COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 36E

Alternative Allocation Bases: Service

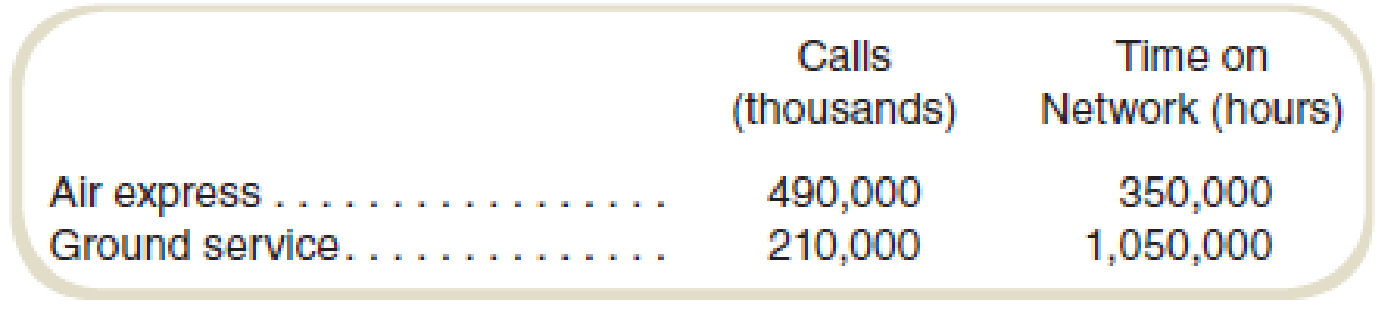

Bartolo Delivery has two divisions, air express and ground service, that share the common costs of the company’s communications network, which are $8,000,000 a year. You have the following information about the two divisions and the common communications network:

Required

- a. What is the communications network cost that is charged to each division if the number of calls is used as the allocation basis?

- b. What is the communications network cost to each division using time on network as the allocation basis?

- c. The cost of the communications network is necessary regardless of which division uses it. Why is the method of allocation important?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting Question provide correct solution

How much in fixed assets must they have purchased?

Sub. General accounting

Chapter 12 Solutions

COST ACCOUNTING W/CONNECT

Ch. 12 - What does decentralization mean in the context of...Ch. 12 - Why is performance measurement an important...Ch. 12 - Prob. 3RQCh. 12 - What does dysfunctional decision making refer to?Ch. 12 - Prob. 5RQCh. 12 - What are the five basic kinds of decentralized...Ch. 12 - What is goal congruence? How is it different from...Ch. 12 - Prob. 8RQCh. 12 - What is relative performance evaluation?Ch. 12 - Prob. 10RQ

Ch. 12 - Prob. 11RQCh. 12 - Prob. 12RQCh. 12 - The management control system collects information...Ch. 12 - Salespeople are often paid a commission based on...Ch. 12 - Prob. 15CADQCh. 12 - Prob. 16CADQCh. 12 - On December 30, a manager determines that income...Ch. 12 - Prob. 18CADQCh. 12 - Prob. 19CADQCh. 12 - The manager of an operating department just...Ch. 12 - In the previous chapters, we considered different...Ch. 12 - A company has a bonus plan that states that...Ch. 12 - Prob. 23CADQCh. 12 - Prob. 24CADQCh. 12 - Prob. 25CADQCh. 12 - Prob. 26CADQCh. 12 - Prob. 27CADQCh. 12 - Prob. 28CADQCh. 12 - Prob. 29ECh. 12 - Evaluating Management Control SystemsEthical...Ch. 12 - Prob. 31ECh. 12 - Management Control Systems and Incentives A...Ch. 12 - Prob. 33ECh. 12 - Prob. 34ECh. 12 - Prob. 35ECh. 12 - Alternative Allocation Bases: Service Bartolo...Ch. 12 - Prob. 37ECh. 12 - Single versus Dual Rates: Ethical Considerations A...Ch. 12 - Single versus Dual Rates

Using the data for the...Ch. 12 - Alternative Allocation Bases Thompson Aeronautics...Ch. 12 - Tone at the Top, Ethics Once upon a time, a major...Ch. 12 - Prob. 42ECh. 12 - Prob. 43ECh. 12 - Internal Controls Commonly in many organizations,...Ch. 12 - Evaluating Management Control Systems SPG Company...Ch. 12 - Analyze Performance Report for Decentralized...Ch. 12 - Divisional Performance Measurement: Behavioral...Ch. 12 - Prob. 48PCh. 12 - Prob. 49PCh. 12 - Cost Allocations: Comparison of Dual and Single...Ch. 12 - Cost Allocation for Travel Reimbursement Your...Ch. 12 - Incentives, Illegal Activities, and Ethics An...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY