a.

Calculate the payback period of project A for the investment of $5,000 for five years.

a.

Explanation of Solution

Payback Period Method:

Payback period method is a method of capital investment analysis. This method is used to evaluate the investment opportunity on the basis of the time taken to recover the initial cost of investment in cash.

Calculate the payback period of project A for the investment of $5,000 for five years:

Therefore, the payback period of project A is 2.78 years.

b.

Calculate the payback period of project B for the investment of $5,000 for five years (assume that the cash inflows occur evenly throughout the year.

b.

Explanation of Solution

Calculate the payback period of project B for the investment of $5,000 for five years (assume that the cash inflows occur evenly throughout the year:

| After-tax | Cumulative | |

| Year | Cash Inflows | After-tax Inflows |

| 1 | $500 | $500 |

| 2 | $1,200 | $1,700 |

| 3 | $2,000 | $3,700 |

| 4 | $2,500 | $6,200 |

Table (1)

Therefore, the payback period of project B for the investment of $5,000 for five years is 3.52 years.

c.

Calculate the payback period of project C for the investment of $5,000 for five years.

c.

Explanation of Solution

Calculate the payback period of project C for the investment of $5,000 for five years:

Working notes:

Calculate the annual after-tax net

Step 1: Calculate the

Step 2: Calculate the taxable income for each year:

Step 3: Calculate the income tax for each year:

Step 4: Calculate the annual after-tax net cash inflow:

Therefore, the payback period of project C for the investment of $5,000 for five years is 2.35 years

d.(1)

Calculate the book

d.(1)

Explanation of Solution

Calculate the book rate of return based on the original investment.

Working notes:

Calculate the depreciation expense per year:

Calculate the operating income:

| Particulars | Amount ($) |

| Taxable Income: | |

| Sales | $4,000 |

| Expenses: | |

| Cash | $1,500 |

| Depreciation | $900 |

| Pre-tax Operating Income | $1,600 |

| Less: Income Taxes | $400 |

| Operating Income | $1,200 |

Table (2)

Therefore, the book rate of return based on the original investment is 24%.

d.(2)

Calculate the book rate of return based on the average book value.

d.(2)

Explanation of Solution

Calculate the book rate of return based on the average book value:

Working note:

Calculate the average book value:

Therefore, the book rate of return based on the average book value is 43.64%.

e.

Calculate the

e.

Explanation of Solution

Calculate the NPV of each project from A to D:

Project A:

Therefore, the NPV of project A is $2,187.4.

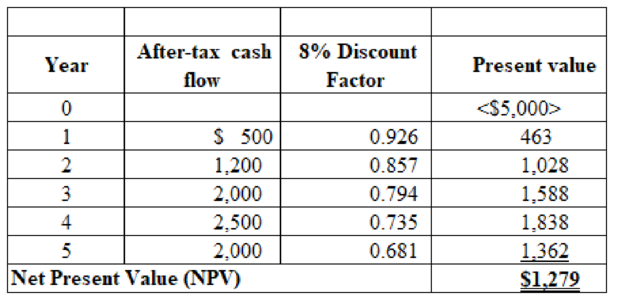

Project B:

Table (3)

Therefore, the NPV of project B is $1,279.

Project C:

Therefore, the NPV of project A is $3,485.

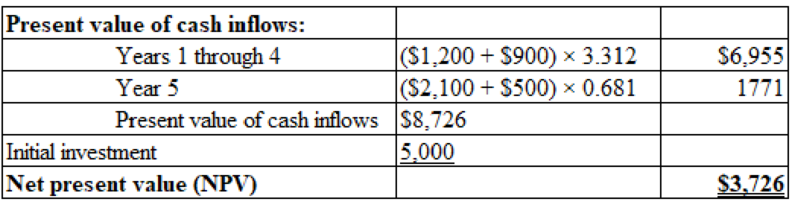

Project D:

Table (4)

Therefore, the NPV of project D is $3,726.

Want to see more full solutions like this?

Chapter 12 Solutions

Cost Management: A Strategic Emphasis

- Hello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardQuintana Corporation projected current year sales of 42,000 units at a unit sale price of $32.50. Actual current year sales were 39,500 units at $33.75 per unit. Actual variable costs, budgeted at $22.75 per unit, totaled $21.90 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $392,000. What is the sales volume variance for total revenue? I want answerarrow_forwardWhat is hemingway corporation taxable income?arrow_forward

- Please given correct answer for General accounting question I need step by step explanationarrow_forwardArmour vacation cabin was destroyed by a wildfire. He had purchased the cabin 14 months ago for $625,000. He received $890,000 from his insurance company to replace the cabin. If he fails to rebuild the cabin or acquire a replacement property in the required time, how much gain must he recognize on this conversion? A. $375,000 B. $160,000 C. $265,000 D. $0 E. None of the above helparrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education