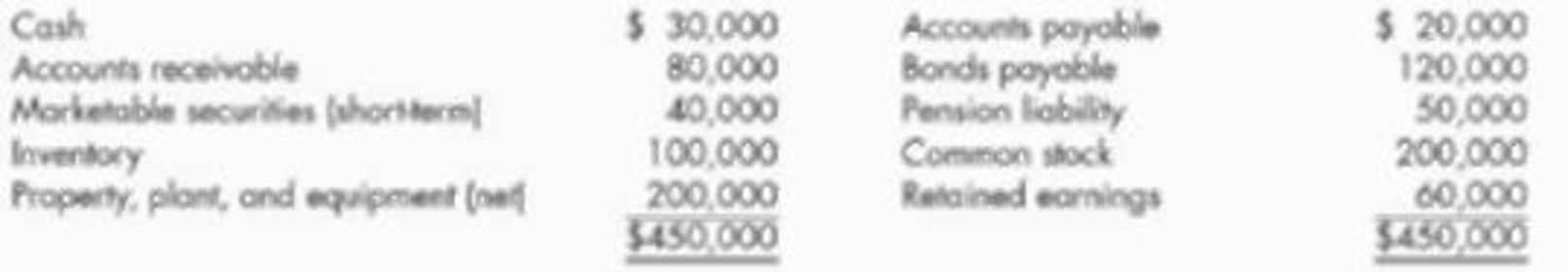

Hamilton Company’s

Korbel Company is considering purchasing Hamilton (a privately held company) and discovers the following about Hamilton:

- a. No allowance for doubtful accounts has been established. A $10,000 allowance is considered appropriate.

- b. Marketable securities are valued at cost. The current market value is $60,000.

- c. The LIFO inventory method is used. The FIFO inventory of $140,000 would be used if the company is acquired.

- d. Land, included in property, plant, and equipment, which is recorded at its cost of $50,000, is worth $120,000. The remaining property, plant, and equipment is worth 10% more than its

depreciated cost. - e. The company has an unrecorded trademark that is worth $70,000.

- f. The company’s bonds are currently trading for $130,000.

- g. The pension liability is understated by $40,000.

Required:

- 1. Compute the amount of

goodwill if Korbel agrees to pay $500,000 cash for Hamilton. - 2. Next Level What are the reasons that the book value of Hamilton’s net identifiable assets differ from their market value?

- 3. Prepare the

journal entry to record the acquisition on the books of Korbel assuming Hamilton is liquidated. - 4. If Korbel agrees to pay only $400,000 cash, how much goodwill exists?

- 5. If Korbel pays only $400,000 cash, prepare the journal entry to record the acquisition on its books, assuming Hamilton is liquidated.

1.

Calculate the amount of goodwill of Company H.

Explanation of Solution

Goodwill: Goodwill is the good reputation developed by a company over years. This is recorded as an intangible asset, and is quantified when other company acquires. Goodwill should be recorded only when one company is acquired by another company. Goodwill value would be impaired, if the book value of goodwill is less than fair market value.

Calculate the amount of goodwill of Company H:

| Particulars | Amount ($) |

| Amount willing to pay | $500,000 |

| Less: Identifiable net assets | $415,000 |

| Goodwill | $85,000 |

Table (1)

Compute the identifiable net assets:

| Assets | Amount ($) |

| Cash | $30,000 |

| Accounts receivable (net) (1) | 70,000 |

| Marketable securities (short-term) | 60,000 |

| Inventory | 140,000 |

| Land | 120,000 |

| Plant Property &Equipment (2) | 165,000 |

| Trademark | 70,000 |

| Total assets (a) | $655,000 |

| Liabilities | |

| Accounts payable | 20,000 |

| Bonds payable | 130,000 |

| Pension liability | 90,000 |

| Total liabilities (b) | $240,000 |

| Identifiable net assets | 415,000 |

Table (2)

Working note (1):

Compute the accounts receivable (net):

Working note (2):

Compute the plant, property and equipment (net):

2.

State the reason for the difference in the book value of Company H’s identifiable net assets from the market value.

Explanation of Solution

Identifiable intangibles: The identifiable intangibles are the intangible assets that can be easily separated from the company, and it would be sold, transferred, licensed, rented or exchanged. Examples: trademarks, patents, copyrights, franchises, customer lists and relationships, non-compete agreements, and licenses.

The book value of H Company’s identifiable net assets differs from its market value for the following reason:

- Some of the assets of Company H are listed on the balance sheet at amounts other than their market value. For instance: The marketable securities are listed at cost and not at a fair value, likewise the inventory is valued using LIFO, instead of FIFO. The land is reported at cost but not at its market value, if it would have reported at its market value, then the cost would be much higher. Equipment is reported at depreciated cost while its market value is much higher.

- Company H has a valuable internally developed trademark that is not recorded.

- An unidentifiable intangible asset (goodwill) exists. However, it is not reported on H Company’s books.

3.

Prepare journal entry for the given transaction.

Explanation of Solution

Prepare journal entry in the books of Company K assume that Company H has been liquidated.

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Cash | 30,000 | |||

| Accounts Receivable | 70,000 | |||

| Marketable Securities | 60,000 | |||

| Inventory | 140,000 | |||

| Land | 120,000 | |||

| Property, Plant, and Equipment | 165,000 | |||

| Trademark | 70,000 | |||

| Goodwill | 85,000 | |||

| Accounts Payable | 20,000 | |||

| Bonds Payable | 130,000 | |||

| Pension Liability | 90,000 | |||

| Cash | 500,000 | |||

| (To record the acquisition of company H) |

Table (3)

4.

Compute the amount of goodwill that exist, when Company K agrees pay only $400,000 cash.

Explanation of Solution

Compute the amount of goodwill that exist, when Company K agrees pay only $400,000 cash

| Particulars | Amount ($) |

| Amount willing to pay | $400,000 |

| Less: Identifiable net assets | 415,000 |

| Goodwill | (15,000) |

Table (4)

5.

Prepare journal entry for the given transaction.

Explanation of Solution

Prepare journal entry in the books of Company K assume that Company H had paid only $400,000.

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Cash | 30,000 | |||

| Accounts Receivable | 70,000 | |||

| Marketable Securities | 60,000 | |||

| Inventory | 140,000 | |||

| Land | 120,000 | |||

| Property, Plant, and Equipment | 165,000 | |||

| Trademark | 70,000 | |||

| Accounts Payable | 20,000 | |||

| Bonds Payable | 130,000 | |||

| Pension Liability | 90,000 | |||

| Cash | 400,000 | |||

| Gain on purchase of Company H | 15,000 | |||

| (To record the gain on acquisition of company H) |

Table (5)

Want to see more full solutions like this?

Chapter 12 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Need answer the financial accounting questionarrow_forwardDuring 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __.Answer this questionarrow_forwardPlease provide answer this general accounting questionarrow_forward

- During 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __.arrow_forwardSummit Steelworks Ltd. reported the following year end information: please answer the general accounting questionarrow_forwardBuffalo Inc. issued $4,200,000 of convertible 5-year bonds on July 1, 2025. The bonds provide for 6% interest payable semiannually on January 1 and July 1. The discount in connection with the issue was $102,000, which is being amortized monthly on a straight-line basis. The bonds are convertible after one year into 15 shares of Buffalo Inc's $1 par value common stock for each $1,000 of bonds. On October 1, 2026, $504,000 of bonds were turned in for conversion into common stock. Interest has been accrued monthly and paid as due. At the time of conversion, any accrued interest on bonds being converted is paid in cash. Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as of the following dates.arrow_forward

- Buffalo Inc. issued $4,200,000 of convertible 5-year bonds on July 1, 2025. The bonds provide for 6% interest payable semiannually on January 1 and July 1. The discount in connection with the issue was $102,000, which is being amortized monthly on a straight-line basis. The bonds are convertible after one year into 15 shares of Buffalo Inc's $1 par value common stock for each $1,000 of bonds. On October 1, 2026, $504,000 of bonds were turned in for conversion into common stock. Interest has been accrued monthly and paid as due. At the time of conversion, any accrued interest on bonds being converted is paid in cash. Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as of the following dates. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.arrow_forwardhttps://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Flectures.mhhe.com%2Fconnect%2Frichardson_iba_1e_1265454345%2Fdata_files%2Fch2%2FIBA_Lab2-4_Alt_Data.xlsx&wdOrigin=BROWSELINK make a pivot table and pivot chart to assess the sum of raw materials quantity purchased by year. make a slicer to interactively filter the pivot chart by state from which the products were ordered. Adjust the pivot chart to show horizontal bararrow_forwardSolve this following requirementsarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning