Concept explainers

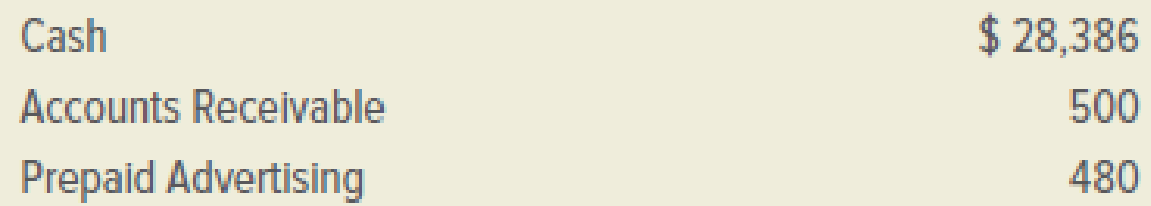

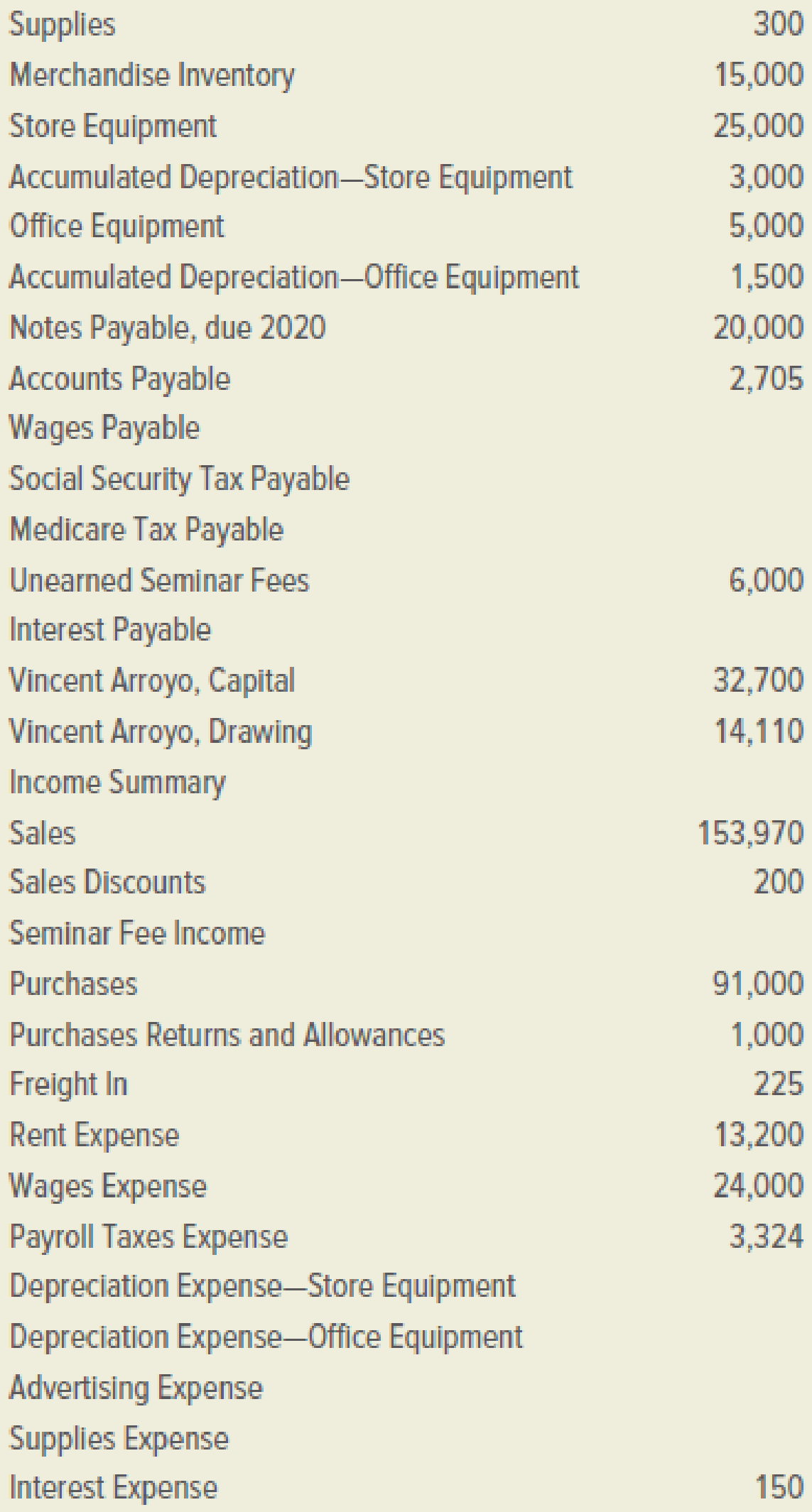

The Artisan Wines is a retail store selling vintage wines. On December 31, 2019, the firm’s general ledger contained the accounts and balances below. All account balances are normal.

INSTRUCTIONS:

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments below in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

ADJUSTMENTS:

a.–b. Merchandise inventory at December 31, 2019, was counted and determined to be $13,000.

c. The amount recorded as prepaid advertising represents $480 paid on September 1, 2019, for 12 months of advertising.

d. The amount of supplies on hand at December 31 was $160.

e. Depreciation on store equipment was $3,000 for 2019.

f. Depreciation on office equipment was $1,125 for 2019.

g. Unearned seminar fees represent $6,000 received on November 1, 2019, for six seminars. At December 31, four of these seminars had been conducted.

h. Wages owed but not paid at December 31 were $500.

i. On December 31, 2019, the firm owed the employer’s social security tax ($31.00) and Medicare tax ($7.25).

j. The note payable bears interest at 6 percent per annum. One month’s interest is owed at December 31, 2019.

Analyze: What was the amount of revenue earned by conducting seminars during the year ended December 31, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- Want answerarrow_forwardFinancial Accounting please give me correct answer this questionarrow_forwardQuestion: What is the formula for computing direct materials price variance? a. actual costs - (actual quantity X standard price) b. actual cost + standard costs c. actual cost - standard costs d. (actual quantity X standard price) - standard costsarrow_forward

- Icon Corporation's return on common stockholders' equity isarrow_forwardprovide correct answer of this General accounting questionarrow_forwardStarlord's Music Shop's cash sales for Year 1 were $783,300, and $939,960 for Year 2. These figures included the 11.9% galatic sales tax. The store gives its customers coupons redeemable for a poster plus a Blue Swede CD. One coupon is issued for each dollar of sales. On the surrender of 100 coupons and $6.00 cash, the poster and CD are given to the customer. It is estimated that 80% of the coupons will be presented for redemption. Coupons redeemed in Year 1 totaled 420,000, and coupons redeemed in Year 2 totaled 750,000. Starlord's Music Shop bought 20,000 posters at $2.50/poster and 20,000 CDs at $7.50/CD. 1. Record the journal entry for sales and sales tax for Year 1 (assume all sales are in cash). Points Value: 10 Redemption Schedule Account Use this schedule to complete the journal entries below. Debit Credit Coupons Coupon Redeemed Redemptions Cash Received Inventory Costs Expense Total Y1 Potential Redemptions 560,000 5,600 33,600 56,000 22,400 Total Redeemed in Y1 420,000 4,200…arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College