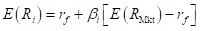

Expected return:

Expected return of the market refers to the return earned from the market over and above the risk-free  is the return that an investor must demand for inflation and the time-value of money, even when there is hardly any risk of any financial loss. Risk premium varies with the systematic risk in an investment. It is the market risk premium multiplied by the beta (ß) of a security. It is determined as the market risk premium multiplied by the beta of the security. The market risk premium is equal to the expected market return less the return earned from risk-free security.

is the return that an investor must demand for inflation and the time-value of money, even when there is hardly any risk of any financial loss. Risk premium varies with the systematic risk in an investment. It is the market risk premium multiplied by the beta (ß) of a security. It is determined as the market risk premium multiplied by the beta of the security. The market risk premium is equal to the expected market return less the return earned from risk-free security.

The expected return can be calculated using the formula given below.

Where,

is the expected return.

is the expected return. is the risk free rate of return.

is the risk free rate of return. is the beta of the asset.

is the beta of the asset. is the expected return of the market.

is the expected return of the market.

Beta:

Beta  measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta

measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta  of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

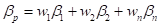

The beta  of a portfolio is the weighted average beta of the overall stocks in a portfolio.

of a portfolio is the weighted average beta of the overall stocks in a portfolio.

The beta  of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

Where,

is the beta of a portfolio.

is the beta of a portfolio. is the weight of a stock.

is the weight of a stock.

To determine:

Whether the stock must be bought.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Fundamentals of Corporate Finance, Student Value Edition Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition)

- You have an investment worth $61,345 that is expected to make regular monthly payments of $1,590 for 20 months and a special payment of $X in 3 months. The expected return for the investment is 0.92 percent per month and the first regular payment will be made in 1 month. What is X? Note: X is a positive number.arrow_forwardA bond with a par value of $1,000 and a maturity of 8 years is selling for $925. If the annual coupon rate is 7%, what’s the yield on the bond? What would be the yield if the bond had semiannual payments?arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Fashion would let you make quarterly payments of $14,930 for 8 years at an interest rate of 1.88 percent per quarter. Your first payment to Silver Fashion would be today. Valley Fashion would let you make X monthly payments of $73,323 at an interest rate of 0.70 percent per month. Your first payment to Valley Fashion would be in 1 month. What is X?arrow_forward

- You just bought a new car for $X. To pay for it, you took out a loan that requires regular monthly payments of $1,940 for 12 months and a special payment of $25,500 in 4 months. The interest rate on the loan is 1.06 percent per month and the first regular payment will be made in 1 month. What is X?arrow_forwardYou own 2 investments, A and B, which have a combined total value of $38,199. Investment A is expected to pay $85,300 in 6 years and has an expected return of 18.91 percent per year. Investment B is expected to pay $37,200 in X years and has an expected return of 18.10 percent. What is X?arrow_forwardYou own 2 investments, A and B, which have a combined total value of $51,280. Investment A is expected to pay $57,300 in 5 years and has an expected return of 13.13 percent per year. Investment B is expected to pay $X in 11 years and has an expected return of 12.73 percent per year. What is X?arrow_forward

- Equipment is worth $225,243. It is expected to produce regular cash flows of $51,300 per year for 9 years and a special cash flow of $27,200 in 9 years. The cost of capital is X percent per year and the first regular cash flow will be produced in 1 year. What is X?arrow_forward2 years ago, you invested $13,500. In 2 years, you expect to have $20,472. If you expect to earn the same annual return after 2 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $55,607?arrow_forwardYou plan to retire in 5 years with $650,489. You plan to withdraw $88,400 per year for 20 years. The expected return is X percent per year and the first regular withdrawal is expected in 6 years. What is X?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education