Advanced Financial Accounting

11th Edition

ISBN: 9780078025877

Author: Theodore E. Christensen, David M Cottrell, Cassy JH Budd Advanced Financial Accounting

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.9E

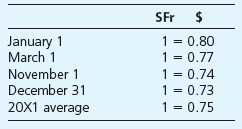

Translation with Strengthening U.S. Dollar

Refer to the data in Exercise E12-5, but now assume that the exchange rates were as follows:

The receivable from Popular Creek Corporation is denominated in Swiss francs. Popular Creek’s books show a $3,650 payable to RoadTime.

Assume the Swiss franc is the functional currency.

Required

- Prepare a schedule translating the December 31, 20X1,

trial balance from Swiss francs to dollars. - Compare the results of Exercise E12-5, in which the dollar is weakening against the Swiss franc during 20X1, with the results in this exercise (E12-9), in which the dollar is strengthening against the Swiss franc during 20X1.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

GreenView Company's receivable from a foreign customer is denominated in the customers

local currency, the Brazilian Real (BRL). This receivable totaled 900,000 BRL and was

translated to $300,000 at December 31, 20X5. On January 31, 20X6, the receivable was

collected from the customer at an exchange rate of 4 BRL to $1. What journal entry should

GreenView record in January?

Dr. Foreign currency units 300,000

Cr. Accounts receivable

Dr. Foreign currency units 225,000

2. Cr. Accounts receivable

01.

03.

4.

Dr. Foreign currency units 300,000

Cr. Exchange gain

Cr. Accounts receivable

Dr. Foreign currency units

Dr. Exchange loss

Cr. Accounts receivable

225,000

75,000

300,000

225,000

75,000

225,000

300,000

Foreign currency transactions

Use the following information for the next two questions:

On December 1, 20x1, Entity A sells good to Entity B, on credit, for a total sale price of $1,000.

Entity B settles the account on January 6, 20x1. Entity A's functional currency is the Philippine

peso (P). The relevant exchange rate are as follows:

Dec. 1, 20x1

Dec. 31, 20x1

Jan. 6, 20x1

P50:$1

P52:$1

P41:$1

How much is the foreign exchange gain (loss) to be recognized by Entity A on December 31,

20x1?

ASSUME THAT THE LOCAL CURRENCY UNIT IS THE FUNCTIONAL CURRENCY.

Cade Inc. had a debit adjustment of $6400 for the year ended December 31, 2019, from restating its foreign

subsidiary's accounts from their local currency units into U.S. dollars.

Additionally, Cade had a receivable from a foreign customer. It is denominated in the customer's local currency. On

December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Cade's balance

sheet at $121000. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $123800.

In Cade's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in

computing net income?

BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF

$1,000.

IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000)

Your Answer:

Chapter 12 Solutions

Advanced Financial Accounting

Ch. 12 - Prob. 12.1QCh. 12 - Prob. 12.2QCh. 12 - Prob. 12.3QCh. 12 - How widely used are IFRS? Can IFRS be used for...Ch. 12 - Prob. 12.5QCh. 12 - Prob. 12.6QCh. 12 - Prob. 12.7QCh. 12 - Prob. 12.8QCh. 12 - Prob. 12.9QCh. 12 - Prob. 12.10Q

Ch. 12 - Prob. 12.11QCh. 12 - Prob. 12.12QCh. 12 - Prob. 12.13QCh. 12 - Prob. 12.14QCh. 12 - Prob. 12.15QCh. 12 - Prob. 12.16QCh. 12 - Prob. 12.17QCh. 12 - Prob. 12.18QCh. 12 - Prob. 12.19QCh. 12 - Prob. 12.20QCh. 12 - Prob. 12.4CCh. 12 - Prob. 12.5CCh. 12 - Prob. 12.6CCh. 12 - Prob. 12.7CCh. 12 - Prob. 12.1.1ECh. 12 - Prob. 12.1.2ECh. 12 - Prob. 12.1.3ECh. 12 - Prob. 12.1.4ECh. 12 - Prob. 12.1.5ECh. 12 - Prob. 12.1.6ECh. 12 - Prob. 12.1.7ECh. 12 - Prob. 12.2.1ECh. 12 - Prob. 12.2.2ECh. 12 - Prob. 12.2.3ECh. 12 - Prob. 12.2.4ECh. 12 - Prob. 12.2.5ECh. 12 - Prob. 12.2.6ECh. 12 - Prob. 12.3ECh. 12 - Prob. 12.4.1ECh. 12 - Prob. 12.4.2ECh. 12 - Prob. 12.4.3ECh. 12 - Prob. 12.4.4ECh. 12 - Prob. 12.4.5ECh. 12 - Prob. 12.4.6ECh. 12 - Prob. 12.4.7ECh. 12 - Prob. 12.5ECh. 12 - Prob. 12.6ECh. 12 - Prob. 12.7ECh. 12 - Prob. 12.8ECh. 12 - Translation with Strengthening U.S. Dollar Refer...Ch. 12 - Remeasurement with Strengthening U.S. Dollar Refer...Ch. 12 - Prob. 12.11ECh. 12 - Prob. 12.12ECh. 12 - Prob. 12.13ECh. 12 - Prob. 12.14ECh. 12 - Prob. 12.15ECh. 12 - Prob. 12.16PCh. 12 - Prob. 12.17PCh. 12 - Prob. 12.18PCh. 12 - Proof of Translation Adjustment Refer to the...Ch. 12 - Prob. 12.20PCh. 12 - Prob. 12.21PCh. 12 - Remeasurement and Proof of Remeasurement Gain or...Ch. 12 - Prob. 12.23PCh. 12 - Prob. 12.24PCh. 12 - Prob. 12.25PCh. 12 - Prob. 12.26PCh. 12 - Prob. 12.27PCh. 12 - Prob. 12.28PCh. 12 - Prob. 12.29PCh. 12 - Prob. 12.30PCh. 12 - Prob. 12.31PCh. 12 - Prob. 12.32PCh. 12 - Prob. 12.33P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For each of the following transactions, determine which U.S balance of payments account is credited and which is debited and by how much. Assume payments for all transactions are deposited into a U.S dollar-denominated bank account. Calculate for c and d.arrow_forwardSubject :- Accountingarrow_forwardPlease help mearrow_forward

- Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows: Маy 8 Мay 31 Spot rate: $1.16 Spot rate: $1.18 Spot rate: $1.12 June 7 For what amount should Clark's Accounts Payable be credited on May 8? Multiple Choice $1,770,000. $1,680,000. $1,740,000. $1,850,000. $1,500,000.arrow_forwardOn December 20, 2023, Momeier Company (a U.S.-based company) sold parts to a foreign customer at a price of 165,000 rials. Payment is received on January 10, 2024. Currency exchange rates are as follows: DateU.S. Dollar per RialDecember 20, 2023$ 1.26December 31, 20231.23January 10, 20241.19 Required: How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier's 2023 income statement? How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier's 2024 income statement? a. The rial receivable exchange b. The rial receivable exchange S in U.S. dollar value, resulting in a foreign of in 2023. in U.S. dollar value, resulting in a foreign of in 2024.arrow_forwardHello, please help with letter a. Thank you 1) ABC Corp has Accounts Receivable of FC 400,000 and Accounts Payable FC 300,000 on both March 31 and April 30, 2010. The applicable exchange rates at that date were as follows: March 30 April 30 Spot rate 1FC = .35 US 1FC = .37 US Forward rate(1 month). 1FC= .36 US. 1FC= .39 US a) What is the FX transaction gain or loss on Accounts REeceivable on April 30, 2010? b) What is the FX transaction gain or loss on Accounts Payable on April 30, 2010? c) If on March 31, ABC wishes to hedge its exposure to changing exchange rates what is the appropriate action it will take. Answer by saying whether ABC will enter a spot contract or forward contract and say whether the contract will involve purchasing FC and selling US dollars, or purchasing US dollards and selling FC and specify the appropriate exchange…arrow_forward

- B1.arrow_forwardJournal entries for an accounts receivable denominated in Swiss Francs ($US strengthens and weakens) Assume that your company sells products to a customer located in Switzerland on November 20. The invoice specifies that payment is to be made on February 20 in Swiss Francs (CHF) in the amount of CHF 250,000. Your company operates on a calendar year basis. Assume the following exchange rates: November 20 $1.12:1CHF December 31 $1.09.1CHF February 20 $1.11:1CHF Prepare the journal entries to record the sale (ignore cost of goods sold), the required adjusting entry at December 31, and the receipt of payment February 20. Description Date 11/20 Accounts receivable Sales 12/31 Foreign currency transaction loss Accounts receivable 2/20 Cash Accounts receivable Accounts receivable Debit + ✓ 250,000 x + ✓ ✓ # ✓ 0✓ 10,000 x 0✓ ÷ ✓ 277,500✔ ooo 4 x 0✔ 0✓ Credit 0✓ 250,000 x 0✓ 10,000 x 277,500 x 0xarrow_forwardJournal entries for an accounts receivable denominated in Swiss Francs ($US strengthens and weakens) Assume that your company sells products to a customer located in Switzerland on November 20. The invoice specifies that payment is to be made on February 20 in Swiss Francs (CHF) in the amount of CHF 250,000. Your company operates on a calendar year basis. Assume the following exchange rates: November 20 $1.12:1CHF December 31 $1.09:1CHF February 20 $1.11:1CHF Prepare the journal entries to record the sale (ignore cost of goods sold), the required adjusting entry at December 31, and the receipt of payment February 20. Date Description Credit 11/20 Accounts receivable Sales 12/31 Foreign currency transaction loss Accounts receivable 2/20 Cash Accounts receivable Accounts receivable → ✓ ✓ ✓ + → ✔ ✓ → Debit 250,000 x 0 ✓ 10,000 * 0✔ 277,500✔ 0✓ 0✔ 0✔ 250,000 * 0✔ 10,000 x 0 ✓ 277,500 * 0 xarrow_forward

- Help with parts A,B,Carrow_forward8. Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows: May 8 May 31 June 7 Spot rate: $1.16 Spot rate:$1.18 Spot rate: $1.12 For what amount should Clark's Accounts Payable be credited on May 8? a. $1,680,000. b. $1,850,000. c. $1,740,000. d. $1,500,000. e. $1,770,000. in hearrow_forwardRequired: 1. Calculate the exchange gain or loss to be reported in 20X7. (Do not round intermediate calculations.) 2. Calculate the accounts receivable on the 31 December 20X7 statement of financial position. 3. Calculate the sales revenue to be recorded from the transactions listed above. Thumb up if you have the correct answer! Thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The Exchange Rate and the Foreign Exchange Market [AP Macroeconomics Explained]; Author: Heimler's History;https://www.youtube.com/watch?v=JsKLBpy6cEc;License: Standard Youtube License