Principles of Financial Accounting.

24th Edition

ISBN: 9781260158625

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 5BTN

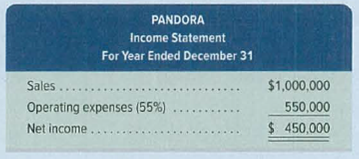

Review the chapter’s opening feature about Tim Westergren and the business he founded, Pandora. Assume that he is considering expanding the business to Europe and that the current abbreviated income statement appears as follows.

Assume also that the company currently has no interest-bearing debt. If it expands to Europe, it will require a $300,000 loan. The company has found a bank that will loan it the money on a 7% note payable. The company believes that, at least for the first few years, sales in Europe will equal $250,000 and that all expenses at both locations will continue to equal 55% of sales.

Required

- 1. Prepare an income statement (showing three separate columns for current operations, European, and total) for the company assuming that it borrows the funds and expands to Europe. Annual revenues for current operations are expected to remain at $1,000,000.

- 2. Compute the company’s times interest earned under the expansion assumptions in part 1.

- 3. Assume sales in Europe are $400,000. Prepare an income statement (with columns for current operations, European, and total) for the company and compute times interest earned.

- 4. Assume sales in Europe are $100,000. Prepare an income statement (with columns for current operations, European, and total) for the company and compute times interest earned.

- 5. Comment on your results from parts 1 through 4.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you explain this financial accounting question using accurate calculation methods?

I am looking for help with this financial accounting question using proper accounting standards.

I am looking for help with this general accounting question using proper accounting standards.

Chapter 11 Solutions

Principles of Financial Accounting.

Ch. 11 - On December 1, a company signed a 6,000, 90-day,...Ch. 11 - Prob. 2MCQCh. 11 - Prob. 3MCQCh. 11 - Prob. 4MCQCh. 11 - Prob. 5MCQCh. 11 - Prob. 1DQCh. 11 - Prob. 2DQCh. 11 - What are the three important questions concerning...Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQ

Ch. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - Prob. 9DQCh. 11 - Prob. 10DQCh. 11 - Prob. 11DQCh. 11 - What amount of income tax is withheld from the...Ch. 11 - Prob. 13DQCh. 11 - Prob. 14DQCh. 11 - Prob. 15DQCh. 11 - Refer to Samsungs recent balance sheet in Appendix...Ch. 11 - Which of the following items are normally...Ch. 11 - Prob. 2QSCh. 11 - Prob. 3QSCh. 11 - Prob. 4QSCh. 11 - Prob. 5QSCh. 11 - Prob. 6QSCh. 11 - Prob. 7QSCh. 11 - Prob. 8QSCh. 11 - Prob. 9QSCh. 11 - Prob. 10QSCh. 11 - Prob. 11QSCh. 11 - Prob. 12QSCh. 11 - Prob. 13QSCh. 11 - Prob. 14QSCh. 11 - Prob. 15QSCh. 11 - Prob. 1ECh. 11 - Prob. 2ECh. 11 - Prob. 3ECh. 11 - Prob. 4ECh. 11 - Prob. 5ECh. 11 - Prob. 6ECh. 11 - Prob. 7ECh. 11 - Prob. 8ECh. 11 - Prob. 9ECh. 11 - Prob. 10ECh. 11 - Prob. 11ECh. 11 - Prob. 12ECh. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Prob. 17ECh. 11 - Prob. 18ECh. 11 - Prob. 19ECh. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Prob. 3APCh. 11 - Prob. 4APCh. 11 - Shown here are condensed income statements for two...Ch. 11 - Prob. 6APCh. 11 - Prob. 1BPCh. 11 - Prob. 2BPCh. 11 - Prob. 3BPCh. 11 - Prob. 4BPCh. 11 - Prob. 5BPCh. 11 - Entries for payroll transactions MLS Company has...Ch. 11 - Prob. 11SPCh. 11 - Prob. 1AACh. 11 - Prob. 2AACh. 11 - Prob. 3AACh. 11 - Beyond the Numbers Cameron Bly is a sales manager...Ch. 11 - Prob. 2BTNCh. 11 - Review the chapters opening feature about Tim...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardI am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forward

- Can you solve this financial accounting problem with appropriate steps and explanations?arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Liquidity Risk (FRM Part 2 – Book 4 – Chapter 1); Author: AnalystPrep;https://www.youtube.com/watch?v=TguAvyxM6vg;License: Standard Youtube License