Concept explainers

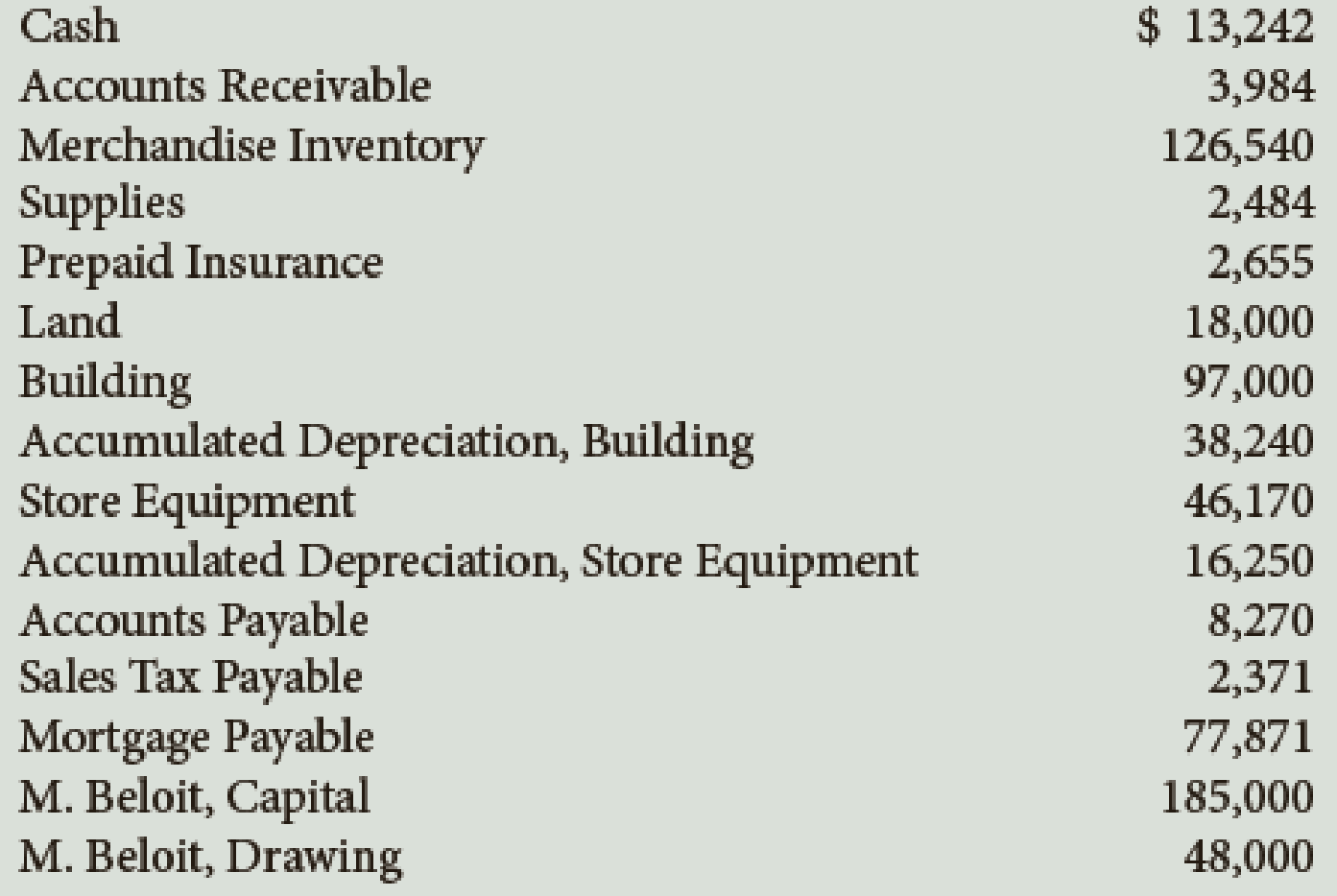

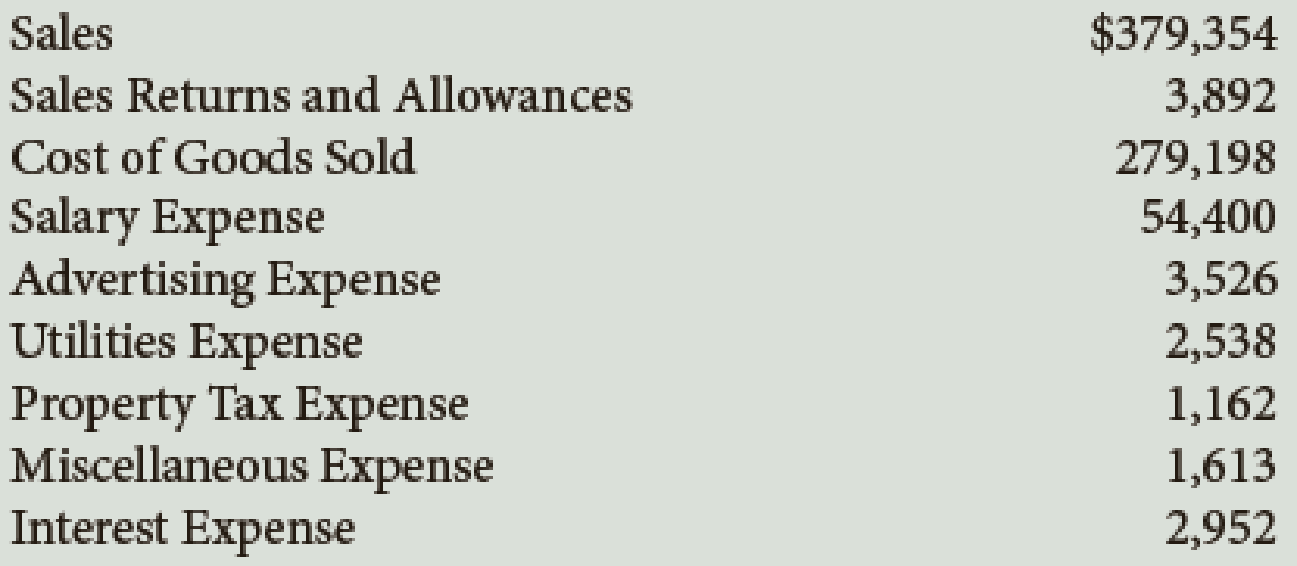

Here are the accounts in the ledger of Misha’s Jewel Box, with the balances as of December 31, the end of its fiscal year.

Here are the data for the adjustments. Assume that Misha’s Jewel Box uses the perpetual inventory system.

a. Merchandise Inventory at December 31, $124,630.

b. Insurance expired during the year, $1,294.

c.

d. Depreciation of store equipment, $6,470.

e. Salaries accrued at December 31, $2,470.

f. Store supplies inventory (on hand) at December 31, $1,959.

Required

- 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL.

- 2. Journalize the

adjusting entries . If using manual working papers, record adjusting entries on journal page 63.

Trending nowThis is a popular solution!

Chapter 11 Solutions

Working Papers with Study Guide for Scott's College Accounting: A Career Approach, 13th

Additional Business Textbook Solutions

Fundamentals of Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

- General Accountarrow_forwardNeed A EXPERT NOT AI The following facts perta lessee. a non-cancelable lease agreement between Splish Brothers Leasing Company and Sunland Company Commencement date May 1, 2025 Annual lease payment due at the beginning of each year, beginning with May 1, 2025 $20,456.70 Bargain purchase option price at end of lease term $4,000 Lease term 5 years Economic life of leased equipment 10 years Lessor's cost $65,000 Fair value of asset at May 1, 2025 $98.000.20 Lessor's implicit rate 4 % Lessee's incremental borrowing rate 4 % The collectibility of the lease…arrow_forwardRecognizing Red Flags Refer to the article below, which was assigned as part of the reading for this week, about a $1.3 million fraud committed by an employee at the Fort Worth, Texas stockyard. This fraud is a stark example of what can happen, and for how long, when no one is looking for red flags. White Collar Crime: The criminal in the next cubicle. Respond to the following: Explain what happened in the case, how long the fraudulent lasted, who discovered the fraud and how, what the court decided, and what the consequences were for the stockyard. Describe some of the red flags and internal control procedures that should have been in place to deter the fraud. Support your answer. Be sure to respond to at least one of your classmates' posts.arrow_forward

- Need A EXPERT NOT AI The following facts perta lessee. a non-cancelable lease agreement between Splish Brothers Leasing Company and Sunland Company Commencement date May 1, 2025 Annual lease payment due at the beginning of each year, beginning with May 1, 2025 $20,456.70 Bargain purchase option price at end of lease term $4,000 Lease term 5 years Economic life of leased equipment 10 years Lessor's cost $65,000 Fair value of asset at May 1, 2025 $98.000.20 Lessor's implicit rate 4 % Lessee's incremental borrowing rate 4 % The collectibility of the lease…arrow_forwardNeed A EXPERT NOT AI The following facts perta lessee. a non-cancelable lease agreement between Splish Brothers Leasing Company and Sunland Company Commencement date May 1, 2025 Annual lease payment due at the beginning of each year, beginning with May 1, 2025 $20,456.70 Bargain purchase option price at end of lease term $4,000 Lease term 5 years Economic life of leased equipment 10 years Lessor's cost $65,000 Fair value of asset at May 1, 2025 $98.000.20 Lessor's implicit rate 4 % Lessee's incremental borrowing rate 4 % The collectibility of the lease…arrow_forwardComprehensive Problem 2-76 (LO 2-1, LO 2-2, LO 2-3, LO 2-4, LO 2-5) (Algo) Skip to question [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2023. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2023: Asset Cost Date Placed in Service Office furniture $ 400,000 02/03 Machinery 1,810,000 07/22 Used delivery truck *Note: 90,000 08/17 *Note:Not considered a luxury automobile. During 2023, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production capacity. These are the assets acquired during 2024: Asset Cost Date Placed in Service Computers and information system $ 450,000 03/31 Luxury auto*Note: 92,500 05/26 Assembly equipment 1,200,000 08/15 Storage building 800,000 11/13 *Note:Used 100…arrow_forward

- Entire chart at bottom needs filled in! Now assume that during 2024, Karane decides to buy a competitor's assets for a purchase price of $1,649,500. Compute the maximum 2024 cost recovery, including §179 expense and bonus depreciation. Karane purchased the following assets in 2024 for the lump-sum purchase price: Note: Round your final answers to the nearest whole dollar amount. Asset Cost Date Placed in Service Inventory $ 270,000 09/15 Office furniture 280,000 09/15 Machinery 300,000 09/15 Patent 243,000 09/15 Goodwill 6,500 09/15 Building 480,000 09/15 Land 70,000 09/15 Assume that Karane takes the maximum section 179 expense for the Assembly Equipment. Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2023. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2023: Asset Cost Date Placed in Service Office furniture $ 400,000…arrow_forwardKarane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2023. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2023: Asset Cost Date Placed in Service Office furniture $ 400,000 02/03 Machinery 1,810,000 07/22 Used delivery truck*Note: 90,000 08/17 *Note:Not considered a luxury automobile. During 2023, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production capacity. These are the assets acquired during 2024: Asset Cost Date Placed in Service Computers and information system $ 450,000 03/31 Luxury auto*Note: 92,500 05/26 Assembly equipment 1,200,000 08/15 Storage building 800,000 11/13 *Note:Used 100 percent for business purposes. Karane generated taxable income in 2024 of $1,795,000 for purposes of computing the §179 expense limitation. (Use MACRS Table 1, Table…arrow_forwardThe following facts perta lessee. non-cancelable lease agreement between Splish Brothers Leasing Company and Sunland Company Commencement date May 1, 2025 Annual lease payment due at the beginning of each year, beginning with May 1, 2025 $20.456.70 Bargain purchase option price at end of lease term $4,000 Lease term 5 years Economic life of leased equipment 10 years Lessor's cost $65,000 Fair value of asset at May 1, 2025 $98,000.20 Lessor's implicit rate 4% Lessee's incremental borrowing rate 4% The collectibility of the lease payments by Splish Brothers is probable. Prepare the journal entries to reflect the…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning