Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 23E

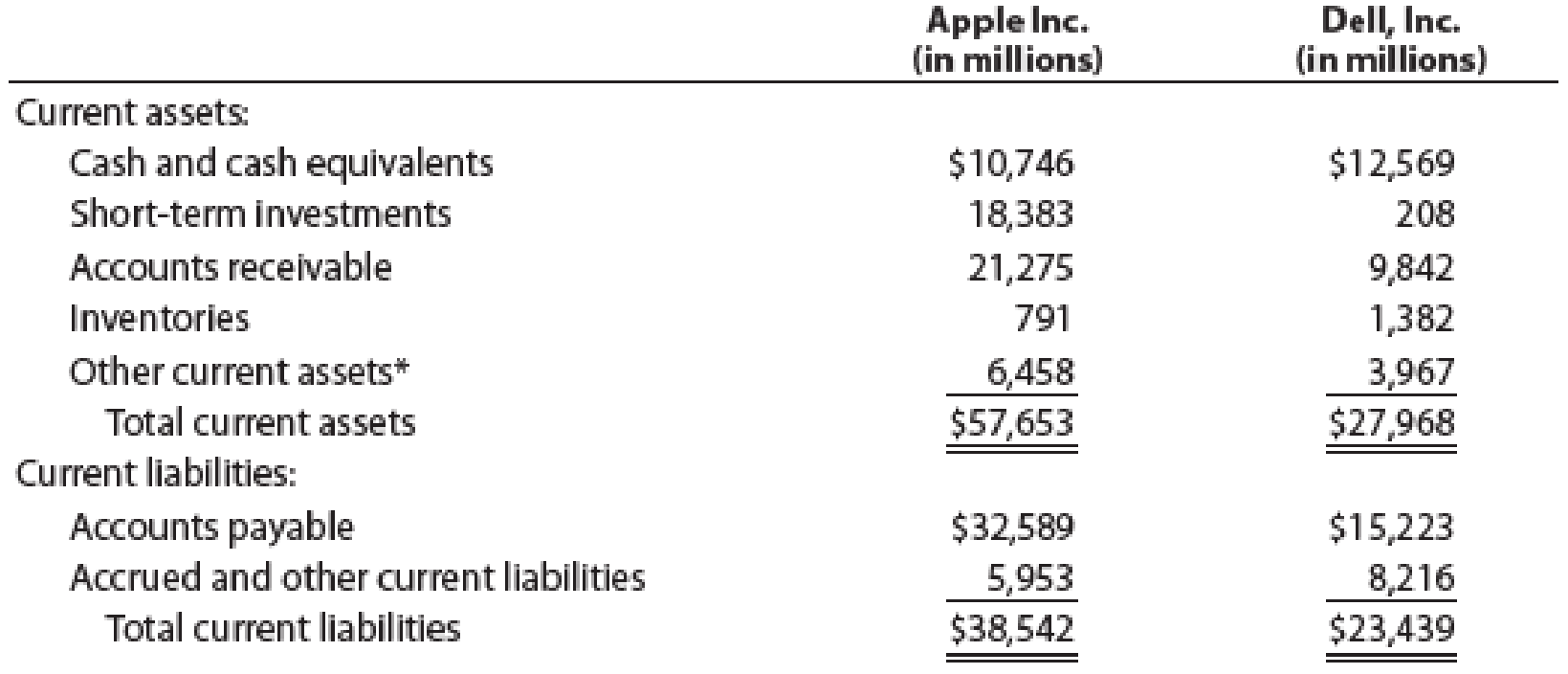

The current assets and current liabilities for Apple Inc. and Dell, Inc., are as follows at the end of a recent fiscal period:

*These represent prepaid expense and other nonquick current assets.

- a. Determine the quick ratio for both companies. (Round to one decimal place.)

- b. Interpret the quick ratio difference between the two companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the answer to this general accounting question using the right approach.

Jennifer Industries allocates overhead based on direct labor costs. Assume Jennifer expects to incur a total of $875,000 in overhead costs and $625,000 in direct labor costs. Actual overhead costs incurred totaled $890,000, and actual direct labor costs totaled $640,000. Jennifer's predetermined overhead rate is: a. 140.00% of direct labor cost. b. 128.13% of direct labor cost. c. 138.90% of direct labor cost. d. 130.95% of direct labor cost.

Please explain the accurate process for solving this financial accounting question with proper principles.

Chapter 11 Solutions

Financial Accounting

Ch. 11 - Does a discounted note payable provide credit...Ch. 11 - Employees are subject to taxes withheld from their...Ch. 11 - Prob. 3DQCh. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - When should the liability associated with a...Ch. 11 - Prob. 10DQ

Ch. 11 - On October 12, Belleville Co. borrowed cash from...Ch. 11 - Proceeds from notes payable On January 26, Nyree...Ch. 11 - Prob. 2PEACh. 11 - Prob. 2PEBCh. 11 - Prob. 3PEACh. 11 - Prob. 3PEBCh. 11 - The payroll register of Konrath Co. indicates...Ch. 11 - Journalize period payroll The payroll register of...Ch. 11 - Prob. 5PEACh. 11 - Prob. 5PEBCh. 11 - Prob. 6PEACh. 11 - Prob. 6PEBCh. 11 - Prob. 7PEACh. 11 - Prob. 7PEBCh. 11 - Quick ratio Nabors Company reported the following...Ch. 11 - Quick ratio Adieu Company reported the following...Ch. 11 - Bon Nebo Co. sold 25,000 annual subscriptions of...Ch. 11 - Entries for notes payable Cosimo Enterprises...Ch. 11 - Evaluating alternative notes A borrower has two...Ch. 11 - Entries for notes payable A business issued a...Ch. 11 - A business issued a 60-day note for 75,000 to a...Ch. 11 - On June 30, Collins Management Company purchased...Ch. 11 - Prob. 7ECh. 11 - Prob. 8ECh. 11 - Prob. 9ECh. 11 - Summary payroll data In the following summary of...Ch. 11 - Prob. 11ECh. 11 - The payroll register for Proctor Company for the...Ch. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Prob. 15ECh. 11 - A business provides its employees with varying...Ch. 11 - Prob. 17ECh. 11 - Prob. 18ECh. 11 - Prob. 19ECh. 11 - Accrued product warranty General Motors...Ch. 11 - Prob. 21ECh. 11 - Quick ratio Gmeiner Co. had the following current...Ch. 11 - The current assets and current liabilities for...Ch. 11 - The following items were selected from among the...Ch. 11 - The following information about the payroll for...Ch. 11 - Prob. 3PACh. 11 - Prob. 4PACh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 1PBCh. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Jocame Inc. began business on January 2, 2015....Ch. 11 - Prob. 4PBCh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 3CPPCh. 11 - Tonya Latirno is a certified public accountant...Ch. 11 - Recognizing pension expense The annual examination...Ch. 11 - Prob. 3CPCh. 11 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License