Concept explainers

Entries for payroll transactions

MLS Company has five employees, each of whom earns $1,600 per month and is paid on the last day of each month. All five have been employed continuously at this amount since January 1. On June 1, the following accounts and balances exist in its general ledger:

- a. FICA—Social Security Taxes Payable, $992; FICA—Medicare Taxes Payable, $232. (The balances of these accounts represent total liabilities for both the employer’s and employees’ FICA taxes for the May payroll only.)

- b. Employees’ Federal Income Taxes Payable, $1,050 (liability for May only).

- c. Federal

Unemployment Taxes Payable, $66 (liability for April and May together). - d. State Unemployment Taxes Payable, $440 (liability for April and May together).

During June and July, the company had the following payroll transactions.

| June 15 | Issued check payable to Security Bank, a federal depository bank authorized to accept employers’ payments of FICA taxes and employee income tax withholdings. The $2,274 check is in payment of the May FICA and employee income taxes. |

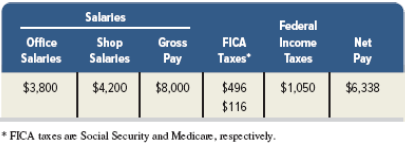

| 30 | Recorded the

|

| 30 | Recorded the employer’s payroll taxes resulting from the June payroll. The company has a merit rating that reduces its state unemployment tax rate to 4.0% of the first $7,000 paid each employee. The federal rate is 0.6%. Check June 30: Dr. Payroll Taxes Expenses, $612 |

| July 15 | Issued check payable to Security Bank in payment of the June FICA and employee income taxes July 15: Cr. Cash, $2,274 (Security Bank) |

| 15 | Issued check to the State Tax Commission for the April, May, and June state unemployment taxes. Filed the check and the second-quarter tax return with the State Tax Commission. |

| 31 | Issued check payable to Security Bank in payment of the employer’s FUTA taxes for the first quarter of the year. |

| 31 | Filed Form 941 with the IRS, reporting the FICA taxes and the employees’ federal income tax withholdings for the second quarter. |

Required

Prepare journal entries to record the transactions and events for both June and July.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Principles of Financial Accounting.

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning