Concept explainers

(a)

Statement of

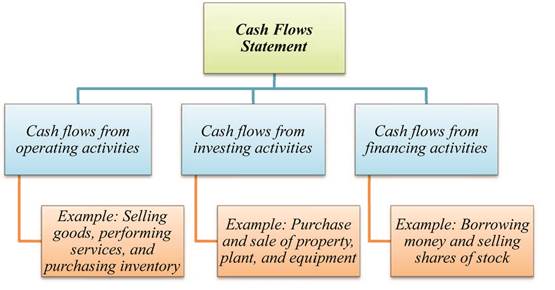

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Type of activities reported in statement of cash flows:

Figure (1)

To Indicate: Statement presentation of transactions.

Issue of bonds payable for cash amounted to $200,000 must be reported in the Financing activities in the statement of cash flow.

(b)

To Indicate: Statement presentation of transactions.

Purchase of equipment for cash amounted to $180,000 must be reported in the Investing activities in the statement of cash flow.

(c)

To Indicate: Statement presentation of transactions.

Sale of land for cash amounted to $20,000 must be reported in the Investing activities in the statement of cash flow.

(d)

To Indicate: Statement presentation of transactions.

Payment of cash dividend amounted to $50,000 must be reported in the Financing activities in the statement of cash flow.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Need correct answer general accounting questionarrow_forwardNonearrow_forwardA supplier offers credit terms of 2/10, net 30, meaning a 2% discount is available if payment is made within 10 days. If a company purchases $12,000 worth of goods and pays within 7 days, calculate the amount paid after applying the discount.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning