Concept explainers

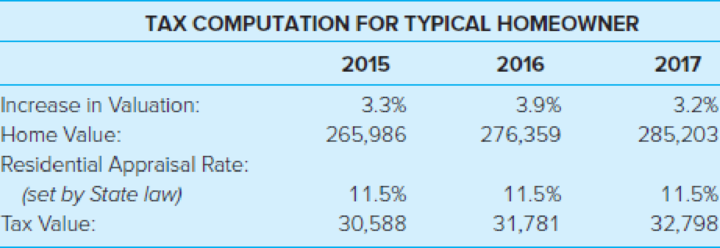

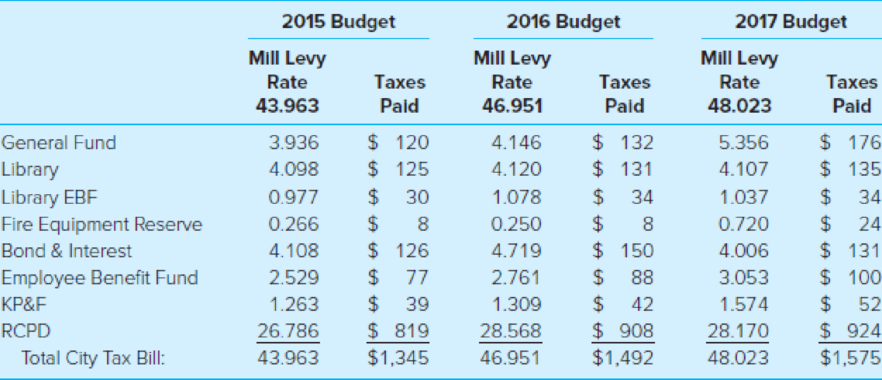

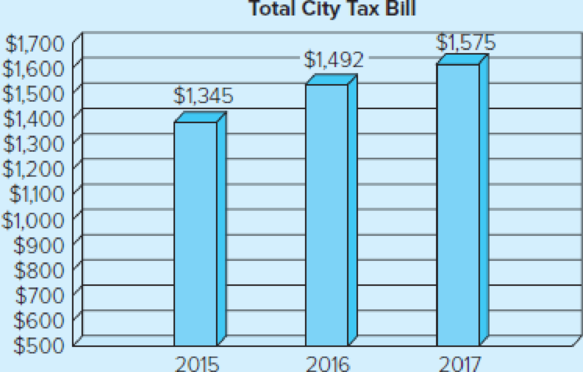

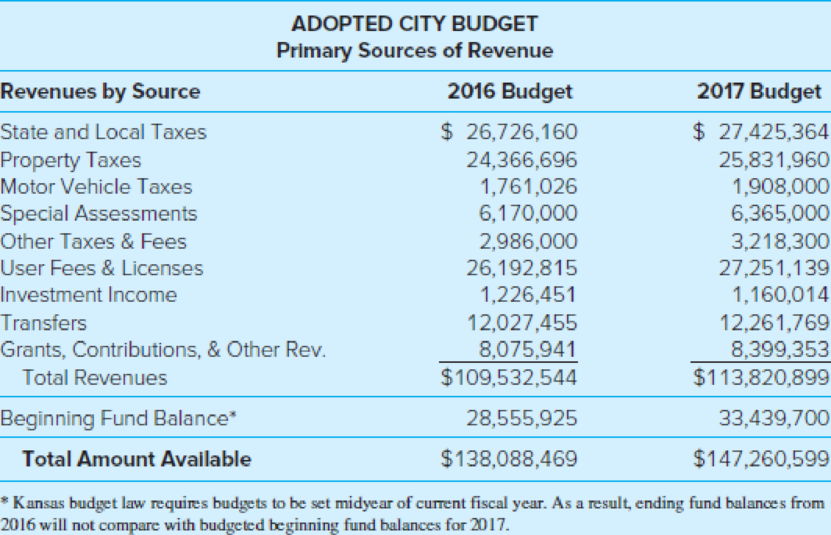

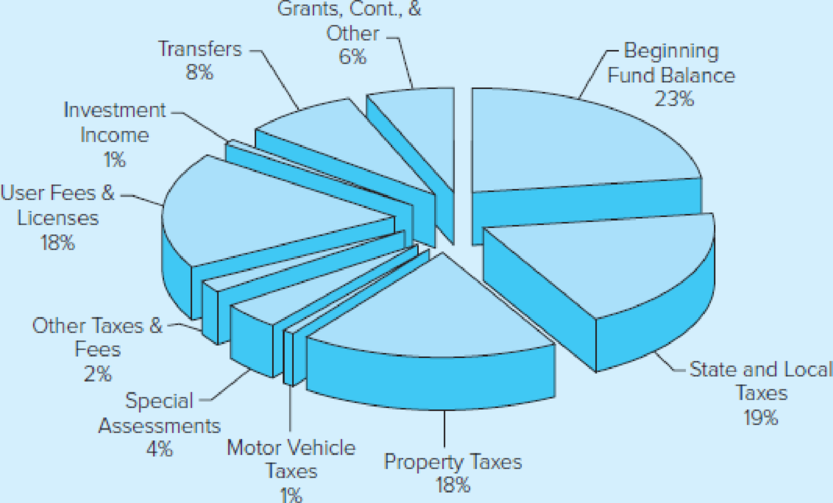

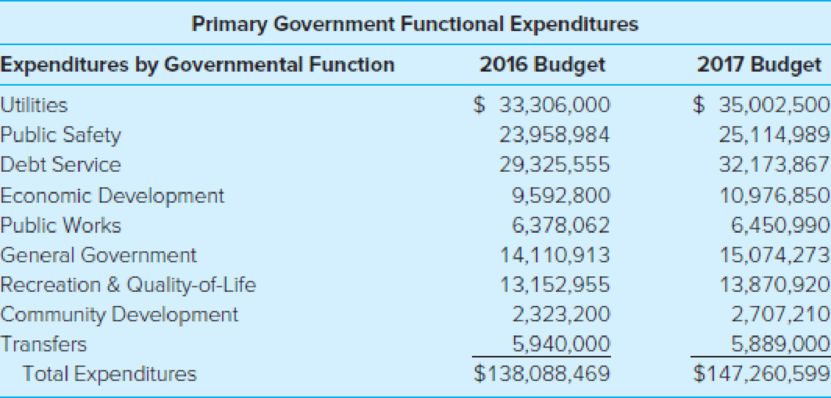

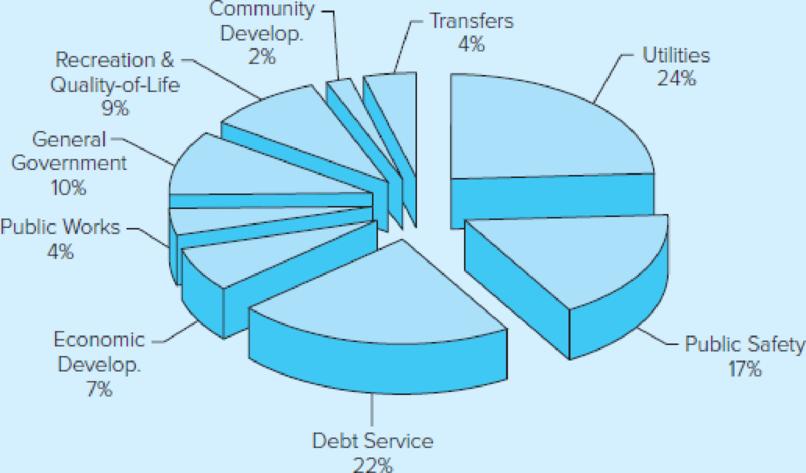

The City of Manhattan, Kansas, prepares an annual Budget Book, a comprehensive document that includes a citywide budget, as well as department budgets. The city has received the GFOA Distinguished Budget Award for more than 25 years. Following are graphical excerpts from the 2017 Budget Book that disclose typical taxpayer tax payments and primary revenue sources and functional expense categories.

Required

- a. Examine the taxpayer calculation for the three-year period. What observations can you make from this illustration? What questions might you ask city budget officials at a public budget hearing?

- b. Examine the pie charts and data provided for revenue sources and functional expenses. What are the primary revenue sources? What are the greatest expenditure categories? Taken together, do you have any questions regarding the city’s finances?

- c. As a citizen, did you find these illustrations user-friendly and relevant?

State & Local Sales Taxes: Includes city/county sales taxes, and franchise fees

Property Taxes: Includes ad valorem, delinquent taxes, and PILOT’s

User Fees & Licenses: Includes licenses & permits, services and sales, program revenue, utility sales, and fines

Investment Income: Includes land rent, farm income, and misc. investment income

Transfers: Includes transfers for utility administrative services, sales tax, debt service, etc.

Grants, Cont., & Other Rev.: Includes contributions, grants, and misc. revenues

Utilities: Includes Water, Wastewater, and Stormwater operations

Public Safety: Includes Fire Operations, Administration, Technical Services, Building Maintenance, Fire Equipment Reserve, Fire Pension K. P. & F., and R.C.P.D

Debt Service: Includes all long-term debt payments

Economic Development: Includes General Improvement, Industrial Promotion, Economic Development Opportunity Fund, CIP Reserves, and Downtown Redevelopment T.I.F.

Public Works: Includes Admin., Streets, Engineering, Traffic, and Special Street & Highway

General Government: Includes General Government, Finance, Human Resources, Airport, Court, General Services, Outside Services, Municipal Parking Lot, City University Fund, Employee Benefits, and Special Alcohol Programs

Recreation & Quality-of-Life: Parks & Recreation, Zoo, Pools, Flint Hills Discovery Center, Library, and Library Employee Benefits

Community Development: Administration and Planning, Business Districts, and Tourism & Convention Fund

Transfers: Includes transfers from Sales Tax to General Fund and Special Revenue Funds

Source: City of Manhattan, Kansas, 2017 Budget Book, pp. 46-49.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Accounting For Governmental & Nonprofit Entities

- Silver Star Manufacturing has $20 million in sales, an ROE of 15%, and a total assets turnover of 5 times. Common equity on the firm's balance sheet is 30% of its total assets. What is its net income? Round the answer to the nearest cent.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardprovide (P/E ratio)?arrow_forward

- What was xyz corporation's stockholders' equity at the of marcharrow_forward???arrow_forwardHorizon Consulting started the year with total assets of $80,000 and total liabilities of $30,000. During the year, the business recorded $65,000 in service revenues and $40,000 in expenses. Additionally, Horizon issued $12,000 in stock and paid $18,000 in dividends. By how much did stockholders' equity change from the beginning of the year to the end of the year?arrow_forward

- х chat gpt - Sea Content Content × CengageNOW × Wallet X takesssignment/takeAssignmentMax.co?muckers&takeAssignment Session Loca agenow.com Instructions Labels and Amount Descriptions Income Statement Instructions A-One Travel Service is owned and operated by Kate Duffner. The revenues and expenses of A-One Travel Service Accounts (revenue and expense items) < Fees earned Office expense Miscellaneous expense Wages expense Required! $1,480,000 350,000 36,000 875,000 Prepare an income statement for the year ended August 31, 2016 Labels and Amount Descriptions Labels Expenses For the Year Ended August 31, 20Y6 Check My Work All work saved.arrow_forwardEvergreen Corp. began the year with stockholders' equity of $350,000. During the year, the company recorded revenues of $500,000 and expenses of $320,000. The company also paid dividends of $30,000. What was Evergreen Corp.'s stockholders' equity at the end of the year?arrow_forwardEvergreen corp.'s stockholders' equity at the end of the yeararrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education