Concept explainers

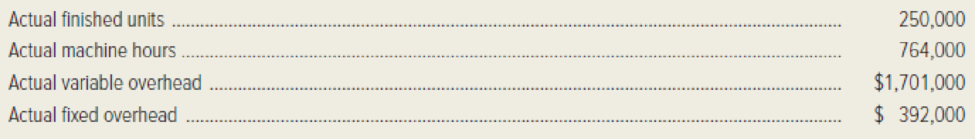

Montreal Scholastic Supply Company uses a standard-costing system. The firm estimates that it will operate its manufacturing facilities at 800,000 machine hours for the year. The estimate for total budgeted

Required:

- 1. Compute the following variances. Indicate whether each is favorable or unfavorable, where appropriate.

- a. Variable-overhead spending variance.

- b. Variable-overhead efficiency variance.

- c. Fixed-overhead

budget variance . - d. Fixed-overhead volume variance.

- 2. Prepare

journal entries to- Record the incurrence of actual variable overhead and actual fixed overhead.

- Add variable and fixed overhead to Work-in-Process Inventory.

- Close underapplied or overapplied overhead into Cost of Goods Sold.

1.

Calculate the given variances and indicate whether it is favorable or unfavorable of Company M.

Explanation of Solution

Flexible Budget: A flexible budget is a budget that is prepared for different levels of the output. In other words, it is a budget that adjusts according to the changes in the volume of the activity. The main purpose of preparing flexible budget is to determine the differences among standard and actual result.

Variance: Variance refers to the difference level in the actual cost incurred and standard cost. The total cost variance is subdivided into separate cost variances; this cost variance indicates that the amount of variance that is attributable to specific casual factors.

Calculate the given variances and indicate whether it is favorable or unfavorable of Company M as follows:

a. Variable overhead spending variance:

b. Variable overhead efficiency variance:

c. Fixed overhead budget variance:

d. Fixed overhead volume variance:

Working note (1):

Calculate the standard hour per unit.

Working note (2):

Calculate the standard hours for variable variance.

Working note (3):

Calculate the budgeted fixed overhead.

Working note (4):

Calculate the standard allowed hours.

2.

Prepare journal entries of company M for the given transaction.

Explanation of Solution

Prepare journal entry to record the actual variable and fixed overhead costs:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Production overhead (5) | 2,093,000 | ||

| Various Accounts | 2,093,000 | ||

| (To record the actual overhead costs) |

Table (1)

- Production overhead is an asset account and it increases the value of assets. Hence, debit the production overhead account with $2,093,000.

- A various account is an asset account, and it decreases the value of assets. Hence, credit the various account with $2,093,000.

Working note (5):

Calculate the production overheads.

Prepare journal entry to record the work-in-process inventory:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (6) | 1,875,000 | ||

| Production overhead | 1,875,000 | ||

| (To record the applied production overhead) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $1,875,000.

- Production overhead is an assets account and it decreases the value of assets. Hence, credit the production overhead account with $1,875,000.

Working note (6):

Calculate the work-in process inventory.

Prepare journal entry to record the cost of goods sold:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Cost of goods sold (6) | 218,000 | ||

| Production Overhead | 218,000 | ||

| (To close the under-applied overhead cost into cost of goods sold) |

Table (3)

- Cost of goods sold is an expense account and it decreases the value of stockholder’s equity. Hence, debit the cost of goods sold account with $218,000.

- Production overhead is an assets account and it decreases the value of assets. Hence, credit the production overhead account with $218,000.

Working note (7):

Calculate the under applied overhead cost.

Want to see more full solutions like this?

Chapter 11 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,