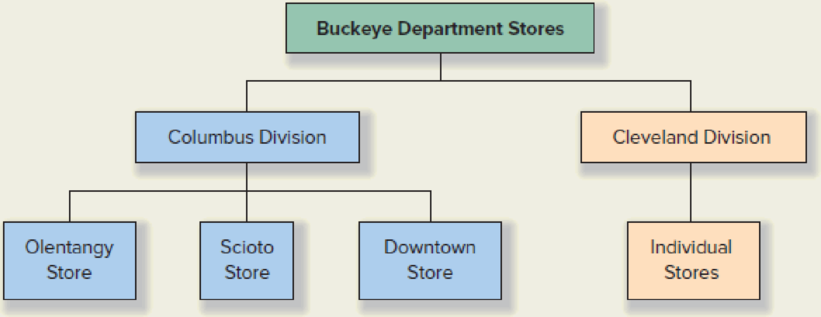

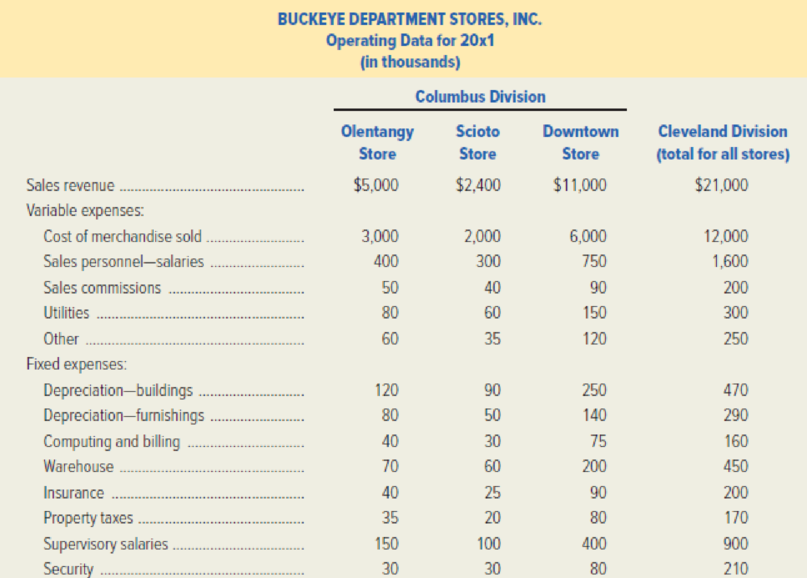

Buckeye Department Stores, Inc. operates a chain of department stores in Ohio. The company’s organization chart appears below. Operating data for 20x1 follow.

The following fixed expenses are controllable at the divisional level: depreciation—furnishings, computing and billing, warehouse, insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs, which are not allocated to individual stores.

The following fixed expenses are controllable only at the company level: depreciation—building, property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $100,000, which are not allocated to individual stores.

Buckeye Department Stores incurs common fixed expenses of $120,000, which are not allocated to the two divisions. Income-tax expense for 20x1 is $1,950,000.

Required:

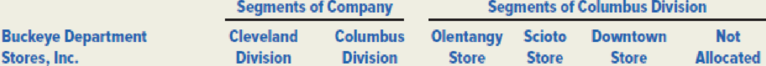

- 1. Prepare a segmented income statement similar to Exhibit 12–7 for Buckeye Department Stores, Inc. The statement should have the following columns:

Prepare the statement in the contribution format, and indicate the controllability of expenses. Subtract all variable expenses, including cost of merchandise sold, from sales revenue to obtain the contribution margin.

- 2. How would the segmented income statement help the president of Buckeye Department Stores manage the company?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning