Concept explainers

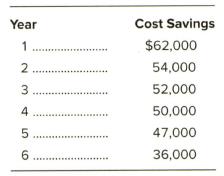

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for

A new piece of equipment will cost

The firm's tax rate is 25 percent and the cost of capital is 12 percent.

a. What is the book value of the old equipment?

b. What is the tax loss on the sale of the old equipment?

c. What is the tax benefit from the sale?

d. What is the

e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.)

f. Determine the depreciation schedule for the new equipment.

g. Determine the depreciation schedule for the remaining years of the old equipment.

h. Determine the incremental depreciation between the old and new equipment and the related tax shield benefits.

i. Compute the aftertax benefits of the cost savings.

j. Add the depreciation tax shield benefits and the aftertax cost savings, and determine the present value. (See Table 12-20 as an example.)

k. Compare the present value of the incremental benefits (j) to the net cost of the new equipment (e). Should the replacement be undertaken?

a.

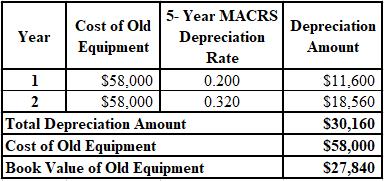

To calculate: The book value of the old equipment.

Introduction:

Book value:

It refers to the total worth of the company if it liquidates all its assets and pays off all the liabilities. It is also referred to as asset price in the balance sheet.

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Answer to Problem 33P

The calculation of the book value of the old equipment is shown below:

Hence, the book value of the old equipment is $27,480.

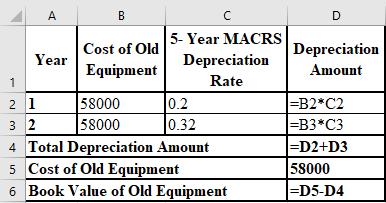

Explanation of Solution

The formulae used for calculation of the book value of the old equipment are shown below:

b.

To calculate: The tax loss incurred on the sale of the old equipment.

Introduction:

Tax loss:

It is the loss incurred when the total deduction claimed in a financial year exceeds the total assessable income of the year.

Answer to Problem 33P

The tax loss incurred on the sale of the old equipment is $3,040.

Explanation of Solution

The calculation of the tax loss on the sale of the old equipment is shown below:

c.

To calculate: The tax benefit from the sale of the old equipment.

Introduction:

Tax benefit:

It is the allowable deductions on the assessable income of the taxpayer, with an intent to reduce the tax liability and burden of the taxpayer.

Answer to Problem 33P

The tax benefit from the sale of the old equipment is $760.

Explanation of Solution

The calculation of the tax benefit from the sale of the old equipment is shown below:

d.

To calculate: The cash inflow received due to sale of old equipment.

Introduction:

Cash inflow:

It is the money received by the firm as the result of its operating, investing, and financing activities. It is the money which is received in the business and recorded in the cash flow statement.

Answer to Problem 33P

The cash inflow received due to sale of old equipment is $25,560.

Explanation of Solution

The calculation of the cash inflow from the sale of the old equipment is shown below:

e.

To calculate: The net cost of the new equipment.

Introduction:

Net cost:

The cost that is computed by deducting all the expenses related to an object, such as freight costs, discounts, etc. from the gross cost of the object.

Answer to Problem 33P

The net cost of the new equipment is $122,440.

Explanation of Solution

The calculation of the net cost of the new equipment is shown below:

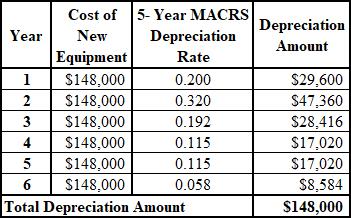

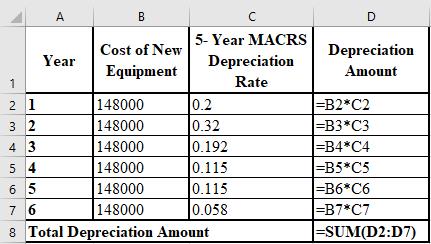

f.

To prepare: The depreciation schedule of new equipment.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Answer to Problem 33P

The depreciation schedule of new equipment is shown below:

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of new equipment are shown below:

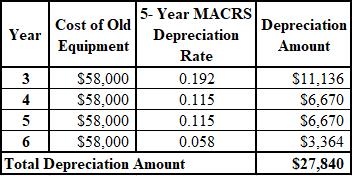

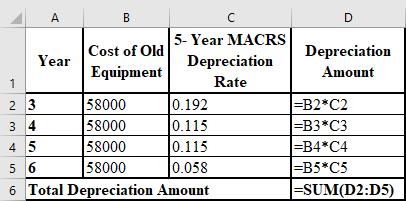

g.

To prepare: The depreciation schedule of remaining years of the old equipment.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Answer to Problem 33P

The depreciation schedule of remaining years of the old equipment is shown below:

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of remaining years of the old equipment are shown below:

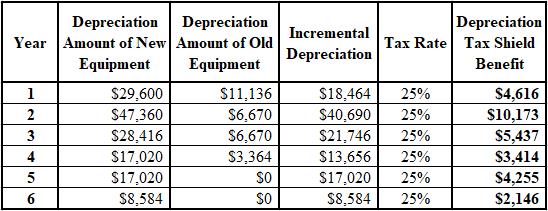

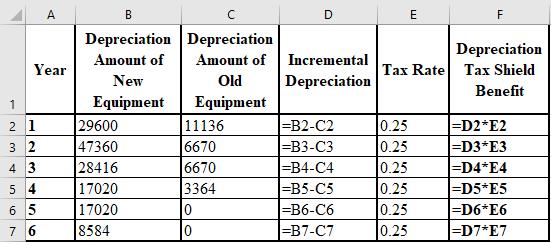

h.

To calculate: The incremental depreciation of old and new equipment and the depreciation tax shield benefit.

Introduction:

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Depreciation tax shield:

It is a particular kind of a tax shield provided to an individual or corporations in which depreciation as an expense is deducted from the taxable income.

Answer to Problem 33P

The calculation of the incremental depreciation of old and new equipment and the tax shield benefit is shown below:

Explanation of Solution

The formulae used for the calculation of the incremental depreciation of old and new equipment and the tax shield benefit are shown below:

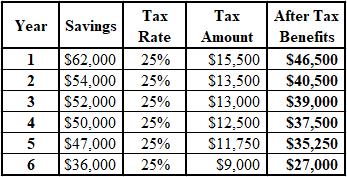

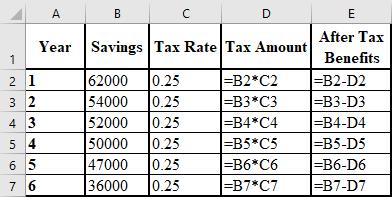

i.

To calculate: The after tax benefits of the cost savings.

Introduction:

After tax benefits:

After tax benefits are those deductions for which the individuals are eligible post the income tax is calculated.

Answer to Problem 33P

The calculation of the after tax benefits of the cost savings is shown below:

Explanation of Solution

The formulae used for the calculation of the after tax benefits of the cost savings are shown below:

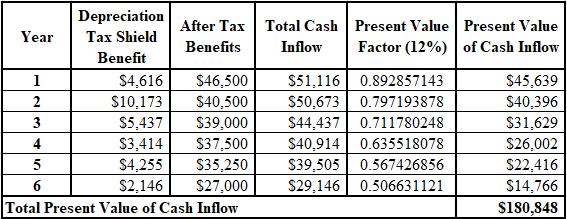

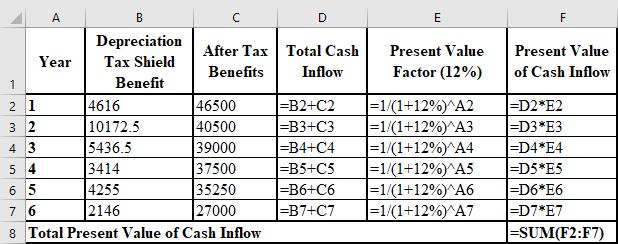

j.

To calculate: The present value of the total cash inflow (sum of depreciation tax shield and after tax benefits).

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Cash inflow:

It is the money received by the firm as the result of its operating, investing, and financing activities. It is the money which is received in the business and recorded in the cash flow statement.

Answer to Problem 33P

The calculation of the PV of the total cash inflow is shown below:

Explanation of Solution

The formulae used for the calculation of the PV of the total cash inflow are shown below:

k.

To determine: Whether the replacement shall be undertaken or not.

Introduction:

Net present value (NPV):

It is the difference between the PV (present value) of cash inflows and the cash outflows. It is used in capital budgeting and planning of investment to assess the benefits and losses of any project or investment.

Answer to Problem 33P

The replacement should be undertaken because the NPV of the project is $58,408 and the positive NPV indicates that the replacement is beneficial for the corporation.

Explanation of Solution

The calculation of the NPV of the replacement is as follows:

Want to see more full solutions like this?

Chapter 12 Solutions

BUS 225 DAYONE LL

- I need help checking my spreadsheet. Q: Assume that Temp Force’s dividend is expected to experience supernormal growth of 73%from Year 0 to Year 1, 47% from Year 1 to Year 2, 32% from Year 2 to Year 3 and 21% from year3 to year 4. After Year 4, dividends will grow at a constant rate of 2.75%. What is the stock’sintrinsic value under these conditions? What are the expected dividend yield and capital gainsyield during the first year? What are the expected dividend yield and capital gains yield duringthe fifth year (from Year 4 to Year 5)?arrow_forwardwhat are the five components of case study design? Please help explain with examplesarrow_forwardCommissions are usually charged when a right is exercised. a warrant is exercised. a right is sold. all of the above will have commissions A and B are correct, C is not correctarrow_forward

- Don't used Ai solutionarrow_forwardDon't used Ai solutionarrow_forwardQuestion 25 Jasmine bought a house for $225 000. She already knows that for the first $200 000, the land transfer tax will cost $1650. Calculate the total land transfer tax. (2 marks) Land Transfer Tax Table Value of Property Rate On the first $30 000 0% On the next $60 000 0.5% (i.e., $30 001 to $90 000) On the next $60 000 1.0% (i.e., $90 001 to $150 000) On the next $50 000 1.5% (i.e., $150 001 to $200 000) On amounts in excess of $200 000 2.0% 22 5000–200 000. 10 825000 2.5000.00 2 x 25000 =8500 2 maarrow_forward

- Question 25 Jasmine bought a house for $225 000. She already knows that for the first $200 000, the land transfer tax will cost $1650. Calculate the total land transfer tax. (2 marks) Land Transfer Tax Table Value of Property Rate On the first $30 000 0% On the next $60 000 0.5% (i.e., $30 001 to $90 000) On the next $60 000 1.0% (i.e., $90 001 to $150 000) On the next $50 000 1.5% (i.e., $150 001 to $200 000) On amounts in excess of $200 000 2.0% 225000–200 000 = 825000 25000.002 × 25000 1= 8500 16 50+ 500 2 marksarrow_forwardSuppose you deposit $1,000 today (t = 0) in a bank account that pays an interest rate of 7% per year. If you keep the account for 5 years before you withdraw all the money, how much will you be able to withdraw after 5 years? Calculate using formula. Calculate using year-by-year approach. Find the present value of a security that will pay $2,500 in 4 years. The opportunity cost (interest rate that you could earn from alternative investments) is 5%. Calculate using the formula. Calculate using year-by-year discounting approach. Solve for the unknown in each of the following: Present value Years Interest rate Future value $50,000 12 ? $152,184 $21,400 30 ? $575,000 $16,500 ? 14% $238,830 $21,400 ? 9% $213,000 Suppose you enter into a monthly deposit scheme with Chase, where you have your salary account. The bank will deduct $25 from your salary account every month and the first payment (deduction) will be made…arrow_forwardPowerPoint presentation of a financial analysis that includes the balance sheet, income statement, and statement of cash flows for Nike and Adidas. Your analysis should also accomplish the following: Include the last three years of data, and evaluate the trends in the data. Summarize the footnotes on each of the statements. Compute the earnings per share for the three years. Compare the two companies and determine the insights gathered from the trend analysis.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT