LOOSE-LEAF Advanced Financial Accounting with Connect

11th Edition

ISBN: 9781259605192

Author: Theodore E. Christensen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.10E

Remeasurement with Strengthening U.S. Dollar

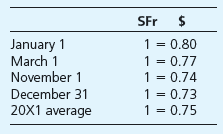

Refer to the data in Exercise E12-5, but now assume that the exchange rates were as follows:

The receivable from Popular Creek is denominated in Swiss francs. Its books show a $3,650 payable to RoadTime.

Assume that the U.S. dollar is the functional currency.

Required

- Prepare a schedule remeasuring the December 31, 20X1,

trial balance from Swiss francs to dollars. - Compare the results of Exercise E12-7, in which the dollar weakens against the Swiss franc during 20X1, with the results in this exercise (E12-10), in which the dollar strengthened against the Swiss franc during 20X1.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ASSUME THAT THE LOCAL CURRENCY UNIT IS THE FUNCTIONAL CURRENCY.

Cade Inc. had a debit adjustment of $6400 for the year ended December 31, 2019, from restating its foreign

subsidiary's accounts from their local currency units into U.S. dollars.

Additionally, Cade had a receivable from a foreign customer. It is denominated in the customer's local currency. On

December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Cade's balance

sheet at $121000. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $123800.

In Cade's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in

computing net income?

BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF

$1,000.

IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000)

Your Answer:

Subject :- Accounting

Date Account Titles and Explanation Debit Credit (To record gain or loss on foreign currency) (To record gain or loss on firm commitment) (To record payment to exchange dealer and receipt of foreign currency) (To record settlement of firm commitment)

Chapter 12 Solutions

LOOSE-LEAF Advanced Financial Accounting with Connect

Ch. 12 - Prob. 12.1QCh. 12 - Prob. 12.2QCh. 12 - Prob. 12.3QCh. 12 - How widely used are IFRS? Can IFRS be used for...Ch. 12 - Prob. 12.5QCh. 12 - Prob. 12.6QCh. 12 - Prob. 12.7QCh. 12 - Prob. 12.8QCh. 12 - Prob. 12.9QCh. 12 - Prob. 12.10Q

Ch. 12 - Prob. 12.11QCh. 12 - Prob. 12.12QCh. 12 - Prob. 12.13QCh. 12 - Prob. 12.14QCh. 12 - Prob. 12.15QCh. 12 - Prob. 12.16QCh. 12 - Prob. 12.17QCh. 12 - Prob. 12.18QCh. 12 - Prob. 12.19QCh. 12 - Prob. 12.20QCh. 12 - Prob. 12.4CCh. 12 - Prob. 12.5CCh. 12 - Prob. 12.6CCh. 12 - Prob. 12.7CCh. 12 - Prob. 12.1.1ECh. 12 - Prob. 12.1.2ECh. 12 - Prob. 12.1.3ECh. 12 - Prob. 12.1.4ECh. 12 - Prob. 12.1.5ECh. 12 - Prob. 12.1.6ECh. 12 - Prob. 12.1.7ECh. 12 - Prob. 12.2.1ECh. 12 - Prob. 12.2.2ECh. 12 - Prob. 12.2.3ECh. 12 - Prob. 12.2.4ECh. 12 - Prob. 12.2.5ECh. 12 - Prob. 12.2.6ECh. 12 - Prob. 12.3ECh. 12 - Prob. 12.4.1ECh. 12 - Prob. 12.4.2ECh. 12 - Prob. 12.4.3ECh. 12 - Prob. 12.4.4ECh. 12 - Prob. 12.4.5ECh. 12 - Prob. 12.4.6ECh. 12 - Prob. 12.4.7ECh. 12 - Prob. 12.5ECh. 12 - Prob. 12.6ECh. 12 - Prob. 12.7ECh. 12 - Prob. 12.8ECh. 12 - Translation with Strengthening U.S. Dollar Refer...Ch. 12 - Remeasurement with Strengthening U.S. Dollar Refer...Ch. 12 - Prob. 12.11ECh. 12 - Prob. 12.12ECh. 12 - Prob. 12.13ECh. 12 - Prob. 12.14ECh. 12 - Prob. 12.15ECh. 12 - Prob. 12.16PCh. 12 - Prob. 12.17PCh. 12 - Prob. 12.18PCh. 12 - Proof of Translation Adjustment Refer to the...Ch. 12 - Prob. 12.20PCh. 12 - Prob. 12.21PCh. 12 - Remeasurement and Proof of Remeasurement Gain or...Ch. 12 - Prob. 12.23PCh. 12 - Prob. 12.24PCh. 12 - Prob. 12.25PCh. 12 - Prob. 12.26PCh. 12 - Prob. 12.27PCh. 12 - Prob. 12.28PCh. 12 - Prob. 12.29PCh. 12 - Prob. 12.30PCh. 12 - Prob. 12.31PCh. 12 - Prob. 12.32PCh. 12 - Prob. 12.33P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- GreenView Company's receivable from a foreign customer is denominated in the customers local currency, the Brazilian Real (BRL). This receivable totaled 900,000 BRL and was translated to $300,000 at December 31, 20X5. On January 31, 20X6, the receivable was collected from the customer at an exchange rate of 4 BRL to $1. What journal entry should GreenView record in January? Dr. Foreign currency units 300,000 Cr. Accounts receivable Dr. Foreign currency units 225,000 2. Cr. Accounts receivable 01. 03. 4. Dr. Foreign currency units 300,000 Cr. Exchange gain Cr. Accounts receivable Dr. Foreign currency units Dr. Exchange loss Cr. Accounts receivable 225,000 75,000 300,000 225,000 75,000 225,000 300,000arrow_forwardOn December 20, 2023, Momeier Company (a U.S.-based company) sold parts to a foreign customer at a price of 165,000 rials. Payment is received on January 10, 2024. Currency exchange rates are as follows: DateU.S. Dollar per RialDecember 20, 2023$ 1.26December 31, 20231.23January 10, 20241.19 Required: How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier's 2023 income statement? How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier's 2024 income statement? a. The rial receivable exchange b. The rial receivable exchange S in U.S. dollar value, resulting in a foreign of in 2023. in U.S. dollar value, resulting in a foreign of in 2024.arrow_forwardASSUME THAT THE U.S. DOLLAR IS THE FUNCTIONAL CURRENCY. Ruthie Inc. had a debit adjustment of $7900 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Ruthie had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Ruthie's balance sheet at $124200. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $122200. In Ruthie's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forward

- Help with parts A,B,Carrow_forwardClark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows: Маy 8 Мay 31 Spot rate: $1.16 Spot rate: $1.18 Spot rate: $1.12 June 7 For what amount should Clark's Accounts Payable be credited on May 8? Multiple Choice $1,770,000. $1,680,000. $1,740,000. $1,850,000. $1,500,000.arrow_forward4arrow_forward

- Answer the attached questionarrow_forward8. Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows: May 8 May 31 June 7 Spot rate: $1.16 Spot rate:$1.18 Spot rate: $1.12 For what amount should Clark's Accounts Payable be credited on May 8? a. $1,680,000. b. $1,850,000. c. $1,740,000. d. $1,500,000. e. $1,770,000. in hearrow_forwardJournal entries for an accounts receivable denominated in Swiss Francs ($US strengthens and weakens) Assume that your company sells products to a customer located in Switzerland on November 20. The invoice specifies that payment is to be made on February 20 in Swiss Francs (CHF) in the amount of CHF 250,000. Your company operates on a calendar year basis. Assume the following exchange rates: November 20 $1.12:1CHF December 31 $1.09.1CHF February 20 $1.11:1CHF Prepare the journal entries to record the sale (ignore cost of goods sold), the required adjusting entry at December 31, and the receipt of payment February 20. Description Date 11/20 Accounts receivable Sales 12/31 Foreign currency transaction loss Accounts receivable 2/20 Cash Accounts receivable Accounts receivable Debit + ✓ 250,000 x + ✓ ✓ # ✓ 0✓ 10,000 x 0✓ ÷ ✓ 277,500✔ ooo 4 x 0✔ 0✓ Credit 0✓ 250,000 x 0✓ 10,000 x 277,500 x 0xarrow_forward

- Journal entries for an accounts receivable denominated in Swiss Francs ($US strengthens and weakens) Assume that your company sells products to a customer located in Switzerland on November 20. The invoice specifies that payment is to be made on February 20 in Swiss Francs (CHF) in the amount of CHF 250,000. Your company operates on a calendar year basis. Assume the following exchange rates: November 20 $1.12:1CHF December 31 $1.09:1CHF February 20 $1.11:1CHF Prepare the journal entries to record the sale (ignore cost of goods sold), the required adjusting entry at December 31, and the receipt of payment February 20. Date Description Credit 11/20 Accounts receivable Sales 12/31 Foreign currency transaction loss Accounts receivable 2/20 Cash Accounts receivable Accounts receivable → ✓ ✓ ✓ + → ✔ ✓ → Debit 250,000 x 0 ✓ 10,000 * 0✔ 277,500✔ 0✓ 0✔ 0✔ 250,000 * 0✔ 10,000 x 0 ✓ 277,500 * 0 xarrow_forwardUsing the quotes from Exhibit 5.7, calculate the three-month forward cross-exchange rate for EUR/GBP (X.XXXX)arrow_forward1. – Using the following information, determine each one of the theoretical Exchange Rates (E.R.) for December of year 02 according to the Relative PPP Theory. MARKET MARKET E.R. E.R. COUNTRY CURRENCY СРI CPI Dec-01 Dec-02 Dec-01 Dec-02 Mexico МХР 231.89 264.3546 19.56 20.15 Turkey TRY (Lira) 498 527.88 5.9419 6.07673 Australia AUD 989 1038.45 1.7759 1.81183 Japan JPY 678 745.8 105.866 113.978 United Kingdom GBP 905.26 986.7334 0.5991 0.617849 South Korea KRW (Won) 795.4 874.94 1,658.62 1,793.37 Canada CAD 523.12 554.5072 1.3736 1.4942 U.S.A. USD 1.5 1.56arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The Exchange Rate and the Foreign Exchange Market [AP Macroeconomics Explained]; Author: Heimler's History;https://www.youtube.com/watch?v=JsKLBpy6cEc;License: Standard Youtube License