Concept explainers

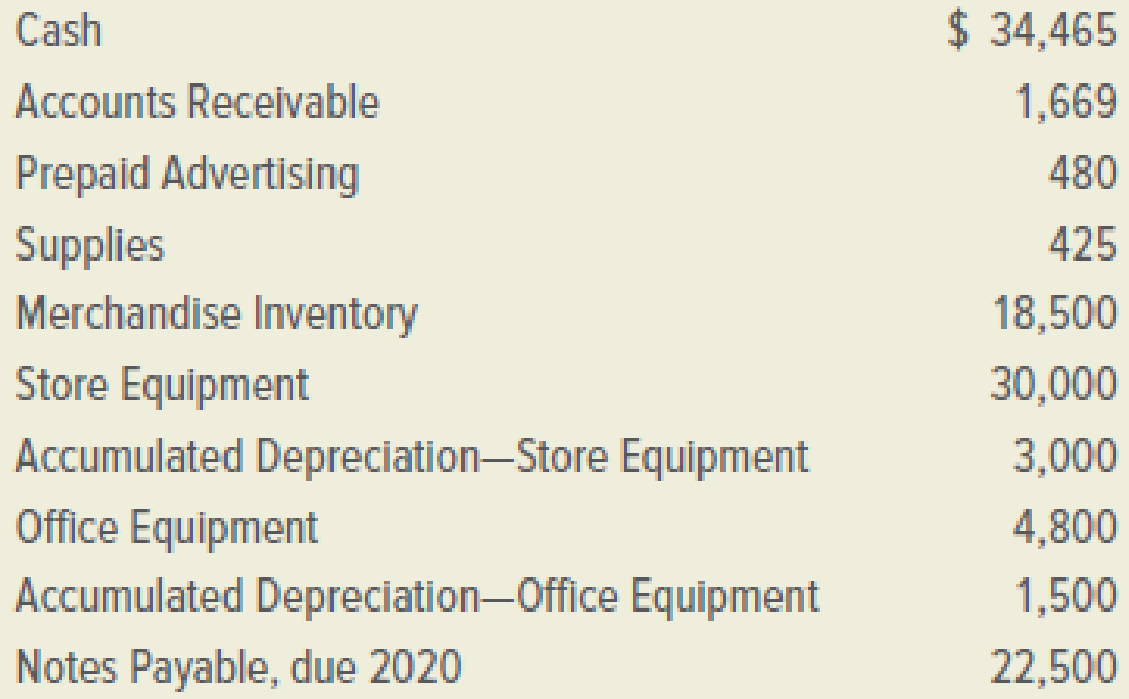

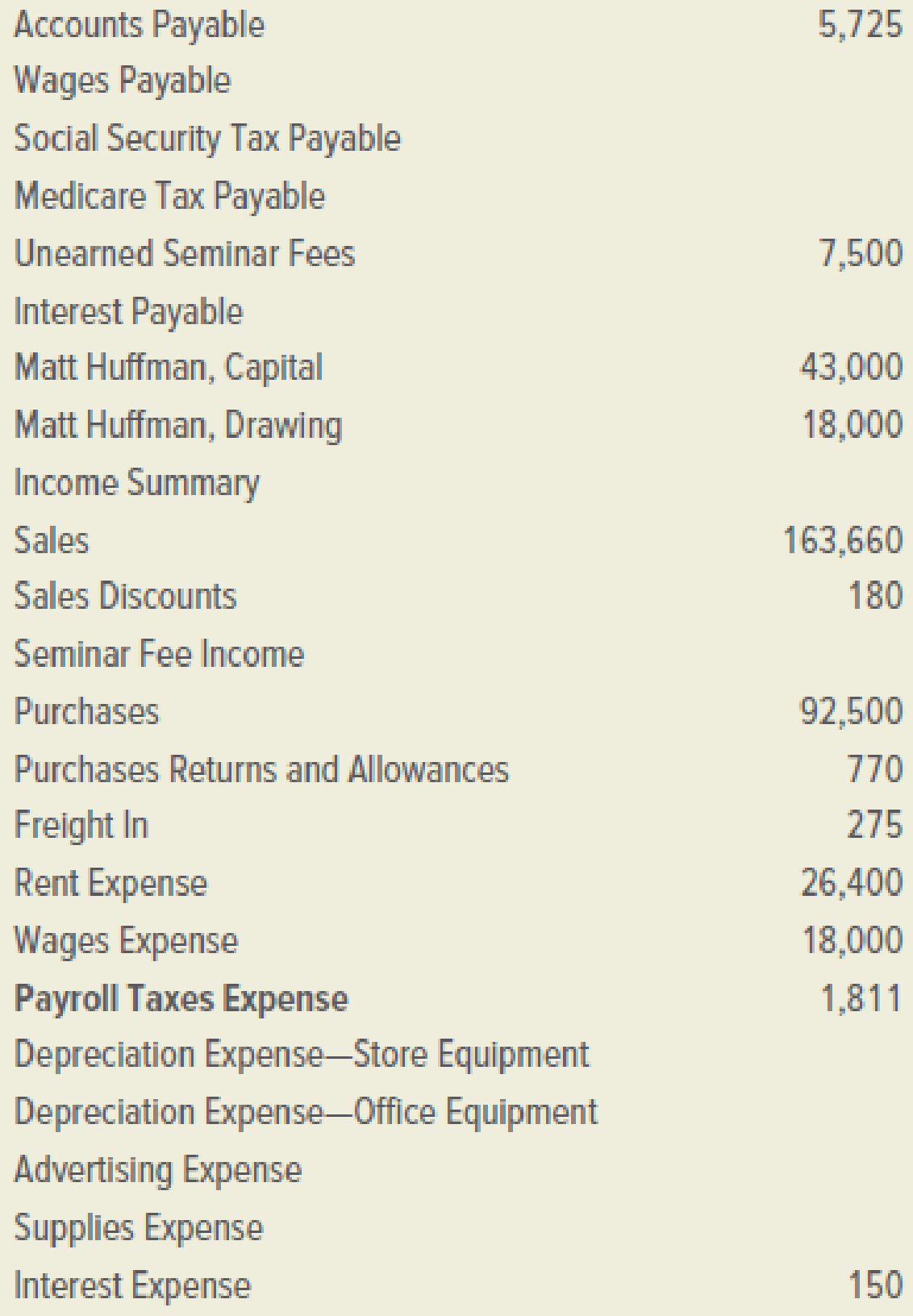

The Game Place is a retail store that sells computer games, owned by Matt Huffman. On December 31, 2019, the firm’s general ledger contained the accounts and balances below. All account balances are normal.

INSTRUCTIONS

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments below in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

ADJUSTMENTS

a.–b. Merchandise inventory at December 31, 2019, was counted and determined to be $21,200.

c. The amount recorded as prepaid advertising represents $480 paid on September 1, 2019, for six months of advertising.

d. The amount of supplies on hand at December 31 was $125.

e. Depreciation on store equipment was $4,500 for 2019.

f. Depreciation on office equipment was $1,500 for 2019.

g. Unearned seminar fees represent $7,500 received on November 1, 2019, for five seminars. At December 31, three of these seminars had been conducted.

h. Wages owed but not paid at December 31 were $800.

i. On December 31, 2019, the firm owed the employer’s social security tax ($49.60) and Medicare tax ($11.60).

j. The note payable bears interest at 8 percent per annum. One month’s interest is owed at December 31, 2016.

Analyze: How did the balance of merchandise inventory change during the year ended December 31, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- Baker's Market began the current month with inventory costing $35,250, then purchased additional inventory at a cost of $78,400. The perpetual inventory system indicates that inventory costing $82,500 was sold during the month for $88,250. An inventory count at month-end shows that inventory costing $29,000 is actually on hand. What amount of shrinkage occurred during the month? a) $350 b) $1,150 c) $1,750 d) $2,150arrow_forwardA pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forward

- A company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forwardhello tutor provide solutionarrow_forwardGerry Co. has a gross profit of $990,000 and $290,000 in depreciation expenses. Selling and administrative expense is $129,000. Given that the tax rate is 37%, compute the cash flow for Gerry Co. a. $700,000 b. $128,963 c. $649,730 d. $652,230arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub