Translation

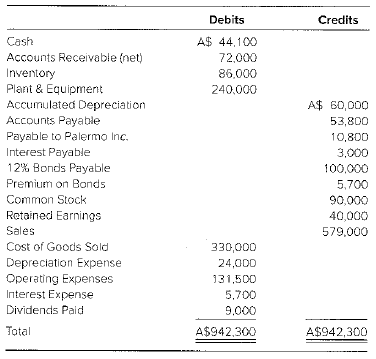

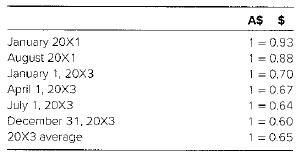

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (AS) was A$200,000, and A$40,000 of the differential was allocated lo plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a Patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching’s

Additional Information

1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20X3. The ending inventory was acquired at the average exchange rate for the year.

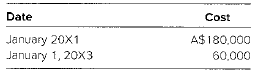

2. Plain and equipment were acquired as follows:

3. Plant and equipment are

4. The payable to Palermo is in Australian dollars. Palermo’s books show a receivable from Salina Ranching of $6,480.

5. The 10−year bonds were issued on July 1, 20X3, for A$106,000. The premium is amortized on a straight−line basis. The interest is paid on April 1 and October 1,

6. The dividends were declared arid paid on April 1.

7. Exchange rates were as follows:

Required

a. Prepare a schedule translating the December 31, 20X3, trial balance of Salina Ranching from Australian dollars to U.S. dollars.

b. Prepare a schedule providing a proof of the translation adjustment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

ADV.FIN.ACCT.LL W/CONNECT+PROCTORIO PLUS

- Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- accounting question?arrow_forwardThree individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares. a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.arrow_forwardNonearrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,