Concept explainers

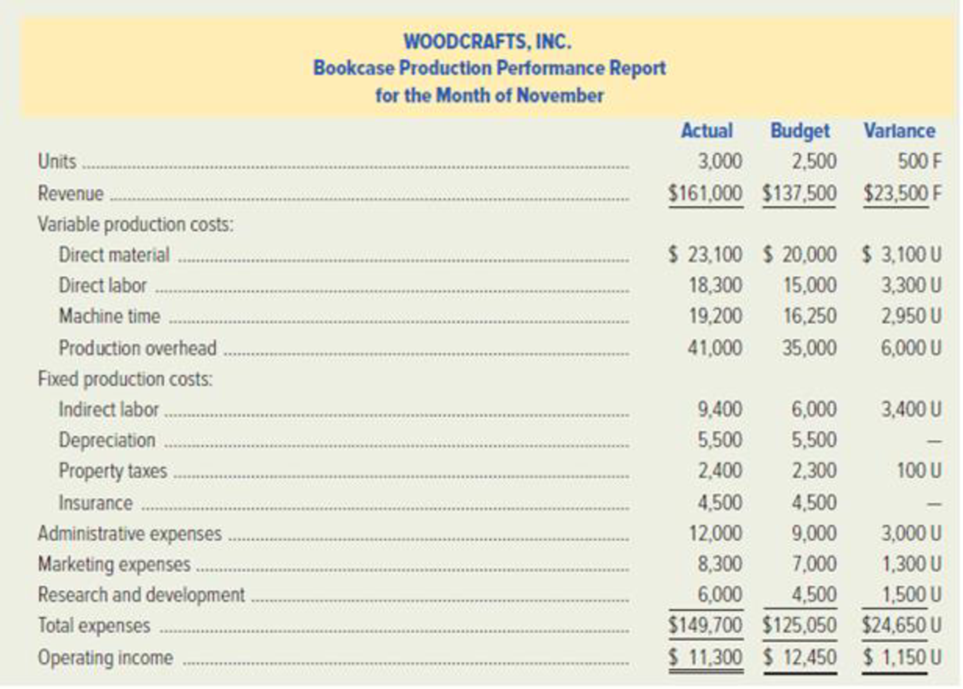

WoodCrafts, Inc. is a manufacturer of furniture for specialty shops throughout the Northeast and has an annual sales volume of $12 million. The company has four major product lines: bookcases, magazine racks, end tables, and bar stools. Each line is managed by a production manager. Since production is spread fairly evenly over the 12 months of operation. Sara McKinley, WoodCrafts’ controller, has pre pared an annual budget divided into 12 periods for monthly reporting purposes.

WoodCrafts uses a standard-costing system and applies variable

While distributing the monthly reports at the meeting, McKinley remarked to Clark, “We need to talk about getting your division back on track. Be sure to see me after the meeting.”

Clark had been so convinced that his division did well in November that McKinlcy’s remark was a real surprise. He spent the balance of the meeting avoiding the looks of his fellow managers and trying to figure out what could have gone wrong. The monthly performance report was no help.

Required:

- 1. a. Identify three weaknesses in WoodCrafts, Inc.’s monthly Bookcase Production Performance Report.

b. Discuss the behavioral implications of Sara McKinley’s remarks to Steve Clark during the meeting.

- 2. WoodCrafts, Inc. could do a better job of reporting monthly performance to the production managers.

- a. Recommend how the report could be improved to eliminate weaknesses, and revise it accordingly.

- b. Discuss how the recommended changes in reporting are likely to affect Steve Clark’s behavior.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Determine the following requirements of this financial accounting questionarrow_forwardProvide correct answer this financial accounting questionarrow_forwardChapter 15 Homework 13 Saved Help Save & Exit Submit Part 1 of 2 0.83 points eBook Ask Required information Use the following information to answer questions. (Algo) [The following information applies to the questions displayed below.] Information on Kwon Manufacturing's activities for its first month of operations follows: a. Purchased $100,800 of raw materials on credit. b. Materials requisitions show the following materials used for the month. Job 201 Job 202 Total direct materials Indirect materials Total materials used $ 49,000 24,400 73,400 9,420 $ 82,820 c. Time tickets show the following labor used for the month. Print References Job 201 $ 40,000 Job 202 13,400 Total direct labor 53,400 25,000 $ 78,400 Indirect labor Total labor used d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. Sold Job 201 for $166,160 on credit. g. Incurred the following actual other…arrow_forward

- quesrion 2arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2, 173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes $76,000; Dividends $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capital (325 marks)arrow_forwardQS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forward

- Question 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forwarddiscus extensivery source of bussines finances requaments not less than 4 pages font size 12 spacing 1.5 roman times references must be less thhan 5arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning