Foundations of Finance (9th Edition) (Pearson Series in Finance)

9th Edition

ISBN: 9780134083285

Author: Arthur J. Keown, John D. Martin, J. William Petty

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 6SP

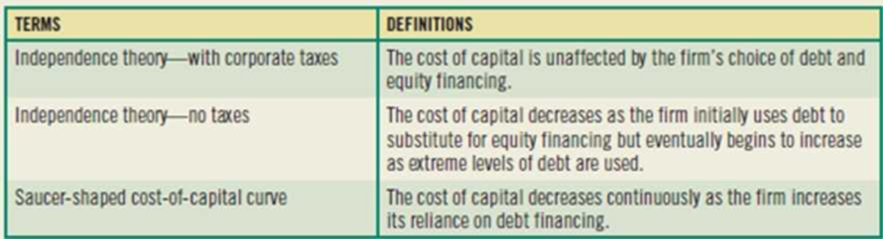

(Capital structure theory) Match each of the following definitions to the appropriate terms:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Explain briefly the concept of the capital components of the capital adequacy framework and provide an example each.

Explain the assumptions of Capital Asset Pricing Model.

Answer all parts of this question.(a) Discuss the main assumptions of the Capital Asset Pricing Model (CAPM).

Chapter 12 Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Ch. 12 - Prob. 1RQCh. 12 - Prob. 2RQCh. 12 - Prob. 3RQCh. 12 - Prob. 4RQCh. 12 - Prob. 5RQCh. 12 - Prob. 8RQCh. 12 - Prob. 13RQCh. 12 - Prob. 1SPCh. 12 - Prob. 3SPCh. 12 - Prob. 4SP

Ch. 12 - Prob. 5SPCh. 12 - (Capital structure theory) Match each of the...Ch. 12 - (Capital structure theory) Which of the following...Ch. 12 - Prob. 8SPCh. 12 - Prob. 9SPCh. 12 - (Assessing leverage use) Financial data for three...Ch. 12 - Prob. 1.1MCCh. 12 - Prob. 1.2MCCh. 12 - Prob. 1.3MCCh. 12 - Prob. 2.1MCCh. 12 - Prob. 2.2MCCh. 12 - Prob. 2.3MC

Additional Business Textbook Solutions

Find more solutions based on key concepts

The reason behind the expected return of a risky security that generally differs from the risk-free interest ra...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

The major benefits of the debt financing and its effect on the company’s cost of debt. Introduction: The capita...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Why a convertible security not be converted when the market price of stock raises above the conversion price an...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

What is incorrect in the given statement. Statement: “If a firm issues debt that is risk free, because there is...

Corporate Finance

How would a human resources department use information in the operating budgets?

Principles of Accounting Volume 2

Standard costing, journal entries. The Warner Company manufactures reproductions of expensive sunglasses. Warne...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Define the following terms, using graphs or equations to illustrate youranswers wherever feasible: c. Capital Asset Pricing Model (CAPM); Capital Market Line (CML)arrow_forwardExplain the blended capitalization rate and where it can be applied?arrow_forwardIn general terms, what is the Capital AssetPricing Model (CAPM)? What assumptions weremade when it was derived?arrow_forward

- 2. Explain the weighted average cost of capital (WACC) and its significance and include hypothetical examples for better clarity.arrow_forward(a) Differentiate between agency theory and pecking order hypothesis of capital structure. In each case, list the assumptions.arrow_forwardExplain, using practical example how Capital expenditure should be capitalized?arrow_forward

- What is the Capital Asset Pricing Model (CAPM)?What are the assumptions that underlie themodel?arrow_forwardDiscuss the main features of Capital Asset Pricing Model (CAPM) and comment on the validity of the model in the real world.arrow_forwardExplain with example traditional capital structure theory. How is it different from the capital structure theory of Modigliani & Miller. Which of the two theories would you prefer – give reasons.arrow_forward

- What is the capital components. breifly define.arrow_forwardDefine the terms “book-value capital structure,” “market-value capital structure,” and“target capital structure,” and explain why they differ from one another.arrow_forwardThe conceptual framework indicates that there are two concepts of capital. Clarify the two concepts in question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License