1.

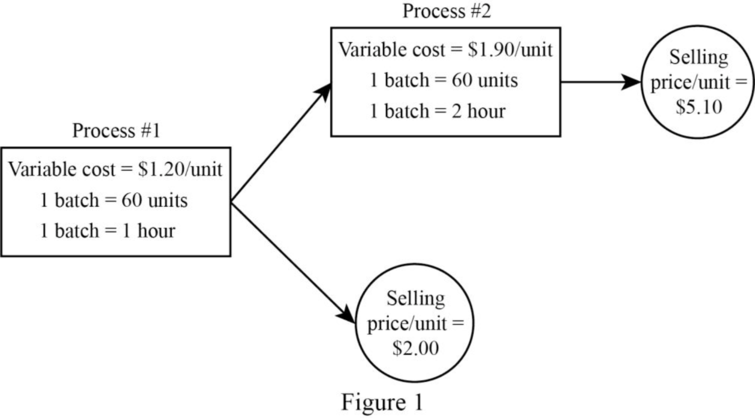

Develop a schematic diagram of the two-stage production process.

1.

Explanation of Solution

Develop a schematic diagram of the two-stage production process:

Figure (1)

Note: In this case, the manufacturing overhead is entirely fixed, as such; hence it is considered a sunk cost with respect to the sell-or-process-further decision.

2.

Compute the following:

- a. Contribution margin per hour for output from Process 1.

- b. Contribution margin per hour for output from Process 2.

- c. The implication of the given information, if the goal of the company is to maximize shorttermoperating income.

2.

Explanation of Solution

In this case, the number of processing hours (Scarce resource)is limited,so the short-term objective would be to maximize the contribution margin per hour of processing time. Contribution margin per hour for output from Process 1 and Process 2 are as follows:

| Particulars | Process 1 | Process 2 |

| Net selling price per unit (a) | $ 2 | $ 5.10 |

| Less: Cost of goods sold | ||

| Direct material cost per unit | $ 1.00 | $ 1.50 |

| Direct labor cost per unit | $ 0.20 | $ 0.40 |

| Transferred in costs from process 1 | $ 0.00 | $ 1.20 |

| Total variable cost per unit (b) | $ 1.20 | $ 3.10 |

| Contribution margin per unit | $ 0.80 | $ 2.00 |

| Number of hours per unit (d) | ||

| 0.0167 | ||

| 0.0500 | ||

| Contribution margin per unit | $ 47.90 | $ 40.00 |

Table (1)

From the above calculation, it is clear that Contribution margin per unit of Process 1 output is more profitable than output from Process 2. Therefore, the short-run operating income would be maximized if all available hours were used to produce Process #1 output.

3.

Compute the lowest acceptable selling price per unit for the output from Process 2 to make this output as profitable as the output from Process 1.

3.

Explanation of Solution

Compute the lowest acceptable selling price per unit for the output from Process 2 to make this output as profitable as the output from Process 1:

| Particulars | Process 1 | Process 2 |

| Current selling price per unit | $5.10 per unit | |

| The required increase in profitability per processing hour | $ 8 | |

| Multiply by:One unit of output from Process 2 requires | 0.05 hours | |

| Increase in selling price | $0.40 | |

| Minimum selling pricethe output from Process 2 | $5.50 per unit |

Table (2)

4.

Compute the following, by Assuming that 50% of the total overhead costs are variable:

- a. Revised Contribution margin per hour for output from Process 1.

- b. RevisedContribution margin per hour for output from Process 2.

- c. Describe whether the answer computed in requirement 2 changes, based on these revised calculations.

4.

Explanation of Solution

Compute the given by Assuming that 50% of the total overhead costs are variable:

| Particulars | Process 1 | Process 2 |

| Net selling price per unit (a) | $ 2 | $ 5.10 |

| Less: Cost of goods sold | ||

| Direct material cost per unit | $ 1.00 | $ 1.50 |

| Direct labor cost per unit | $ 0.20 | $ 0.40 |

| Variable overhead @50% | $0.30 | $0.60 |

| Transferred in costs from process 1 | $ 0.00 | $ 1.50 |

| Total variable cost per unit (b) | $ 1.50 | $4.00 |

| Contribution margin per unit | $ 0.50 | $1.10 |

| Number of hours per unit (d) | ||

| 0.0167 | ||

| 0.0500 | ||

| Contribution margin per unit | $29.94 | $22.00 |

Table (3)

From the above calculation, it is clear that the conclusion reached above in Requirement 2 still holds.

5.

- a. Calculate the contribution margin per processing hour using the sensitivity analysis for both Process 1 output and Process 2 output under the given assumptions regarding thepercentage of variable overhead costs: 0%, 25%, 50%, and 100%. Perform these calculations for Process2 output both for a selling price of $5.10 per unit and a selling price of $5.50 per unit.

- b. State the generalconclusion that could be drawn on the basis of this sensitivity analysis.

5.

Explanation of Solution

| Contribution margin or processing hour | ||||||

| % VOH | ||||||

| P1 | P2 | Δ | P1 | P2 | Δ | |

| 0% | $48.00 | $40.00 | $4.00 | $48.00 | $58.00 | $10.00 |

| 25% | $39.00 | $31.00 | $8.00 | $39.00 | $49.00 | $10.00 |

| 50% | $30.00 | $22.00 | $8.00 | $30.00 | $40.00 | $10.00 |

| 100% | $12.00 | $4.00 | $8.00 | $12.00 | $22.00 | $10.00 |

Table (4)

In this case, the sensitivity analysis aidsto explain the result obtained in Requirement 4, and when Process #2 output uses three times as much processing time per unit, whencompared to Process #1. This is independent of selling prices and the composition of variable overhead. Moreover, the amount of variable overhead charged per unit of Process #2 output is always three times as much variable overhead charged per unit of output from Process #1.

Since these ratios are “constant across selling prices per unit for output from Process #2 and also constant across levels of variable overhead, the difference in contribution margin per hour between Process #1 and Process #2 output, at each assumed selling price per unit for Process #2 output, will be constant and independent of the proportion of total overhead that is variable”.

Want to see more full solutions like this?

Chapter 11 Solutions

Cost Management

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardLarkson Equipment purchased a conveyor system for $52,000 on January 1, 2019. The system has an expected salvage value of $3,000 and is expected to be used for 200,000 hours over its estimated useful life of 8 years. Actual usage was 22,000 hours in 2019 and 18,500 hours in 2020. Calculate depreciation expense per hour under the units-of-activity method. (Round the answer to 2 decimal places).arrow_forwardLabor rate variance is?arrow_forward

- Franklin Corp. has 25 million shares outstanding and trades at $38 per share. Franklin has net identifiable assets with a book value of $800 million and a fair value of $950 million. Riverdale Investments purchases all of Franklin Corp.'s stock for $48 per share. How much will Riverdale Investments record as goodwill upon acquiring Franklin Corp.?arrow_forwardI need assistance with this financial accounting question using appropriate principles.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education