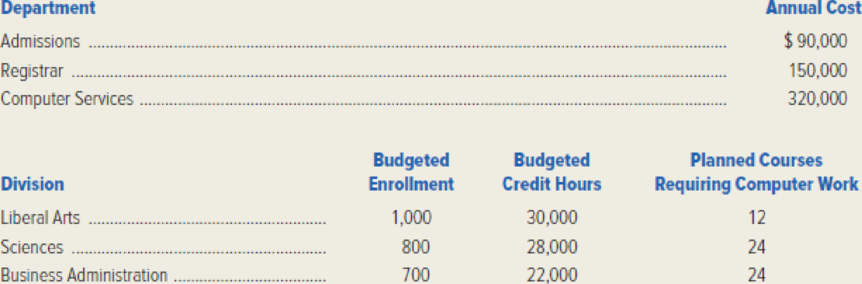

Lackawanna Community College has three divisions: Liberal Arts, Sciences, and Business Administration. The college’s comptroller is trying to decide how to allocate the costs of the Admissions Department, the Registrar’s Department, and the Computer Services Department. The comptroller has compiled the following data for the year just ended.

Required:

- 1. For each department, choose an allocation base and distribute the departmental costs to the college’s three divisions. Justify your choice of an allocation base.

- 2. Would you have preferred a different allocation base than those available using the data compiled by the comptroller? Why?

- 3. Build a spreadsheet: Construct an Excel spreadsheet to solve requirement (1) above. Show how the solution will change if the following information changes: the costs incurred by the departments were $120,000, $160,000, and $360,000, for Admissions, Registrar, and Computer Services, respectively.

1.

Choose an allocation base and distribute the departmental costs to the three divisions of the college for each department.

Explanation of Solution

Cost Allocation: The process of assigning the cost to the cost object is cost allocation. The cost allocation is done by the accountant to allocate the manufacturing overhead cost to different divisions.

Cost allocation base: An allocation base is the measure of activity, economic characteristic or physical characteristic that is related with responsibility centers.

Select an allocation base and distribute the departmental costs to the three divisions of the college for each department:

| Division | ||||

| Department and allocation base | Liberal arts | Sciences | Business administration | Total cost allocated |

| Admissions (enrollment) | (1)$36,000 | (4)$$28,800 | (7)$$25,200 | $90,000 |

| Registrar(credit hours) | (2)$56,250 | (5)$$52,500 | (8)$$41,250 | $150,000 |

| Computer Services(courses requiringcomputer) | (3)$64,000 | (6)$$128,000 | (9)$$128,000 | $320,000 |

Table (1)

- The costs for admissions department are assigned on the basis of enrollment. If the numbers of students enrolled are more in a division then more admissions are there to process.

- The cost for registrar department is assigned on the basis of credit hours. Higher the number of credit hours, the more course registrations are there to process.

- The cost for computer science department is assigned on the basis of the number of courses requiring computer work. Higher the number of computer-intensive courses, higher will be the demands placed on the computer service department.

Working notes:

(1)Calculate the admissions department’s distribution of costs for Division Liberal arts:

(2)Calculate the registrar department’s distribution of costs for Division Liberal arts:

(3)Calculate the computer service department’s distribution of costs for Division Liberal arts:

(4)Calculate the admissions department’s distribution of costs for Division science:

(5)Calculate the registrar department’s distribution of costs for Division science:

(6)Calculate the computer service department’s distribution of costs for Division science:

(7)Calculate the admissions department’s distribution of costs for Division Business administration:

(8)Calculate the registrar department’s distribution of costs for Division Business administration:

(9)Calculate the computer service department’s distribution of costs for Division Business administration:

2.

State whether different allocation base can be preferred than those that are available using the data compiled by the computer.

Explanation of Solution

- The number of courses is possibly the most appropriate allocation base for the registrar’s costs. Costs in this department are determined by processing course registration and not driven by the credit hours. Four credit hours do not need any more registration effort than a three credit course.

- The requirement of estimated amount of computer time is possibly the most appropriate allocation base for the computer science department. Two different courses requiring computer work can place difference demands on the department of computer science.

3.

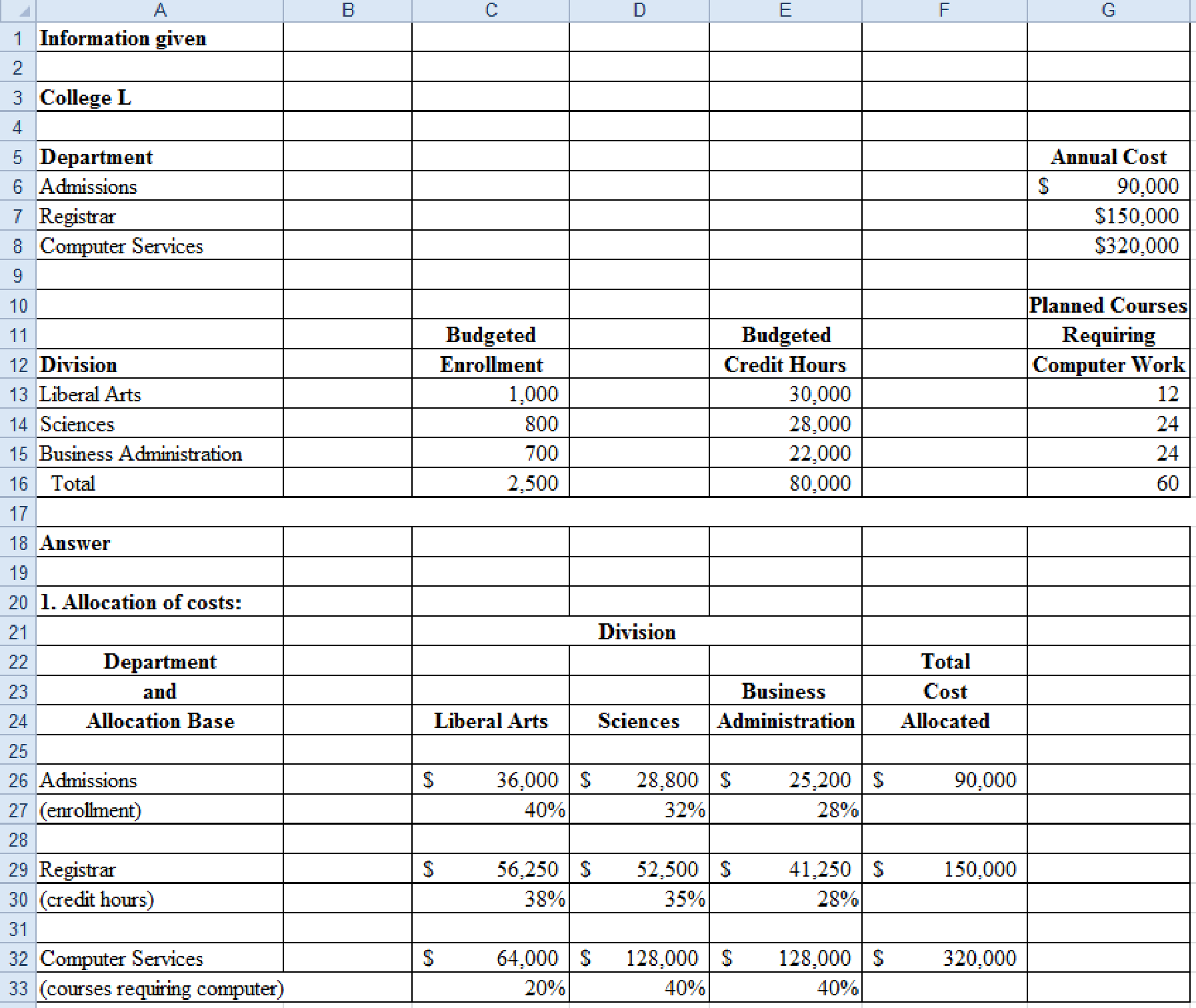

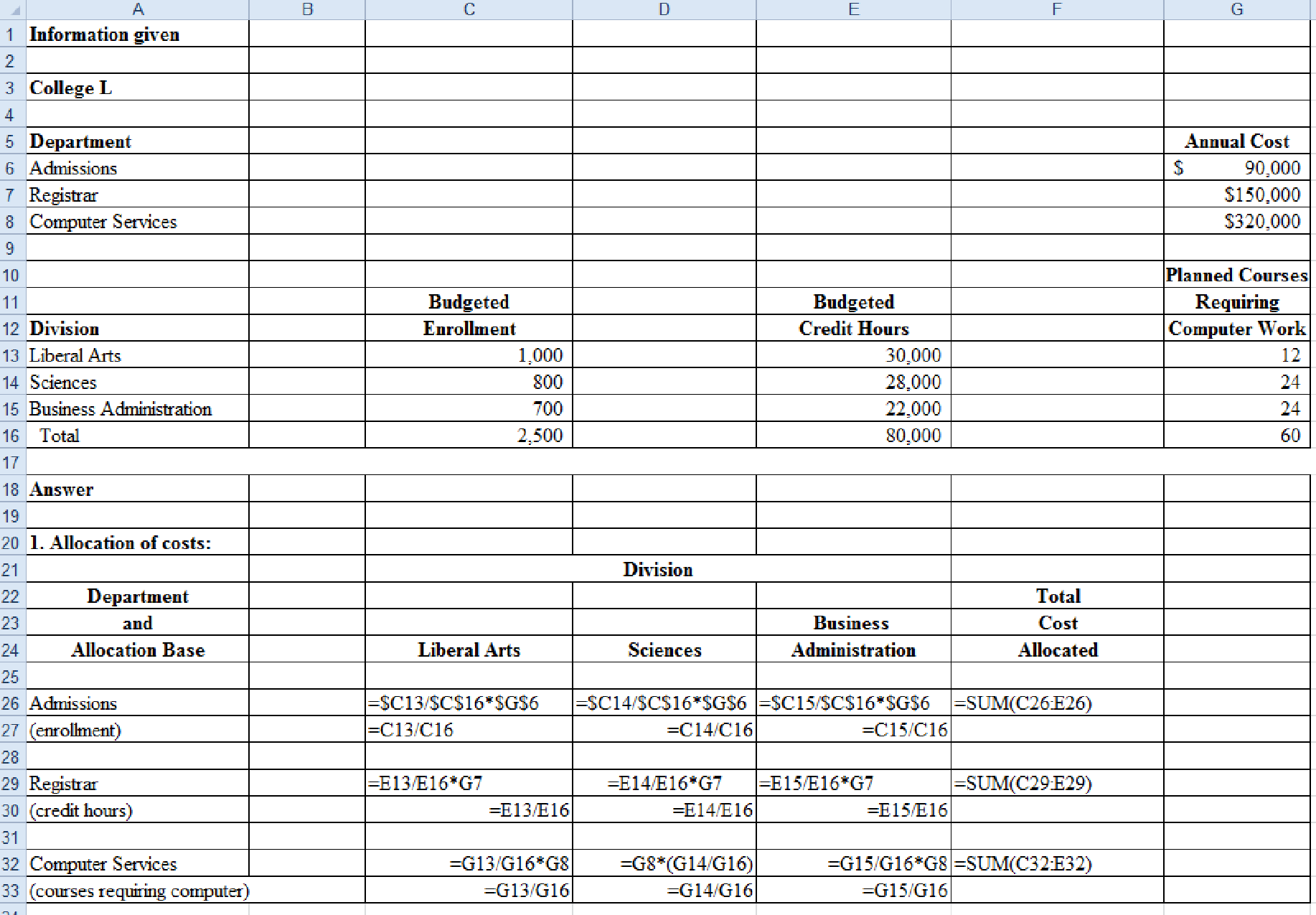

Prepare excel to show the change in the information.

Explanation of Solution

Prepare excel to show the change in the information:

Figure (1)

Working note:

Figure (2)

Want to see more full solutions like this?

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,000, direct labor of $3,400, and applied overhead of $2,890. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $26,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Direct materials used Direct labor used $ 2,300 3,400 Job 121 $ 7,100 4,700 Job 122 $ 2,600 3,700 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forwardIn 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?arrow_forwardHelp me to solve this questionsarrow_forward

- correct answer pleasearrow_forwardGive this question financial accountingarrow_forward1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forward

- Nonearrow_forwardWhat was her capital gains yield? General accountingarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question:arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning