Fundamentals of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

9th Edition

ISBN: 9781259722615

Author: Richard A Brealey, Stewart C Myers, Alan J. Marcus Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 6QP

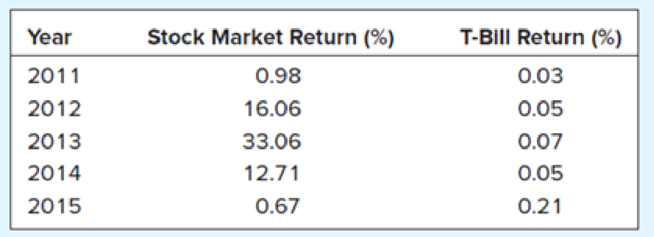

Risk Premiums. Here are

- a. What was the risk premium on common stock in each year?

- b. What was the average risk premium?

- c. What was the standard deviation of the risk premium?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help

Assume these are the stock market and Treasury bill returns for a 5-year period:

Stock Market T-Bill Return

Return (%)

(%)

0.14

Year

2013

34.20

2014

13.90

0.14

2015

-3.80

0.14

2016

14.80

0.09

2017

24.30

0.11

Required:

a. What was the risk premium on common stock in each year?

b. What was the average risk premium?

c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) (Do not round

intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Standard deviation

%

Assume these are the stock market and Treasury bill returns for a 5-year period:

Year

Stock Market Return (%)

T-Bill Return (%)

2016

13.0

0.2

2017

21.0

0.8

2018

-6.2

1.8

2019

29.8

2.1

2020

20.6

0.4

Required:

What was the risk premium on common stock in each year?

What was the average risk premium?

What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)-- expressed in % (NOTE: 11.31% & 13.68% is incorrect)

Chapter 11 Solutions

Fundamentals of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume these are the stock market and Treasury bill returns for a 5-year period: Year Stock Market Return (%) T-Bill Return (%) 2016 13.0 0.2 2017 21.0 0.8 2018 -6.2 1.8 2019 29.8 2.1 2020 20.6 0.4 Required: What was the risk premium on common stock in each year? What was the average risk premium? What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: ITT Stock Market T-Bill Return Year Return (%) (%) 2013 33.70 0.13 2014 13.30 0.13 2015 -3.60 0.13 2016 14.70 0.08 2017 24.20 0.10 Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. Required A Required B Required C What was the risk premium on common stock in each year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Year Risk Premium 2013 % 2014 % 2015 % 2016 2017 %arrow_forwardI need help with Carrow_forward

- Assume these are the stock market and Treasury bill returns for a 5-year period: T-Bill Return Year Stock Market Return (8) (8) 2016 32.50 0.07 2017 11.80 0.07 2018 -2.40 0.07 2019 13.70 0.25 2020 22.40 0.27 Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. Required A Required B Required C What was the risk premium on common stock in each year? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Negative values should be entered with a negative sign.. Year Risk Premium 2016 % 2017 % 2018 % 2019 % 2020 %arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Stock Market T-Bill Year Return (%) Return (%) 2013 31.7 0.02 2014 10.9 0.02 2015 -1.6 0.02 2016 13.0 0.20 2017 21.3 0.80 Required: a. What was the risk premium on common stock in each year? (Negative values should be entered with a negative sign.) b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) es Complete this question by entering your answers in the tabs below. Required A Required B Required C What was the risk premium on common stock in each vear? (Do not round intermediate calculations. Enter vour answers as e to searcharrow_forwardneed answer in step by steparrow_forward

- Assume these are the stock market and Treasury bill returns for a 5-year period: Year 2016 2017 2018 2019 2020 Stock Market Return (%) 33.30 13.20 -3.50 14.50 23.80 Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) 3 Required A Required B T-Bill Return Complete this question by entering your answers in the tabs below. Standard deviation (%) 0.12 0.12 0.12 0.07 0.09 x Answer is complete but not entirely correct. Required C What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. 13.69 X % घarrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Year 2013 Stock Market Return () 31.7 T-Bill Return () 0.02 0.02 2014 2015 2016 10.9 -1.6 13.0 21.3 0.02 0.20 0.80 2017 Required: a. What was the risk premium on common stock in each year? (Negative values should be entered with a negative sign.) b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. Required A Required B Required C What was the average risk premium? (Do not round intermediate calculations. Enter vour answer as a percent rounded to 2 a o searcharrow_forwardSubject:- financearrow_forward

- Risk Premiums. Here are rates of return on a broad stock market index and on Treasury bills between 2013 and 2017: (LO11-1) 6. Year Stock Market Return (%) T-Bill Return (%) 2013 31.7% 0.02% 2014 10.9 0.02 2015 -1.6 0.02 2016 13.0 0.20 2017 21.3 0.80 a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? ear, it pays a divi-arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period in the attached image: A. What was the risk premium on common stock in each year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Risk Premium 2013 % 2014 % 2015 % 2016 % 2017 % b. What was the average risk premium? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardBhupatbhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY