Concept explainers

Payroll accounts and year-end entries

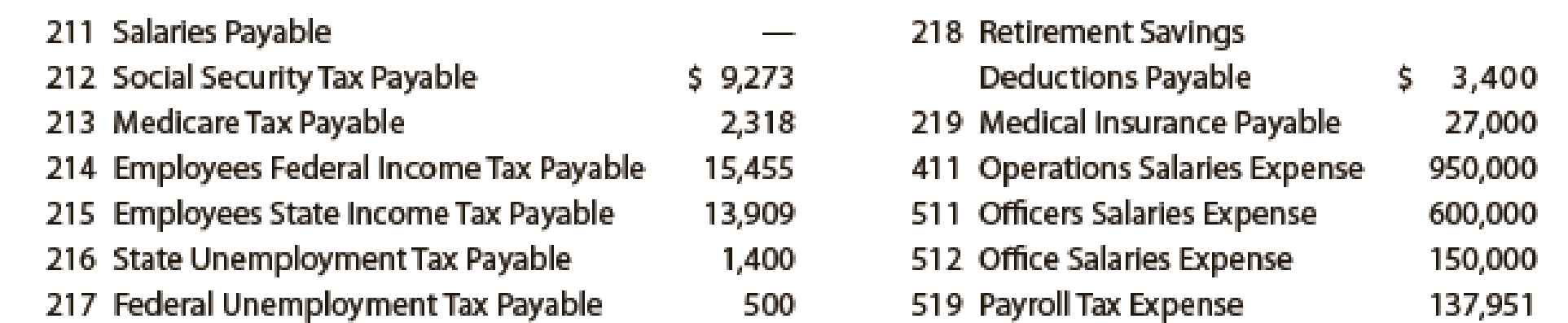

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December:

Dec. 2. Issued Check No. 410 for $3,400 to Jay Bank to invest in a retirement savings account for employees.

2. Issued Check No. 411 to Jay Bank for $27,046, in payment of $9,273 of social security tax, $2,318 of Medicare tax, and $15,455 of employees’ federal income tax due.

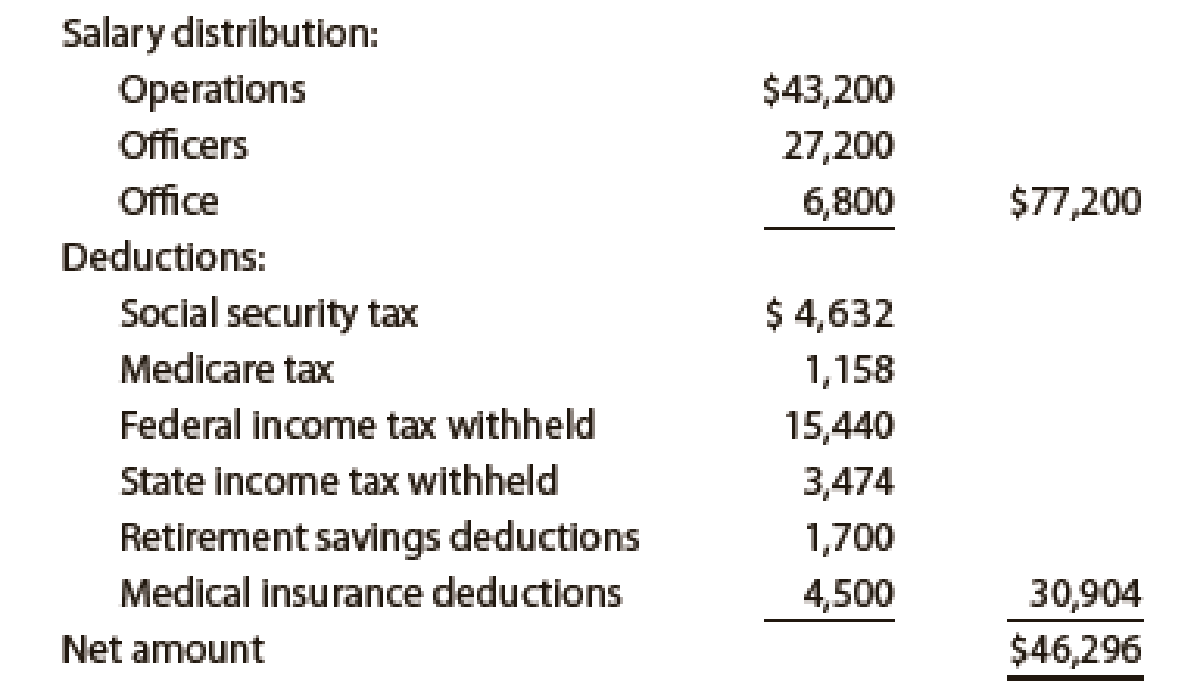

13.

Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account.

13. Journalized the entry to record payroll taxes on employees’ earnings of December13: social security tax, $4,632; Medicare tax, $1,158; state

16. Issued Check No. 424 to Jay Bank for $27,020, in payment of $9,264 of social security tax, $2,316 of Medicare tax, and $15,440 of employees’ federal income tax due.

19. Issued Check No. 429 to Sims-Walker Insurance Company for $31,500, in payment of the semiannual premium on the group medical insurance policy.

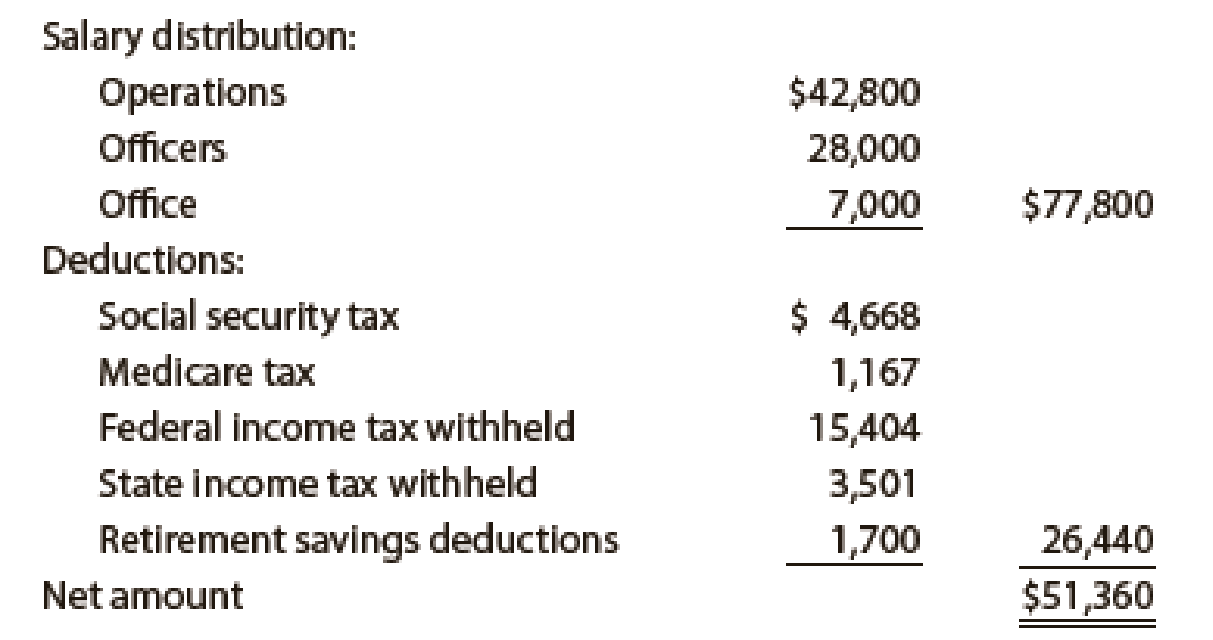

27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account.

27. Journalized the entry to record payroll taxes on employees’ earnings of December27: social security tax, $4,668; Medicare tax, $1,167; state unemployment tax, $225; federal unemployment tax, $75.

27. Issued Check No. 543 for $20,884 to State Department of Revenue in payment of employees’ state income tax due on December 31.

31. Issued Check No. 545 to Jay Bank for $3,400 to invest in a retirement savings account for employees.

31. Paid $45,000 to the employee pension plan. The annual pension cost is $60,000. (Record both the payment and unfunded pension liability.)

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries,$1,400. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $15,000.

Trending nowThis is a popular solution!

Chapter 11 Solutions

Financial Accounting

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning