College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 10SPA

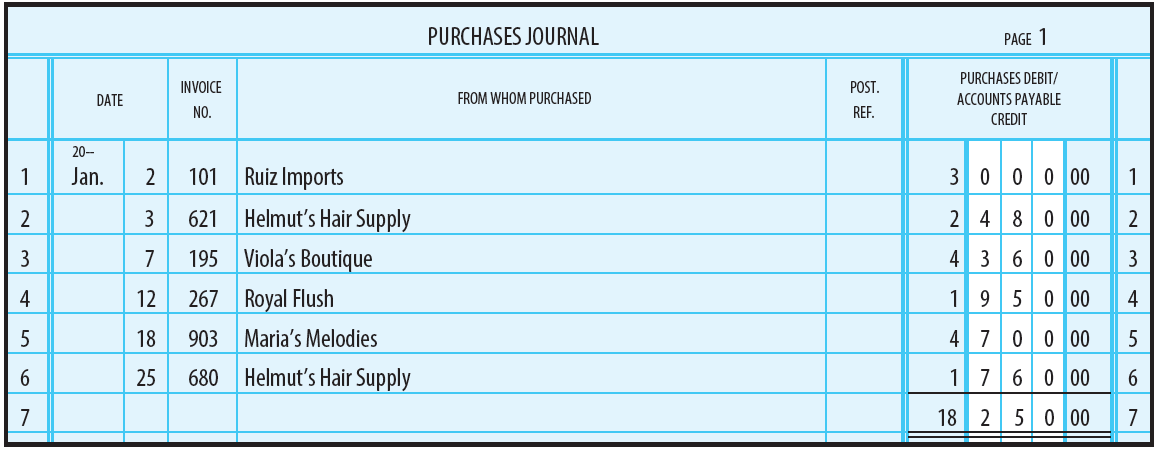

PURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS PAYABLE LEDGER The purchases journal of Kevin’s Kettle, a small retail business, is as follows:

Required

- 1. Post the total of the purchases journal to the appropriate general ledger accounts. Use account numbers as shown in the chapter.

- 2. Post the individual purchase amounts to the accounts payable ledger.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Need help this question

hi expert please help me

What is its accounts receivable turnover for the period?

Chapter 12 Solutions

College Accounting, Chapters 1-27

Ch. 12 - LO1 The types of special journals a business uses...Ch. 12 - Prob. 2TFCh. 12 - Prob. 3TFCh. 12 - Prob. 4TFCh. 12 - LO4 Purchases returns and allowances are recorded...Ch. 12 - The first step in posting the sales journal to the...Ch. 12 - LO3 In the cash receipts journal, each amount in...Ch. 12 - The journal that should be used to record the...Ch. 12 - A purchases journal usually is used to record all...Ch. 12 - In the cash payments journal, each amount in the...

Ch. 12 - Prob. 1CECh. 12 - LO3 Enter the following transactions in a cash...Ch. 12 - LO4 Enter the following transaction in a purchases...Ch. 12 - Enter the following transactions in a cash...Ch. 12 - Prob. 1RQCh. 12 - List four items of information about each sale...Ch. 12 - Prob. 3RQCh. 12 - Prob. 4RQCh. 12 - Prob. 5RQCh. 12 - Prob. 6RQCh. 12 - Prob. 7RQCh. 12 - Prob. 8RQCh. 12 - Prob. 9RQCh. 12 - Prob. 10RQCh. 12 - Prob. 11RQCh. 12 - What steps are followed in posting from the cash...Ch. 12 - What steps are followed in posting from the cash...Ch. 12 - RECORDING TRANSACTIONS IN THE PROPER JOURNAL...Ch. 12 - Prob. 2SEACh. 12 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 12 - JOURNALIZING PURCHASES TRANSACTIONS Enter the...Ch. 12 - Prob. 5SEACh. 12 - SALES JOURNAL Futi Ishanyan owns a retail business...Ch. 12 - Prob. 7SPACh. 12 - Prob. 8SPACh. 12 - PURCHASES JOURNAL J. B. Speck, owner of Specks...Ch. 12 - PURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS...Ch. 12 - Prob. 11SPACh. 12 - PURCHASES JOURNAL, CASH PAYMENTS JOURNAL, AND...Ch. 12 - RECORDING TRANSACTIONS IN THE PROPER JOURNAL...Ch. 12 - Prob. 2SEBCh. 12 - Prob. 3SEBCh. 12 - JOURNALIZING PURCHASES TRANSACTIONS Enter the...Ch. 12 - JOURNALIZING CASH PAYMENTS Sandcastles Northwest...Ch. 12 - SALES JOURNAL T. M. Maxwell owns a retail business...Ch. 12 - Prob. 7SPBCh. 12 - SALES JOURNAL, CASH RECEIPTS JOURNAL, AND GENERAL...Ch. 12 - PURCHASES JOURNAL Ann Benton, owner of Bentons...Ch. 12 - PURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS...Ch. 12 - Prob. 11SPBCh. 12 - PURCHASES JOURNAL, CASH PAYMENTS JOURNAL, AND...Ch. 12 - Prob. 1MYWCh. 12 - Judy Baresford, the store manager of Comfort...Ch. 12 - During the month of October 20--, The Pink Petal...Ch. 12 - Screpcap Co. had the following transactions during...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are annual credit sales ? General accountingarrow_forwardThe next dividend payment by Skippy Inc. will be $3.45. The dividends are anticipated to maintain a growth rate of 4.2% forever. If the stock currently sells for $37.95 per share, what is the required rate of return? Comprehensive Holdings just paid a dividend of $2.95 per share on its stock. The dividends are expected to grow at a constant rate of 4.8% forever. If investors require a return of 12% on the stock, what is the current price? What will be the price in 3 years? In 7 years? Citibank expects to pay a dividend of $2 per share on its common stock at the end of this year. The growth rate of the dividend is 8% for the next 2 years. After that, the dividends are expected to grow at a constant growth rate of 5% per year forever. The required rate of return on the company’s stock is 11%. What is the price of Citibank stock today? A firm pays a current dividend of $3, which is expected to grow at a rate of 4% indefinitely. If the current value of the firm’s shares is $53,…arrow_forwardGeneral accountingarrow_forward

- The stock P/E ratio.??arrow_forwardprovide correct answer mearrow_forwardHyundai Company had beginning raw materials inventory of $29,000. During the period, the company purchased $115,000 of raw materials on account. If the ending balance in raw materials was $18,500, the amount of raw materials transferred to work in process inventory is?arrow_forward

- Computing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019.arrow_forwardcorrect answer pleasearrow_forwardComputing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019. Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY