Managerial Accounting: Tools for Business Decision Making 7e Binder Ready Version + WileyPLUS Registration Card

7th Edition

ISBN: 9781119036449

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: Wiley (WileyPLUS Products)

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.7E

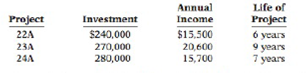

Iggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows.

Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy Company uses the straight-line method of

Instructions

(a) Determine the

(b) If Iggy Company's required rate of return is 10%. which projects are acceptable?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ans plz accounting

Need help

Calculate the accounts receivable period?

Chapter 12 Solutions

Managerial Accounting: Tools for Business Decision Making 7e Binder Ready Version + WileyPLUS Registration Card

Ch. 12 - Prob. 1QCh. 12 - Prob. 2QCh. 12 - Tom Wells claims the formula for the cash payback...Ch. 12 - Prob. 4QCh. 12 - What is the decision rule under the net present...Ch. 12 - Discuss the factors that determine the appropriate...Ch. 12 - What simplifying assumptions were made in the...Ch. 12 - What are some examples of potential intangible...Ch. 12 - What steps can be taken to incorporate intangible...Ch. 12 - Prob. 10Q

Ch. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - Prob. 13QCh. 12 - What are the strengths of the annual rate of...Ch. 12 - Prob. 15QCh. 12 - Prob. 16QCh. 12 - Prob. 12.1BECh. 12 - Hsung Company accumulates the following data...Ch. 12 - Thunder Corporation, an amusement park, is...Ch. 12 - Caine Bottling Corporation is considering the...Ch. 12 - McKnight Company is considering two different,...Ch. 12 - Prob. 12.6BECh. 12 - Prob. 12.7BECh. 12 - Prob. 12.8BECh. 12 - Prob. 12.9BECh. 12 - Prob. 12.1DICh. 12 - Prob. 12.2DICh. 12 - Prob. 12.3DICh. 12 - Prob. 12.4DICh. 12 - Prob. 12.5DICh. 12 - Prob. 12.1ECh. 12 - Doug's Custom Construction Company is considering...Ch. 12 - Prob. 12.3ECh. 12 - BAK Corp. is considering purchasing one of two new...Ch. 12 - Bruno Corporation is involved in the business of...Ch. 12 - BSU Inc. wants to purchase a new machine for...Ch. 12 - Iggy Company is considering three capital...Ch. 12 - Prob. 12.8ECh. 12 - Legend Service Center just purchased an automobile...Ch. 12 - Vilas Company is considering a capital investment...Ch. 12 - Drake Corporation is reviewing an investment...Ch. 12 - U3 Company is considering three long-term capital...Ch. 12 - Prob. 12.2APCh. 12 - Brooks Clinic is considering investing in new...Ch. 12 - Jane's Auto Care is considering the purchase of a...Ch. 12 - Prob. 12.5APCh. 12 - Prob. 12CDCh. 12 - Luang Company is considering the purchase of a new...Ch. 12 - Prob. 12.2BYPCh. 12 - Tecumseh Products Company has its headquarters in...Ch. 12 - Prob. 12.4BYPCh. 12 - Prob. 12.5BYPCh. 12 - Prob. 12.6BYPCh. 12 - Prob. 12.8BYP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your plant produces 134 snowmobiles per month. Direct costs are $2,540 per snowmobile. The monthly overhead is $87,000. What is the average cost per snowmobile with overhead? 4 PTSarrow_forwardprovide this questions answer for this account subjectarrow_forwardYour plant produces 134 snowmobiles per month. Direct costs are $2,540 per snowmobile. The monthly overhead is $87,000. What is the average cost per snowmobile with overhead?arrow_forward

- A specified part can be obtained by either of two methods. Method A will have fixed costs of $40,000 per year and a variable cost of $20 per unit. Method B will have fixed costs of $60,000 per year and a variable cost of $15 per unit. The number of units that must be produced each year for the two methods to be equally attractive is closest toarrow_forwardgeneral accountarrow_forwardGive me Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Economic Value Added EVA - ACCA APM Revision Lecture; Author: OpenTuition;https://www.youtube.com/watch?v=_3hpcMFHPIU;License: Standard Youtube License