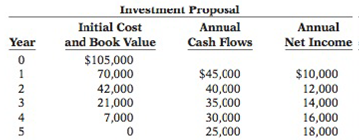

Drake Corporation is reviewing an investment proposal. The initial cost and estimates of the book value of the investment at the end of each year, the net

Drake Corporation uses an 11% target rate of

Instructions

(a) What is the cash payback period for this proposal?

(b) What is the annual rate of return for the investment?

(c) What is the

(CMA-Canada adapted)

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Tools For Business Decision Making, Seventh Edition Wileyplus Card

- Don't want AI ANSWERarrow_forwardOn January 1, Trump Financial Services lends a corporate client $180,000 at an 8% interest rate. The amount of interest revenue that should be recorded for the quarter ending March 31 equals: a) $14,400 b) $3,600 c) $900 d) $3,200arrow_forwardNeed answer pleasearrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning