Tonya Jefferson (single), a sole proprietor, runs a successful lobbying business in Washington, DC. She doesn’t sell many business assets, but she is planning on retiring and selling her historic townhouse, from which she runs her business, to buy a place somewhere sunny and warm. Tonya’s townhouse is worth $1,000,000 and the land is worth another $1,000,000. The original basis in the townhouse was $600,000, and she has claimed $250,000 of

- a) What amount of gain or loss does Tonya recognize on the sale? What is the character of the gain or loss? What effect does the gain or loss have on her tax liability?

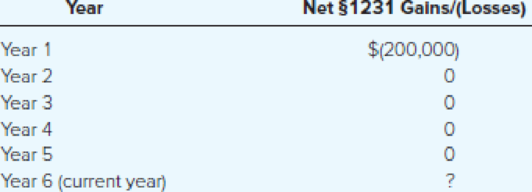

- b) In addition to the original facts, assume that Tonya reports the following nonrecaptured net §1231 loss:

What amount of gain or loss does Tonya recognize on the sale? What is the character of the gain or loss? What effect does the gain or loss have on her year 6 (the current year) tax liability?

- c) As Tonya’s tax adviser, you suggest that Tonya sell the townhouse in year 7 in order to reduce her taxes. What amount of gain or loss does Tonya recognize on the sale in year 7?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Loose Leaf for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT