Corporate Finance

3rd Edition

ISBN: 9780132992473

Author: Jonathan Berk, Peter DeMarzo

Publisher: Prentice Hall

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 10P

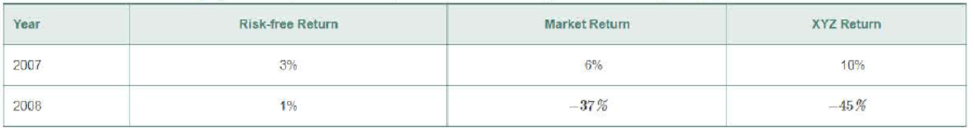

You need to estimate the equity cost or capital for XYZ Corp. You have the following data available regarding past returns:

- a. What was XYZ’s average historical return?

- b. Compute the market’s and XYZ’s excess returns for each year. Estimate XYZ’s beta.

- c. Estimate XYZ’s historical alpha.

- d. Suppose the current risk-free rate is 3%, and you expect the market's return to be 8%. Use the

CAPM to estimate an expected return for XYZ Corp.’s stock. - e. Would you base your estimate of XYZ’s equity cost of capital on your answer in part (a) or in part (d)? How does your answer to part (c) affect your estimate? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a. Given the following holding-period returns,

LOADING...

,

compute the average returns and the standard deviations for the Zemin Corporation and for the market.

b. If Zemin's beta is

1.87

and the risk-free rate is

6

percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.)

c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk?

Month

Zemin Corp.

Market

1

5

%

6

%

2

2

1

3

2

0

4

−4

−1

5

4

3

6

3

4

Assume that you are using the Capital Asset Pricing Model (CAPM) to find the expected return for a share of common stock. Your research shows the following:

Beta = βi = 1.54

Risk free rate = Rf = 2.5% per year

Market return = E(RM) = 6.5% per year

Based on this information, answer the following:

A. Based on the beta, how does the stock's risk compare to the market overall? On what do you base your answer?

B. Based on the beta, how would you expect the stock's returns to react to a decrease in returns in the market overall? Why?

C. According to the CAPM and the information given above, what is the expected return E(Ri) for this stock?

D. If the required rate of return on this stock were 7% per year, would you invest? Why or why not?

The return earned for Asman stock is between time 1 and time 2 is ???

The between time 2 and time 3 is ???

The between time 3 and time 4 is ???

Your investment in Salinas stock yielded an annual rate of return between time 1 and time 2 ???

The between of time 2 and time 3 is ???

The between time 3 and time 4 is ???

Chapter 12 Solutions

Corporate Finance

Ch. 12.1 - According to the CAPM, we can determine the cost...Ch. 12.1 - What inputs do we need to estimate a firms equity...Ch. 12.2 - How do you determine the weight of a stock in the...Ch. 12.2 - Prob. 2CCCh. 12.2 - Prob. 3CCCh. 12.3 - How can you estimate a stocks beta from historical...Ch. 12.3 - How do we define a stocks alpha, and what is its...Ch. 12.4 - Why does the yield to maturity of a firms debt...Ch. 12.4 - Prob. 2CCCh. 12.5 - Prob. 1CC

Ch. 12.5 - Prob. 2CCCh. 12.6 - Why might projects within the same firm have...Ch. 12.6 - Under what conditions can we evaluate a project...Ch. 12.7 - Prob. 1CCCh. 12.7 - Prob. 2CCCh. 12 - Prob. 1PCh. 12 - Suppose the market portfolio has an expected...Ch. 12 - Prob. 3PCh. 12 - Suppose all possible investment opportunities in...Ch. 12 - Using the data in Problem 4, suppose you are...Ch. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Suppose that in place of the SP 500, you wanted to...Ch. 12 - Prob. 9PCh. 12 - You need to estimate the equity cost or capital...Ch. 12 - In mid-2012, Ralston Purina had AA-rated, 10-year...Ch. 12 - Prob. 15PCh. 12 - Prob. 16PCh. 12 - Prob. 17PCh. 12 - Your firm is planning to invest in an automated...Ch. 12 - Prob. 19PCh. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Weston Enterprises is an all-equity firm with two...Ch. 12 - Prob. 24PCh. 12 - Your company operates a steel plant. On average,...Ch. 12 - Prob. 26PCh. 12 - You would like to estimate the weighted average...Ch. 12 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market. b. If Zemin's beta is 0.83 and the risk-free rate is 9 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk? @ 2 a. Given the holding-period returns shown in the table, the average monthly return for the Zemin Corporation is 3%. (Round to two decimal places.) The standard deviation for the Zemin Corporation is 2.74 %. (Round to two decimal places.) Given the…arrow_forwarda. Given the following holding-period returns, (Below)compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.18and the risk-free rate is 4 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk?arrow_forward(Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, LOADING... , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.89 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? Month Sugita Corp. Market 1 2.4 % 1.0 % 2 −0.8 2.0 3 1.0 2.0 4 −1.0 −1.0 5 6.0 7.0 6 6.0…arrow_forward

- Consider an event study of the following stock. Realised return Market return t = 0 (event day) 0.1 0.1 t =1 0.06 0.04 t = 2 0.03 0.02 t = 3 0.015 0.01 Suppose that the estimated market model is . What is the CAR (cumulative abnormal returns) for t = 3?arrow_forwardI need to calculate the cost of equity with the following data: The current appropriate risk-free rate is 6% and the return on the market is 13.5%. levered beta is 1.29. Using the CAPM, estimate DE’s cost of equity. Be sure to state any additional assumptionsarrow_forward(Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.03 and the risk-free rate is 7 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is 2.167 %. (Round to three decimal places.) The standard deviation for the Sugita Corporation is 3.19 %. (Round to two decimal…arrow_forward

- Please help with this question with full working out.arrow_forwardSuppose risk-free rate of return = 2%, market return = 7%, and Stock B’s return = 11%. a. Calculate Stock B’s beta. b. If Stock B’s beta were 0.80, what would be its new rate of return?arrow_forward2 (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market. b. If Zemin's beta is 0.83 and the risk-free rate is 9 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Zemin Corporation is %. (Round to two decimal places.) The standard deviation for the Zemin Corporation is %. (Round to two decimal places.) Given the…arrow_forward

- Suppose that Stock A has a beta of 0.7 and Stock B has a beta of 1.2. Which stock should have a higher actual return next year according to the capital asset pricing model? Please explain briefly.arrow_forwardThe following data have been developed for Ding Corp. State Market Return 1 2 3 4 Probability 0.10 0.30 0.40 0.20 -0.12 0.03 0.10 0.20 Company Return -0.24 0.00 0.15 0.50 Assume that the risk-free rate is 3%. The covariance between Ding and the Market portfolio is 0.018408. Find the required rate of return for Ding Corp using the Capital Asset Pricing Model (CAPM).arrow_forwardSuppose the current risk -free rate of return is 5 percent and the expected market risk premium is 7 percent. Using this information, estimate the cost of retained earnings for a company with a beta coefficient equal to 2.0?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY