Concept explainers

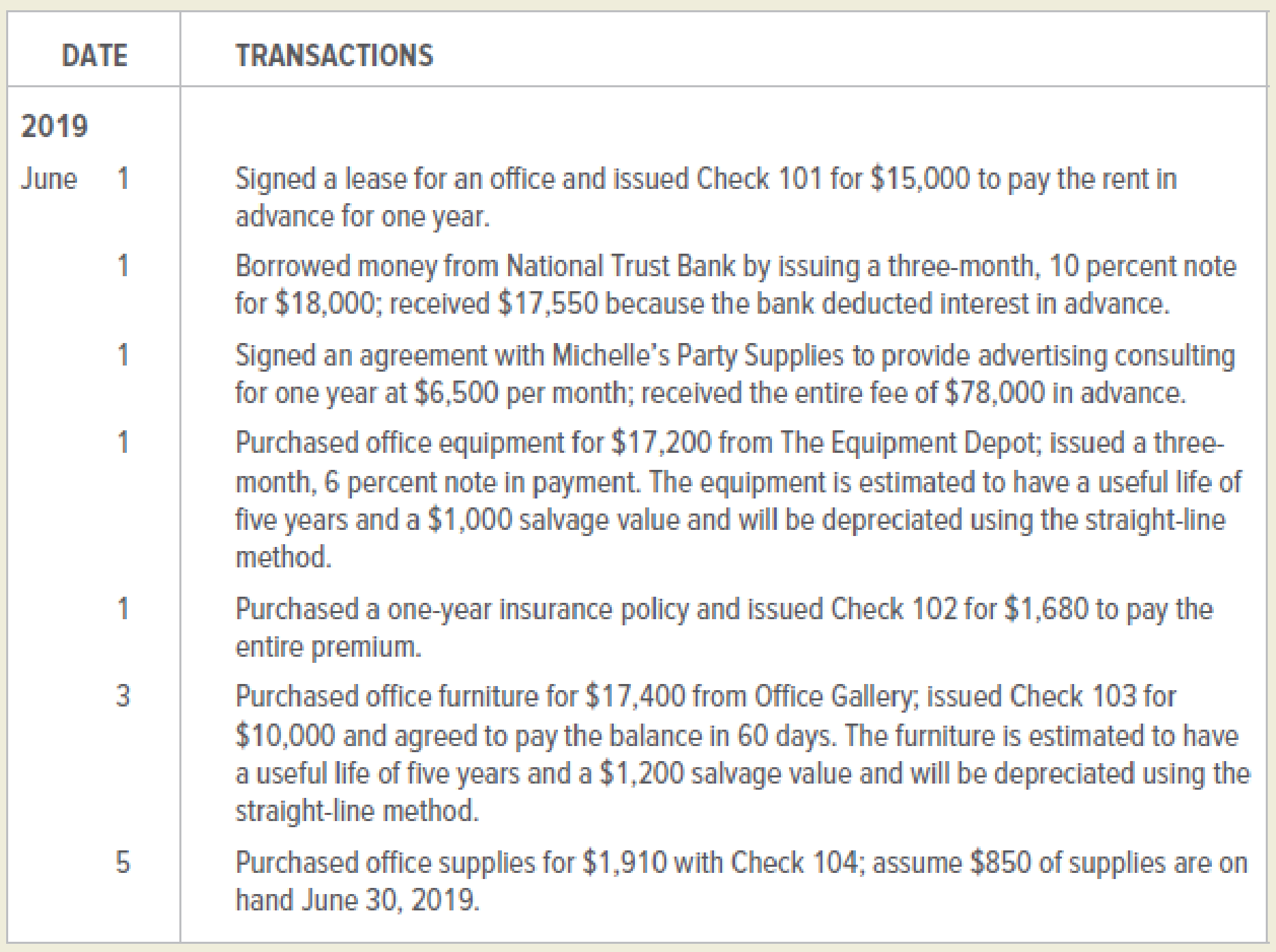

On June 1, 2019, Raquel Ramirez established her own advertising firm. Selected transactions for the first few days of June follow.

- 1. Record the transactions on page 1 of the general journal. Omit descriptions. Assume that the firm initially records prepaid expenses as assets and unearned income as a liability.

- 2. Record the

adjusting journal entries that must be made on June 30, 2019, on page 2 of the general journal. Omit descriptions.

Analyze: At the end of calendar year 2019, how much of the rent paid on June 1 will have been charged to expense?

1.

Pass the journal entries as on June 1.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit: A debit, is an accounting term that refers to the left side of an account. The term debit is be denoted by (Dr). The recording amount on the left side of the account is known as debiting.

Credit: A credit, is an accounting term that refers to the right side of an account. The term credit is denoted as (Cr). The recording amount on the right side of the account is known as crediting.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all the increase in the assets, the expenses and the dividends, all the decrease in liabilities, revenues and the stockholders’ equities.

- Credit, all the increase in the liabilities, the revenues, and the stockholders’ equities, and all decreases in the assets, and the expenses.

Pass the journal entries for the given transactions:

| General Journal | Page - 1 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| June 1 | Prepaid Rent | $15,000 | ||

| Cash | $15,000 | |||

| (To record the rent paid in advance with check 101) | ||||

| June 1 | Cash | $17,550 | ||

| Prepaid Interest | $450 | |||

| Notes Payable | $18,000 | |||

| (To record the interest paid in advance) |

Table (1)

| General Journal | Page - 1 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| June 1 | Cash | $78,000 | ||

| Unearned Advertising Fee | $78,000 | |||

| (To record the fees received in advance) | ||||

| June 1 | Office Equipment | $17,200 | ||

| Notes Payable | $17,200 | |||

| (To record equipment purchased on account) | ||||

| June 1 | Prepaid Insurance | $1,680 | ||

| Cash | $1,680 | |||

| (To record insurance paid in advance using the check 102) | ||||

| June 3 | Office Furniture | $17,400 | ||

| Cash | $10,000 | |||

| Accounts payable | $7,400 | |||

| (To record furniture purchased on account after making a part payment using the check 103) | ||||

| June 5 | Office Supplies | $1,910 | ||

| Cash | $1,910 | |||

| (To record the purchase of supplies using the check 104) |

Table (2)

2.

Pass the adjusting entries as on June 30, and compute the amount of rent expensed by the year end.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Pass the adjusting entries for the given transactions:

| General Journal | Page - 2 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| June 30 | Rent expense | $1,250 | ||

| Prepaid Rent | $1,250 | |||

| (To record the prepaid rent) | ||||

| June 30 | Interest expense | $150 | ||

| Prepaid Interest | $150 | |||

| (To record the prepaid interest) | ||||

| June 30 | Unearned Advertising Fees | $6,500 | ||

| Advertising Fees | $6,500 | |||

| (To record the Advertising fees earned) | ||||

| June 30 | Interest expense | $86 | ||

| Interest Payable | $86 | |||

| (To record the interest payable) | ||||

| June 30 | Depreciation Expense - Office Equipment | $270 | ||

| Accumulated Depreciation - Office Equipment | $270 | |||

| (To record the depreciation on equipment) | ||||

| June 30 | Insurance expense | $140 | ||

| Prepaid Insurance | $140 | |||

| (To record the prepaid insurance) |

Table (3)

| General Journal | Page - 2 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| June 30 | Depreciation Expense - Office Furniture | $270 | ||

| Accumulated Depreciation - Office Furniture | $270 | |||

| (To record the depreciation on furniture) | ||||

| June 30 | Office Supplies Expense | $1,060 | ||

| Office Supplies | $1,060 | |||

| (To record the supplies) |

Table (4)

The amount of rent expensed or charged to the Rent Expense Account will be $8,750 by the end of the year.

Working note:

Calculate the amount of rent expensed:

Want to see more full solutions like this?

Chapter 12 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Please provide correct answerarrow_forwardCalculate the number of units that must be sold in order to realize an operating income of $150,000 when fixed costs are $480,000 and the unit contribution margin is $25. a. 25,200 units b. 26,400 units c. 27,000 units d. 25,600 units.arrow_forwardThe contribution margin per unit would be??arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning