PRINCIPLES OF TAXATION F/BUS.+INVEST.

22nd Edition

ISBN: 9781259917097

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 14AP

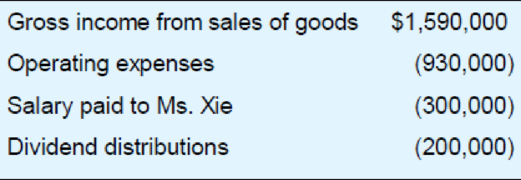

Ms. Xie, who is in the 37 percent tax bracket, is the sole shareholder and president of Xenon. The corporation’s financial records show the following.

- a. Compute the combined tax cost for Xenon and Ms. Xie. (Ignore payroll tax.)

- b. How would your computation change if Ms. Xie’s salary was $500,000 and Xenon paid no dividends?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the companys gross profit?

What is the net income reported by Meera auto repairs for the year?

What is the labor rate variance for the month

Chapter 12 Solutions

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Ch. 12 - Mr. and Mrs. Velotta are self-employed...Ch. 12 - Prob. 2QPDCh. 12 - Ms. Johnson is eager to create a family...Ch. 12 - Discuss the tax and nontax reasons why the stock...Ch. 12 - Mr. Eros operates an antique store located on the...Ch. 12 - Prob. 6QPDCh. 12 - Prob. 7QPDCh. 12 - Prob. 8QPDCh. 12 - Prob. 9QPDCh. 12 - Prob. 10QPD

Ch. 12 - Prob. 11QPDCh. 12 - Ms. Knox recently loaned 20,000 to her closely...Ch. 12 - Explain the logic of the tax rate for both the...Ch. 12 - Prob. 14QPDCh. 12 - Prob. 15QPDCh. 12 - Prob. 16QPDCh. 12 - Mr. Tuck and Ms. Under organized a new business as...Ch. 12 - Grant and Marvin organized a new business as a...Ch. 12 - Prob. 3APCh. 12 - Ms. Kona owns a 10 percent interest in Carlton...Ch. 12 - Mrs. Franklin, who is in the 37 percent tax...Ch. 12 - Prob. 6APCh. 12 - Prob. 7APCh. 12 - Prob. 8APCh. 12 - Prob. 9APCh. 12 - Prob. 10APCh. 12 - Prob. 11APCh. 12 - Prob. 12APCh. 12 - Prob. 13APCh. 12 - Ms. Xie, who is in the 37 percent tax bracket, is...Ch. 12 - Prob. 15APCh. 12 - In 1994, Mr. and Mrs. Adams formed ADC by...Ch. 12 - Prob. 17APCh. 12 - Prob. 18APCh. 12 - Prob. 19APCh. 12 - Prob. 20APCh. 12 - Prob. 21APCh. 12 - Prob. 1IRPCh. 12 - Prob. 2IRPCh. 12 - Prob. 3IRPCh. 12 - REW Inc. is closely held by six members of the REW...Ch. 12 - Prob. 5IRPCh. 12 - Prob. 6IRPCh. 12 - Prob. 7IRPCh. 12 - Prob. 8IRPCh. 12 - Prob. 9IRPCh. 12 - Prob. 10IRPCh. 12 - Prob. 2TPCCh. 12 - Prob. 3TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License