1.

Calculate the cash payback period for the given proposals.

1.

Explanation of Solution

Cash payback method:

Cash payback period is the expected time period which is required to recover the cost of investment. It is one of the capital investment method used by the management to evaluate the long-term investment (fixed assets) of the business.

The cash payback period for the given proposals is as follows:

Proposal A:

Initial investment=$680,000

| Cash payback period of Proposal A | ||||

| Year | Net | Cumulative net cash flows | ||

| 1 | 200,000 | 200,000 | ||

| 2 | 200,000 | 400,000 | ||

| 3 | 200,000 | 600,000 | ||

| 6 months (1) | 80,000 | 680,000 | ||

Table (1)

Hence, the cash payback period of proposal A is 3 years and 6 months.

Working note:

1. Calculate the no. of months in the cash payback period:

Proposal B:

Initial investment=$320,000

| Cash payback period of Proposal B | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 90,000 | 90,000 | ||

| 2 | 90,000 | 180,000 | ||

| 3 | 70,000 | 250,000 | ||

| 4 | 70,000 | 320,000 | ||

Table (2)

Hence, the cash payback period of proposal B is 4 years.

Proposal C:

Initial investment=$108,000

| Cash payback period of Proposal C | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 55,000 | 55,000 | ||

| 2 | 53,000 | 108,000 | ||

Table (3)

Hence, the cash payback period of proposal C is 2 years.

Proposal D:

Initial investment=$400,000

| Cash payback period of Proposal D | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 180,000 | 180,000 | ||

| 2 | 180,000 | 360,000 | ||

| 3 months (2) | 40,000 | 400,000 | ||

Table (4)

Hence, the cash payback period of proposal D is 2 years and 3 months.

Working note:

2. Calculate the no. of months in the cash payback period:

2.

Calculate the average

2.

Explanation of Solution

Average rate of return method:

Average rate of return is the amount of income which is earned over the life of the investment. It is used to measure the average income as a percent of the average investment of the business, and it is also known as the accounting rate of return.

The average rate of return is computed as follows:

The average rate of return for the given proposals is as follows:

Proposal A:

Hence, the average rate of return for Proposal A is 14.1%.

Proposal B:

Hence, the average rate of return for Proposal B is 2.5%.

Proposal C:

Hence, the average rate of return for Proposal C is 52.6%.

Proposal D:

Hence, the average rate of return for Proposal D is 30.0%.

3.

Indicate the proposals which should be accepted for further analysis, and which should be rejected.

3.

Explanation of Solution

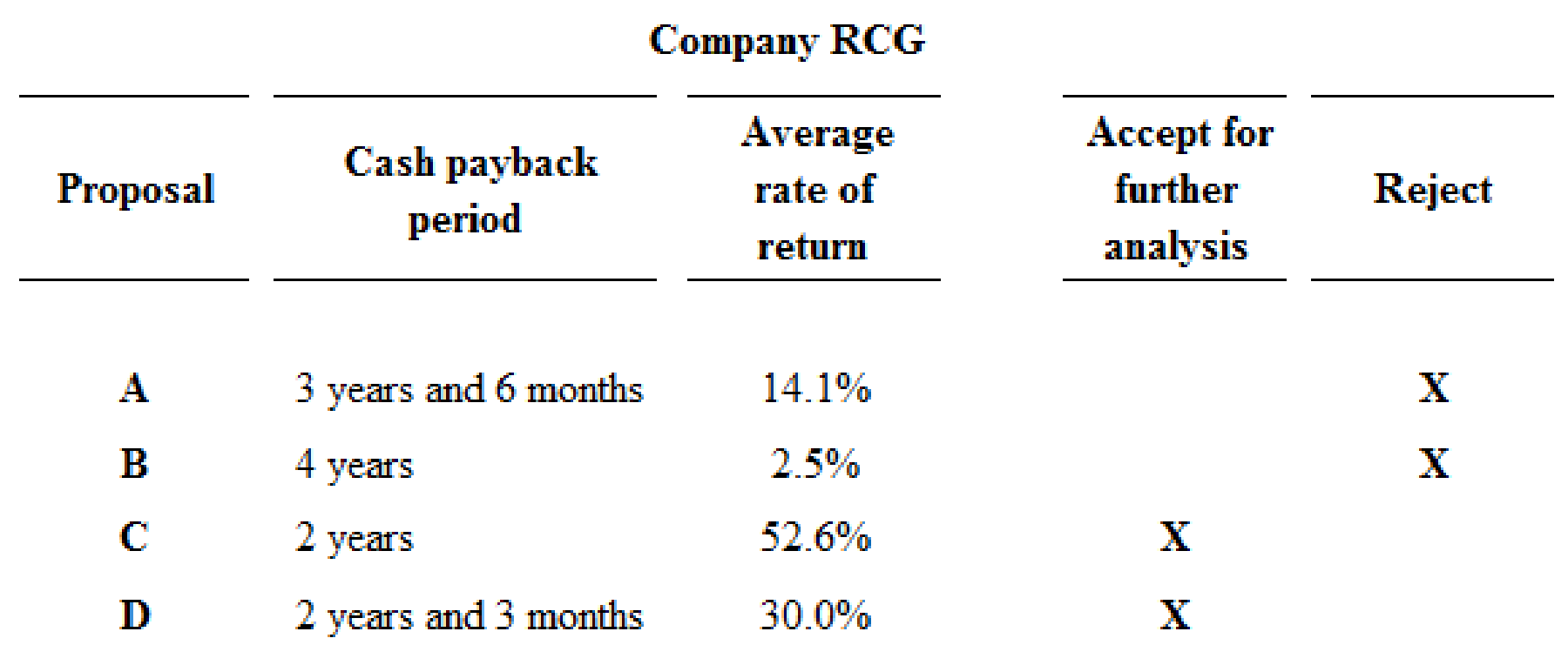

The proposals which should be accepted for further analysis, and which should be rejected is as follows:

Figure (1)

Proposals A and B are rejected, because proposal A and B fails to meet the required maximum cash back period of 3 years, and they has less rate of return than the other proposals. Hence, Proposals C and D are preferable.

4.

Calculate the

4.

Explanation of Solution

Net present value method:

Net present value method is the method which is used to compare the initial

Calculate the net present value of the proposals which has 12% rate of return as follows:

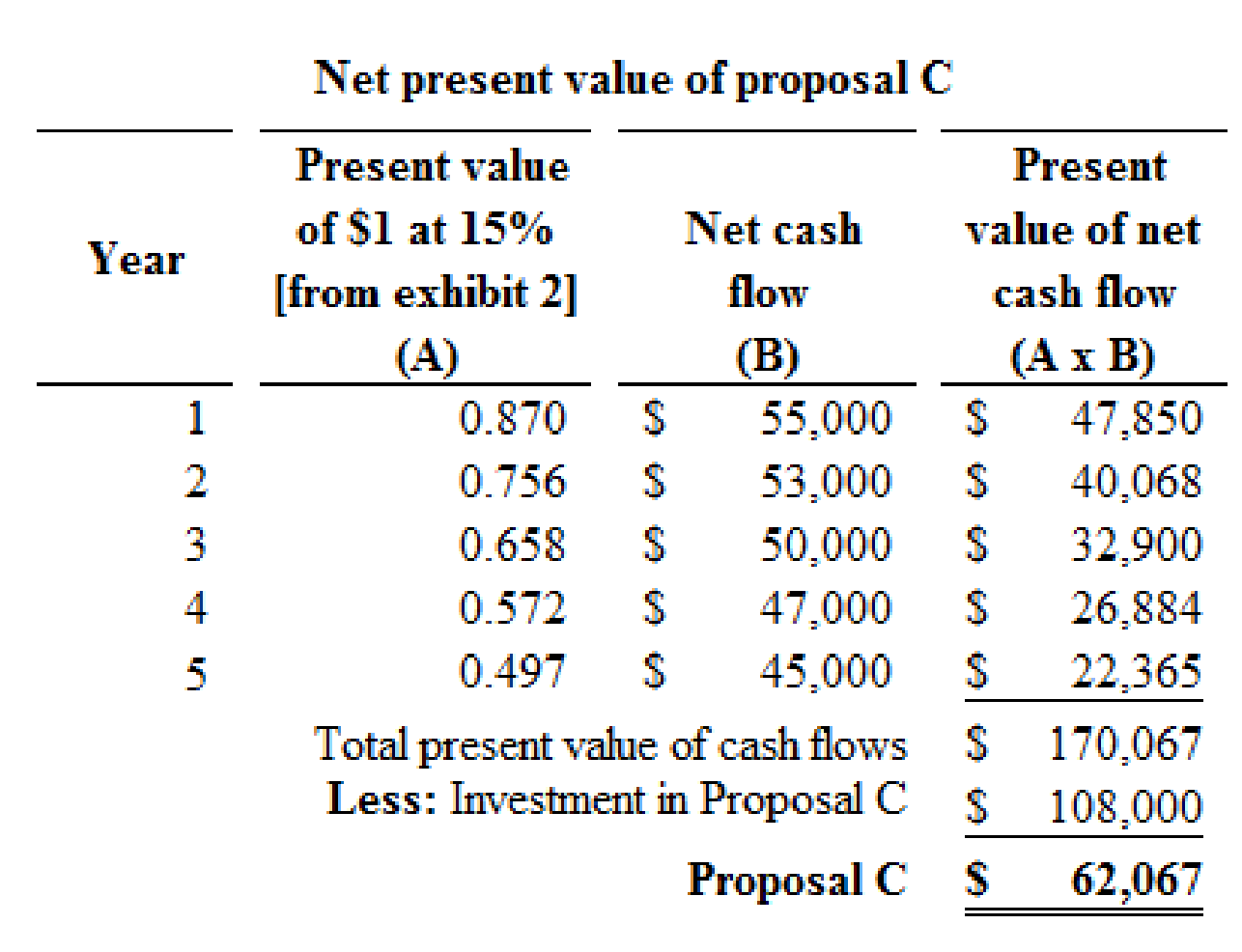

Proposal C:

Figure (2)

Hence, the net present value of proposal C is $62,067.

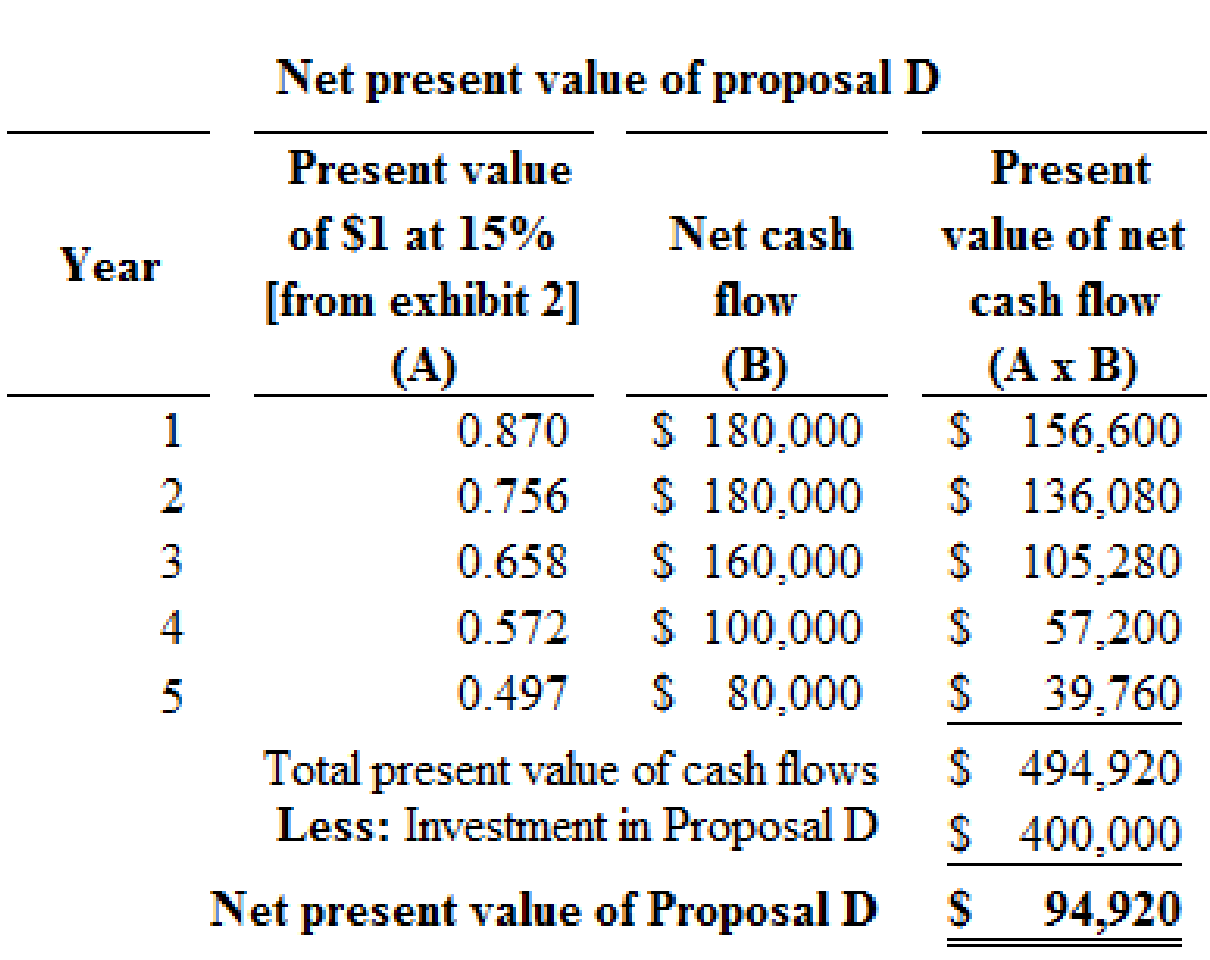

Proposal D:

Figure (3)

Hence, the net present value of proposal D is $94,920.

5.

Calculate the present value index for each proposal.

5.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index for each proposal is as follows:

Proposal C:

Calculate the present value index for proposal C:

Hence, the present value index for proposal C is 1.575.

Proposal D:

Calculate the present value index for proposal D:

Hence, the present value index for proposal D is 1.237.

6.

Rank the proposal from most attractive to least attractive, based on the present value of net cash flows.

6.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

Proposals are arranged by rank is as follows:

| Proposals | Net present value | Rank |

| Proposal D | $ 94,920 | 1 |

| Proposal C | $ 62,067 | 2 |

Table (5)

7.

Rank the proposal from most attractive to least attractive, based on the present value of index.

7.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

Proposals are arranged by rank is as follows:

| Proposals | Present value index | Rank |

| Proposal C | 1.57 | 1 |

| Proposal D | 1.24 | 2 |

Table (6)

8.

Analyze the proposal which is favor to investment, and comment on the relative attractiveness of the proposals based on the rank.

8.

Explanation of Solution

On the basis of net present value:

The net present value of Proposal C is $62,067, and Proposal D is $94,920. In this case, the net present value of proposal D is more than the net present value of proposal C. Hence, investment in Proposal D is preferable.

On the basis of present value index:

The present value index of Proposal C is 1.57, and the present value index of Proposal D is 1.24. In this case, Proposal C has the favorable present value index, because the present value index of Proposal C (1.57) is more than Proposal D (1.24). Thus, the investment in Proposal C is preferable (favorable).

Every business tries to get maximum profit with minimum investment. Hence, the cost of investment in Proposal C is less than the proposal D. Thus, investment in Proposal C is preferable.

Want to see more full solutions like this?

Chapter 11 Solutions

Managerial Accounting

- Answer this Accounting questionarrow_forwardcomplete the following ttable attached - the main items listed should be , Balance , service cost , interest expense , interest revenue , contributions , benefits , asset loss/gain , liability loss / gain , Journal entry , accumulated OCI , then ending balance . The info for the question is - FlagStaff Ltd has a defined benefit pension plan for its employees. The company is considering introducing a defined benefit contribution plan, which will be available to all incoming staff. Although the defined benefit plan is now closed to new staff, the fund is active for all employees who have tenure with the company. In 2020, the following actuarial report was received for the defined benefit plan: 2020/$ Present value of the defined benefit obligation 31 December 2019 18 000 000 Past Service Cost 4 000 000 Net interest ? Current service cost 600 000 Benefits paid 2 000 000 Actuarial gain/loss on DBO ? Present value of the defined benefit obligation 31 December 2020 21 000 000…arrow_forwardA business manufactures a product with variable costs of $3.20 per unit. The product is sold for $6.40 per unit. The business has fixed costs of $4,500 and aims for a profit of $12,500. The sales level in units required to achieve the desired profit is _ units.arrow_forward

- Wilcox Vehicle Inspections specializes in inspecting commercial trucks that have been returned to leasing companies at the end of their contracts. Wilcox's charge per inspection is $75, and its average cost per inspection is $20. The owner wants to expand the business by hiring another employee and acquiring additional inspection equipment. The fixed costs for the new employee and equipment would be $4,500 per month. Required: How many inspections per month would the new employee have to perform to earn a profit of $2,000? Helparrow_forwardCorrect answerarrow_forwardAccounting solnarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College