Concept explainers

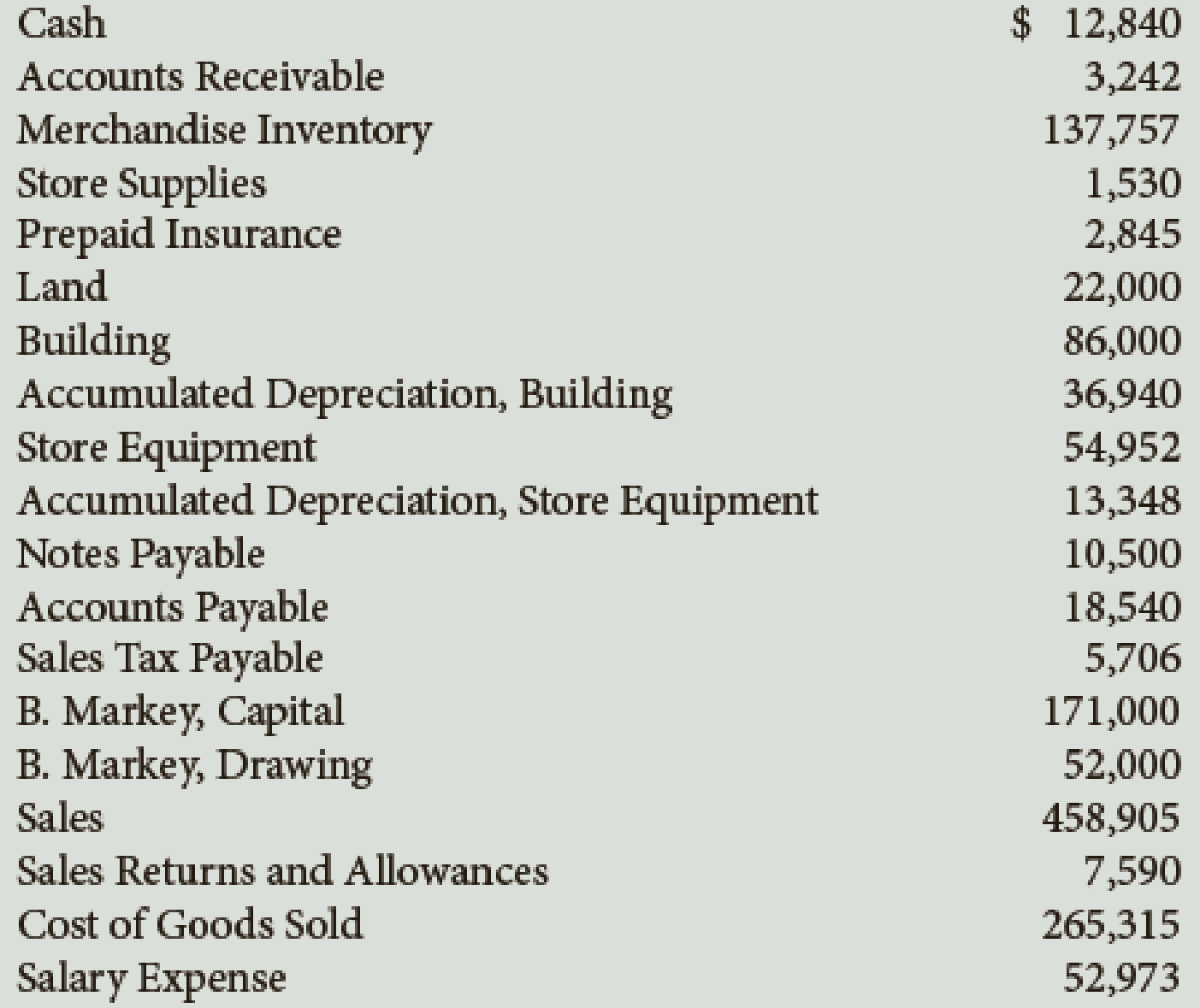

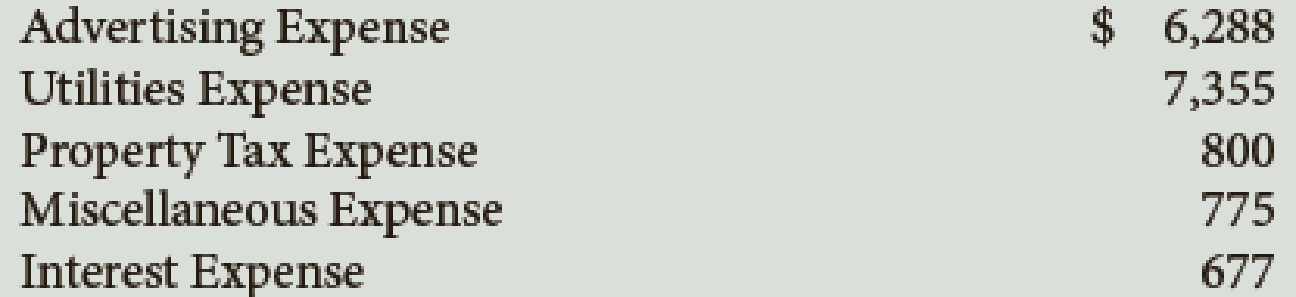

The accounts and their balances in the ledger of Markey’s Mountain Shop as of December 31, the end of its fiscal year, are as follows:

Data for the adjustments are as follows. Assume that Markey’s Mountain Shop uses the perpetual inventory system.

a. Merchandise Inventory at December 31, $140,357.

b. Store supplies inventory (on hand) at December 31, $540.

c.

d. Depreciation of store equipment, $3,800.

e. Salaries accrued at December 31, $1,250.

f. Insurance expired during the year, $1,480.

Required

- 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL.

- 2. Journalize the

adjusting entries . If using manual working papers, record adjusting entries on journal page 63.

Trending nowThis is a popular solution!

Chapter 11 Solutions

College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

Engineering Economy (17th Edition)

- 25.arrow_forwardAnswer this financial accounting problemarrow_forwardDuring FY 2022 Munjya Manufacturing had total manufacturing costs are $408,000. Their cost of goods manufactured for the year was $431,000. The January 1, 2023 balance of the Work-in-Process Inventory is $42,000. Use this information to determine the dollar amount of the FY 2022 beginning Work-in-Process Inventory.arrow_forward

- Question 5 Marks: BigBoss Inc. provides the following extracts from income statement for the year 2009: Net sales $500,000, Cost of Goods Sold (150,000), Gross profit $350,000, Calculate the gross profit percentage.arrow_forwardThe ROA for 2020 was?arrow_forwardPROVIDE ANSWER: On June 30, 2009, Straight Movers had $243,000 in current assets and $211,000 in current liabilities. On August 1, 2009, Straight received $50,000 from an issue of promissory notes that will mature in 2012. The notes pay interest on February 1 at an annual rate of 6 percent. Straights' fiscal year ends on December 31. What is the interest expense for December 31?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage