Financial And Managerial Accounting

15th Edition

ISBN: 9781337912143

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 3PA

Selected stock transactions

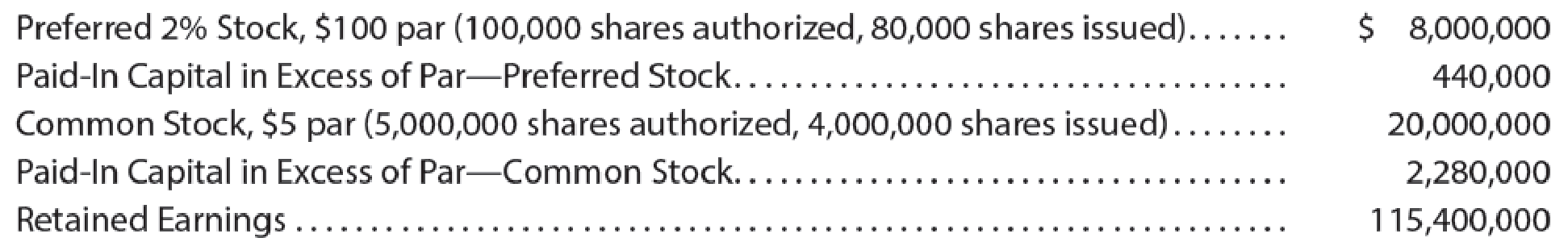

The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year:

During the year, the corporation completed a number of transactions affecting the stockholders’ equity. They are summarized as follows:

- a. Issued 200,000 shares of common stock at $12, receiving cash.

- b. Issued 8,000 shares of preferred 2% stock at $115.

- c. Purchased 175,000 shares of treasury common for $10 per share.

- d. Sold 110,000 shares of treasury common for $14 per share.

- e. Sold 30,000 shares of treasury common for $8 per share.

- f. Declared cash dividends of $1.25 per share on

preferred stock and $0.08 per share on common stock. - g. Paid the cash dividends.

Instructions

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

1. I want to know how to solve these 2 questions and what the answers are 3. Field & Co. expects its EBIT to be $125,000 every year forever. The firm can borrow at 7%. The company currently has no debt, and its cost of equity is 12%. If the tax rate is 24%, what is the value of the firm? What will the value be if the company borrows $205,000 and uses the proceeds to purchase shares?

2. Firms HD and LD each have $30m in invested capital, $8m of EBIT, and a tax rate of 25%. Firm HD has a D/E ratio of 50% with an interest rate of 8% on their debt. Firm LD has a debt-to-capital ratio of 30%, however, pays 9% interest on its debt. Calculate the following:

a. Return on invested capital for firm LDb. Return on equity for each firmc. If HD’s CFO is thinking of lowering the D/E from 50% to 40%, which will lower their interest rate further from 8% to 7%, calculate the new ROE for firm HD.

what is the variable cost per minute?

I want to know how to solve these 2 questions and what the answers are 1. Stella Motors has $50m in assets, which is financed with 40% debt and 60% common equity. The company’s beta is currently 1.25 and its tax rate is 30%. Find Stella’s unlevered beta. 2. Sugar Corp. uses no debt. The weighted average cost of capital is 7.9%. If the current market value of the equity is $15.6 million and there are no taxes, what is the company’s EBIT?

Chapter 12 Solutions

Financial And Managerial Accounting

Ch. 12 - Of two corporations organized at approximately the...Ch. 12 - A stockbroker advises a client to buy preferred...Ch. 12 - A corporation with both preferred stock and common...Ch. 12 - Prob. 4DQCh. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - A corporation reacquires 60,000 shares of its own...Ch. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Dividends per share Zero Calories Company has...Ch. 12 - Entries for issuing stock On January 22, Zentric...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Entries for stock dividends Alpine Energy...Ch. 12 - Entries for treasury stock On May 27, Hydro...Ch. 12 - Reporting stockholders equity Using the following...Ch. 12 - Statement of stockholders equity Noric Cruises...Ch. 12 - Earnings per share Financial statement data for...Ch. 12 - Dividends per share Seventy-Two Inc., a developer...Ch. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Entries for issuing no-par stock On May 15, Helena...Ch. 12 - Issuing stock for assets other than cash On...Ch. 12 - Selected stock transactions Alpha Sounds Corp., an...Ch. 12 - Issuing stock Willow Creek Nursery, with an...Ch. 12 - Issuing stock Professional Products Inc., a...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Selected dividend transactions, stock split...Ch. 12 - Treasury stock transactions Mystic Lake Inc....Ch. 12 - Prob. 15ECh. 12 - Treasury stock transactions Biscayne Bay Water...Ch. 12 - Reporting paid-in capital The following accounts...Ch. 12 - Stockholders' Equity section of balance sheet The...Ch. 12 - Stockholders' Equity section of balance sheet...Ch. 12 - Retained earnings statement Sumter Pumps...Ch. 12 - Prob. 21ECh. 12 - Statement of stockholders equity The stockholders...Ch. 12 - Dividends on preferred and common stock Pecan...Ch. 12 - Stock transactions for corporate expansion On...Ch. 12 - Selected stock transactions The following selected...Ch. 12 - Entries for selected corporate transactions Morrow...Ch. 12 - Prob. 5PACh. 12 - Dividends on preferred and common stock Yosemite...Ch. 12 - Stock transaction for corporate expansion Pulsar...Ch. 12 - Selected stock transactions Diamondback Welding ...Ch. 12 - Entries for selected corporate transactions Nav-Go...Ch. 12 - Prob. 5PBCh. 12 - Selected transactions completed by Equinox...Ch. 12 - Analyze and compare Amazon.com and Wal-Mart...Ch. 12 - Analyze and compare Bank of America and Wells...Ch. 12 - Analyze Pacific Gas and Electric Company Pacific...Ch. 12 - Prob. 4MADCh. 12 - Prob. 5MADCh. 12 - Ethics in Action Tommy Gunn is a division manager...Ch. 12 - Prob. 2TIFCh. 12 - Communications Motion Designs Inc. has paid...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I don't need ai answer general accounting questionarrow_forwardCan you help me with accounting questionsarrow_forwardCariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forward

- Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardProvide solution of this all Question please Financial Accountingarrow_forwardDon't Use AIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License