Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 43P

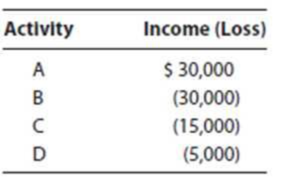

LO.3 Sarah has investments in four passive activity

In the current year, she sold her interest in Activity D for a $10,000 gain. Activity D, which had been profitable until last year, had a current loss of $1,500. How will the sale of Activity D affect Sarah’s taxable income in the current year?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

A new machine with a purchase price of$90,000, transportation costs of $8,000, installation costs of $6,000, and special handling fees of $2,000, would have a cost basis of:

A new machine with a purchase price of$90,000, transportation costs of $8,000, installation costs of $6,000, and special handling fees of $2,000, would have a cost basis of: Answer

Please provide the answer to this general accounting question using the right approach.

Chapter 11 Solutions

Individual Income Taxes

Ch. 11 - Prob. 1DQCh. 11 - List some events that increase or decrease an...Ch. 11 - Roberto invested 18,000 in a chicken production...Ch. 11 - Prob. 4DQCh. 11 - Carlos owns an interest in an activity that...Ch. 11 - Kim owns an interest in an activity that produces...Ch. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - LO.3 Bronze Corporation has 100,000 of active...Ch. 11 - LO.4 Discuss what constitutes a passive activity.

Ch. 11 - Prob. 11DQCh. 11 - LO.5 How many hours must a participant work in a...Ch. 11 - LO.5 Suzanne owns interests in a bagel shop, a...Ch. 11 - Prob. 14DQCh. 11 - Prob. 15DQCh. 11 - LO.5 Some types of work are counted in applying...Ch. 11 - LO.5 Last year Alans accountant informed him that...Ch. 11 - Prob. 18DQCh. 11 - Prob. 19DQCh. 11 - Prob. 20DQCh. 11 - What is a real estate professional? Why could...Ch. 11 - Prob. 22DQCh. 11 - LO.8 Since his college days, Charles has developed...Ch. 11 - LO.8 Brad owns a small townhouse complex that...Ch. 11 - Prob. 25DQCh. 11 - Prob. 26DQCh. 11 - LO.2 In the current year, Ed invests 30,000 in an...Ch. 11 - Prob. 28CECh. 11 - Prob. 29CECh. 11 - LO.7 Rhonda has an adjusted basis and an at-risk...Ch. 11 - LO.8 Noah Yobs, who has 62,000 of AGI (solely from...Ch. 11 - LO.9 Rose dies with passive activity property...Ch. 11 - Prob. 33CECh. 11 - Prob. 34PCh. 11 - LO.2 In the current year, Bill Parker (54 Oak...Ch. 11 - LO.2, 11 Heather wants to invest 40,000 in a...Ch. 11 - LO.1, 3 Dorothy acquired a 100% interest in two...Ch. 11 - Prob. 38PCh. 11 - Prob. 39PCh. 11 - LO.3, 11 Emily has 100,000 that she wants to...Ch. 11 - LO.3 Seojun acquired an activity several years...Ch. 11 - LO.3, 11 Jorge owns two passive investments,...Ch. 11 - LO.3 Sarah has investments in four passive...Ch. 11 - LO.3 Leon sells his interest in a passive activity...Ch. 11 - LO.3 Ash, Inc., a closely held personal service...Ch. 11 - Prob. 46PCh. 11 - LO.2, 3, 7, 11 Kristin Graf (123 Baskerville Mill...Ch. 11 - LO.2, 3, 7, 11 The end of the year is approaching,...Ch. 11 - Prob. 49PCh. 11 - Grace acquired an activity four years ago. The...Ch. 11 - Prob. 51PCh. 11 - LO.2, 3, 7 Five years ago Gerald invested 150,000...Ch. 11 - LO.3, 8 Several years ago Benny Jackson (125 Hill...Ch. 11 - Prob. 54PCh. 11 - Prob. 55PCh. 11 - Prob. 56PCh. 11 - Prob. 57PCh. 11 - Prob. 58PCh. 11 - LO.8 Jiu has 105,000 of losses from a real estate...Ch. 11 - Prob. 60PCh. 11 - LO.9 In the current year, Abe gives an interest in...Ch. 11 - Prob. 62PCh. 11 - Prob. 63PCh. 11 - Prob. 64PCh. 11 - Carol is a successful physician who owns 100% of...Ch. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - Prob. 4RPCh. 11 - Which of the following statements regarding...Ch. 11 - Michael owns a rental house that generated a...Ch. 11 - Prob. 3CPACh. 11 - Prob. 4CPACh. 11 - Sally recently invested 10,000 (tax basis) in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardIf the beginning inventory is $90,000, the cost of goods purchased is $380,000, and the ending inventory is $70,000, what is the cost of goods sold for Yaghan Enterprises? a. $400,000 b. $410,000 c. $380,000 d. $360,000arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License